Concept explainers

Recording Manufacturing Costs and Analyzing Manufacturing

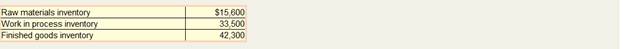

Hamilton Custom Cabinet Company uses a job order cost system with overhead applied as a percentage of direct labor costs. Inventory balance at the beginning of 2016 follow:

The following transactions occurred during January:

a. Purchased materials on account for $42,000.

b. Issued materials to production totaling $45,000, 85 percent of which was traced to specific jobs and the remainder of which was treated as indirect materials.

c. Payroll costs totaling $30,000 were recorded as follows:

$17,300 for assembly workers

8,400 for factory supervision

2,500 for administrative personnel

1,800 for sales commissions

d. Recorded depreciation: $9,000 for machines and $25,000 for the copier used in the administrative Office.

e. Recorded $9,000 of expired insurance. Sixty percent was insurance on the manufacturing facility, with the remainder classified as an administrative expense.

f. Paid $7,900 in other

g. Applied manufacturing overhead at a rate of 200 percent of direct labor cost.

h. Completed all jobs but one; the

$7,000 for direct labor, and $14,000 for applied overhead.

i. Solid jobs costing $40,000 during the period; the company adds a 25 percent markup on cost to determine the sales price.

Determine how much gross profit the company would report during the month of January before any adjustment is made for the overhead balance.

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

Managerial Accounting

- Please provide the accurate answer to this general accounting problem using appropriate methods.arrow_forwardPlease help me solve this general accounting question using the right accounting principles.arrow_forwardPlease provide the accurate answer to this general accounting problem using valid techniques.arrow_forward

- I need guidance with this general accounting problem using the right accounting principles.arrow_forwardI need guidance with this general accounting problem using the right accounting principles.arrow_forwardCan you explain the correct methodology to solve this general accounting problem?arrow_forward

- Can you help me solve this general accounting question using the correct accounting procedures?arrow_forwardI need help with this general accounting question using the proper accounting approach.arrow_forwardCan you explain the correct approach to solve this general accounting question?arrow_forward

- I am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forwardPlease help me solve this general accounting problem with the correct financial process.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning