This Excel worksheet relates to the Dickson Company example that is summarized in Exhibit 2-5. Download the workbook containing this form from Connect, where you will also find instructions about how to use this worksheet form.

You should proceed to the requirements below only after completing your worksheet.

Required:

4. Restore the total number of machine-hours in the Assembly Department to 3000 machine-hours. What happens to the selling price forJob 408 if the total number of direct labor-hours in the Assembly Department decreases from 80,000 direct labor-hours to 50,000direct labor-hours? Does it increase, decrease, or stay the same as in pail 2 above? Why?

Selling price: The cost incurred by selling the product in the market is known as the selling price.

Determine the selling price for Job 408 when the machine hours in Assembly department are restored to 3000 hours and the Direct Labor hours in the said department are reduced from 80000 hours to 50000 hours.

Answer to Problem 4AE

Solution:

The pre-determined rate per direct labor hour increases from $10 to 13.75. As a result of which the total cost increases leading to an ultimate increase in the selling price for Job 408.Explanation of Solution

The calculation is done in the workbook and it is explained below,

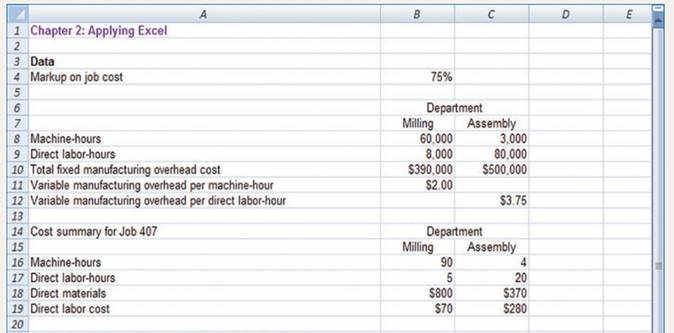

| Chapter 2: Applying Excel | |||

| Data | |||

| Mark-up on job cost | 75% | ||

| Department | |||

| Milling | Assembly | ||

| 1 | Machine hours | 60000 | 6000 |

| 2 | Direct Labour Hours | 8000 | 50000 |

| 3 | Total fixed manufacturing overhead cost | $3,90,000.00 | $5,00,000.00 |

| 4 | Variable manufacturing overhead per machine hour | $2.00 | $ - |

| 5 | Variable manufacturing overhead per direct labour hour | $ - | $3.75 |

| Cost Summary for job 408 | Department | ||

| Milling | Assembly | ||

| 6 | Machine hours | 40 | 10 |

| 7 | Direct Labour Hours | 2 | 6 |

| 8 | Direct Materials | $700.00 | $360.00 |

| 9 | Direct Labour cost | $50.00 | $150.00 |

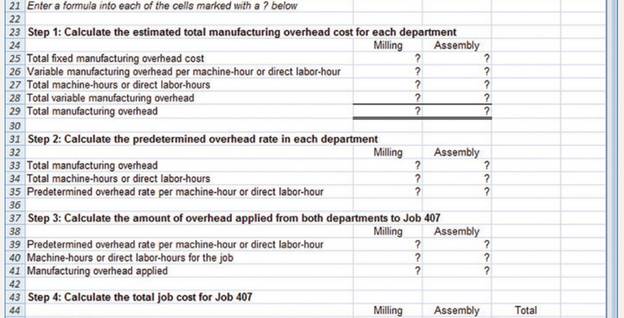

| Enter a formula into each of the cells marked with ? below | |||

| Step 1: Calculate the estimated total manufacturing overhead cost for each department | |||

| Milling | Assembly | ||

| 10 | Total fixed manufacturing overhead (given) | $3,00,000.00 | $5,00,000.00 |

| 11 | Variable manufacturing overhead per machine hour or direct labour hour (given) | $2.00 | $3.75 |

| 12 | Total machine hours or direct labour hours (given) | 60000 | 50000 |

| 13 | Total Variable manufacturing overhead (11 x 12) | $1,20,000.00 | $1,87,500.00 |

| 14 | Total manufacturing overhead (10 + 13) | $4,20,000.00 | $6,87,500.00 |

| Step 2: Calculate the pre-determined overhead rate in each department | |||

| Milling | Assembly | ||

| 15 | Total manufacturing overhead (14) | $4,20,000.00 | $6,87,500.00 |

| 16 | Total machine hours or direct labour hours (given) | 60000 | 50000 |

| 17 | Pre-determined overhead rate per machine hour or direct labour hour (15 divided by 16) | $7.00 | $13.75 |

| Step 3: Calculate the amount of overhead applied to both departments to Job 408 | |||

| Milling | Assembly | ||

| 18 | Pre-determined overhead rate per machine hour or direct labour hour (17) | $7.00 | $13.75 |

| 19 | Machine hours or direct labour hours for the job (given) | 40 | 6 |

| 20 | Manufacturing overhead applied (18 x 19) | $280.00 | $82.50 |

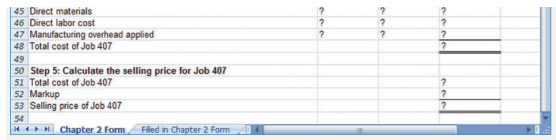

| Step 4: Calculate the total job cost for Job 408 | |||

| Milling | Assembly | ||

| 21 | Direct Materials (given) | $700.00 | $360.00 |

| 22 | Direct Labour cost (given) | $50.00 | $150.00 |

| 23 | Manufacturing overhead applied (20) | $280.00 | $82.50 |

| 24 | Total cost of Job 407 (21 + 22 + 23) | $1,030.00 | $592.50 |

| Total cost of Job 407 (Milling + Assembly) | $1,622.50 | ||

| Step 5: Calculate the selling price for Job 408 | |||

| Milling | Assembly | ||

| 25 | Total cost of Job 407 ( 24) | $1,030.00 | $592.50 |

| 26 | Mark-up (24 x 75%) | $772.50 | $444.38 |

| 27 | Selling price of Job 407 (25 + 26 ) | $1,802.50 | $1,036.88 |

| 28 | Total Selling Price of Job 408 (Milling + Assembly) | $2,839.38 | |

When the direct labor hours are reduced from 80000 hours to 50000 hours, the cost increases since the pre-determined rate per direct labor hour increases from $10 to $13.75. As a result of which the total cost increases leading to an ultimate increase in the selling price.

Since selling price is calculated as per the Cost plus Markup method it is directly related to an increase or a decrease in the cost.

Want to see more full solutions like this?

Chapter 2 Solutions

INTRO MGRL ACCT LL W CONNECT

- Can you demonstrate the proper approach for solving this financial accounting question with valid techniques?arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardI need help finding the correct solution to this financial accounting problem with valid methods.arrow_forward

- Can you solve this financial accounting question with the appropriate financial analysis techniques?arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forwardI need assistance with this financial accounting question using appropriate principles.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning