Concept explainers

Recording Manufacturing Costs and Analyzing Manufacturing

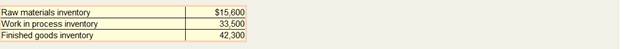

Hamilton Custom Cabinet Company uses a job order cost system with overhead applied as a percentage of direct labor costs. Inventory balance at the beginning of 2016 follow:

The following transactions occurred during January:

a. Purchased materials on account for $42,000.

b. Issued materials to production totaling $45,000, 85 percent of which was traced to specific jobs and the remainder of which was treated as indirect materials.

c. Payroll costs totaling $30,000 were recorded as follows:

$17,300 for assembly workers

8,400 for factory supervision

2,500 for administrative personnel

1,800 for sales commissions

d. Recorded

e. Recorded $9,000 of expired insurance. Sixty percent was insurance on the manufacturing facility, with the remainder classified as an administrative expense.

f. Paid $7,900 in other

g. Applied manufacturing overhead at a rate of 200 percent of direct labor cost.

h. Completed all jobs but one; the

$7,000 for direct labor, and $14,000 for applied overhead.

i. Solid jobs costing $40,000 during the period; the company adds a 25 percent markup on cost to determine the sales price.

Determine the amount of over- or underapplied overhead.

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

Managerial Accounting

- Help with accounting questionarrow_forwardThe lotion manufacturing's quick ratio is ?arrow_forwardHalle Manufacturing has an overhead application rate of 125% and allocates overhead based on direct materials. During the current period, direct labor is $78,000, and direct materials used are $112,000. Determine the amount of overhead Halle Manufacturing should record in the current period. a. $78,000 b. $97,500 c. $112,000 d. $140,000 e. $190,000arrow_forward

- I need guidance with this general accounting problem using the right accounting principles.arrow_forwardWhat is its cash conversion cycle?arrow_forwardBruce Company sold 1,500 units of its product during the current month. The selling price is $45 and the variable cost is $28 per unit. The company's fixed expense totals $11,700 per month. The company's net operating income is: a. $13,800 b. $25,500 c. $17,100 d. $42,000arrow_forward

- August's beginning and ending inventories were 24,600 and 16,200 units, respectively.arrow_forwardWhich accounting concept supports recording bad debt expense before accounts are actually uncollectible? a) Full disclosure principle b) Matching principle c) Going concern concept d) Materiality concept. Helparrow_forwardWhat is the unit product cost for job 882?arrow_forward

- Can you explain the correct approach to solve this general accounting question?arrow_forwardCameron Components Ltd. had a variable costing operating income of $82,600 in 2022. Ending inventory decreased during 2022 from 46,000 units to 43,500 units. During both 2021 and 2022, fixed manufacturing overhead was $840,000, and 105,000 units were produced. Determine the absorption costing operating income for 2022.arrow_forwardCornell Corporation plans to generate $960,000 of sales revenue if a capital project is implemented. Assuming a 30% tax rate, the sales revenue should be reflected in the analysis by:arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning