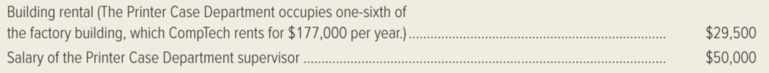

CompTech, Inc. manufactures printers for use with home computing systems. The firm currently manufactures both the electronic components for its printers and the plastic cases in which the devices are enclosed. Jim Cassanitti, the production manager, recently received a proposal from Universal Plastics Corporation to manufacture the cases for CompTech’s printers. If the cases are purchased outside, CompTech will be able to close down its Printer Case Department. To help decide whether to accept the bid from Universal Plastics Corporation, Cassanitti asked CompTech’s controller to prepare an analysis of the costs that would be saved if the Printer Case Department were closed. Included in the controller’s list of annual cost savings were the following items:

In a lunchtime conversation with the controller, Cassanitti learned that CompTech was currently renting space in a warehouse for $39,000. The space is used to store completed printers. If the Printer Case Department were discontinued, the entire storage operation could be moved into the factory building and occupy the space vacated by the closed department. Cassanitti also learned that the supervisor of the Printer Case Department would be retained by CompTech even if the department were closed. The supervisor would be assigned the job of managing the assembly department, whose supervisor recently gave notice of his retirement. All of CompTech’s department supervisors earn the same salary.

Required:

- 1. You have been hired as a consultant by Cassanitti to advise him in his decision. Write a memo to Cassanitti commenting on the costs of space and supervisory salaries included in the controller’s cost analysis. Explain in your memo about the “real” costs of the space occupied by the Printer Case Department and the supervisor’s salary. What types of costs are these?

- 2. Independent of your response to requirement (1), suppose that CompTech’s controller had been approached by his friend Jack Westford, the assistant supervisor of the Printer Case Department.

Westford is worried that he will be laid off if the Printer Case Department is closed down. He has asked his friend to understate the cost savings from closing the department, in order to slant the production manager’s decision toward keeping the department in operation. Comment on the controller’s ethical responsibilities.

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

MANAGERIAL ACCOUNTING-CUSTOM EBOOK>I<

- Thalassines Kataskeves, S.A., of Greece makes marine equipment. The company has been experiencing losses on its bilge pump product line for several years. The most recent quarterly contribution format income statement for the bilge pump follows: Thalassines Kataskeves, S.A. Income Statement—Bilge Pump For the Quarter Ended March 31 Sales $ 410,000 Variable expenses: Variable manufacturing expenses $ 123,000 Sales commissions 50,000 Shipping 21,000 Total variable expenses 194,000 Contribution margin 216,000 Fixed expenses: Advertising (for the bilge pump product line) 27,000 Depreciation of equipment (no resale value) 120,000 General factory overhead 38,000* Salary of product-line manager 113,000 Insurance on inventories 5,000 Purchasing department 49,000† Total fixed expenses 352,000 Net operating loss $ (136,000) *Common costs allocated on the basis of machine-hours. †Common costs allocated on the basis of…arrow_forwardDo companies maintain two sets of depreciation schedules, one for financial reporting and the other one for tax purposes?arrow_forwardnone ??arrow_forward

- Need help with this accounting questionsarrow_forwardCarichem Company produces sanitation products after processing specialized chemicals. The following relates to its activities: 1 Kilogram of chemicals purchased for $4000 and with an additional $2000 is processed into 400 grams of Crystals and 80 litres of a Cleaning agent. At split-off, a gram of Crystal can be sold for $2 and the Cleaning agent can be sold for $8 per litre. At an additional cost of $800, Carichem can process the 400 grams of Crystal into 500 grams of Detergent that can be sold for $4 per gram. The 80 litres of Cleaning agent is packaged at an additional cost of $600 and made into 200 packs of Softener that can be sold for $4 per pack. Required: 1. Allocate the joint cost to the Detergent and the Softener using the following: a. Sales value at split-off method b. NRV method 2. Should Carichem have processed each of the products further? What effect does the allocation method have on this decision?arrow_forwardGeneral accountingarrow_forward

- Allocate the two support departments’ costs to the two operating departments using the following methods: a. Direct method b. Step-down method (allocate HR first) c. Step-down method (allocate IS first) d. The Algebraic method.arrow_forwardCan you help me with accounting questionsarrow_forwardFinancial accounting question not use ai please don'tarrow_forward

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning