Concept explainers

Recording Manufacturing Costs and Analyzing Manufacturing

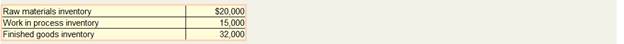

Christopher's Custom Cabinet Company uses a job order cost system with overhead applied as a percentage of direct labor costs. Inventory balance at the beginning of 2016 follow:

The following transactions occurred during January:

a. Purchased materials on account for $26,000.

b. Issued materials to production totaling $40,000, 80 percent of which was traced to specific jobs and the remainder of which was treated as indirect materials.

c. Payroll costs totaling $69,700 were recorded as follows:

$18,000 for assembly workers

5,200 for factory supervision

31,000 for administrative personnel

15,500 for sales commissions

d. Recorded

e. Recorded $4,000 of expired insurance. Forty percent was insurance on the manufacturing facility, with the remainder classified as an administrative expense.

f. Paid $7,800 in other

g. Applied manufacturing overhead at a rate of 300 percent of direct labor cost.

h. Completed all jobs but one; the

$3,000 for direct labor, and $9,000 for applied overhead. i. Solid jobs costing $70,000. The revenue earned on these jobs was $91,000.

Required:

Determine the amount of over- or underapplied overhead.

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

Managerial Accounting

- Can you solve this general accounting question with accurate accounting calculations?arrow_forwardBarnett's Bottles uses the number of hours in its molding machines to allocate overhead costs to products. In a typical month, 3,800 molding hours are expected, and the average monthly overhead costs are $7,600. During March, 4,100 molding hours were used, and total overhead costs were $7,950. Required: Compute Barnett's predetermined overhead rate and the amount of applied overhead for March. Round your answers to the nearest cent.arrow_forwardCan you explain this general accounting question using accurate calculation methods?arrow_forward

- I am searching for the accurate solution to this general accounting problem with the right approach.arrow_forwardPlease explain the solution to this general accounting problem with accurate explanations.arrow_forwardOlivia Production calculates its overhead budget based on budgeted machine-hours. The production schedule indicates that 12,400 machine-hours will be required in November. The variable overhead rate is $8.50 per machine-hour. The company's budgeted fixed manufacturing overhead is $186,000 per month, which includes depreciation of $43,000. All other fixed manufacturing overhead costs represent current cash flows. The company recomputes its predetermined overhead rate every month. What should be Olivia Production's predetermined overhead rate for November? A. $23.50 B. $18.90 C. $21.26 D. $16.00arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,