Concept explainers

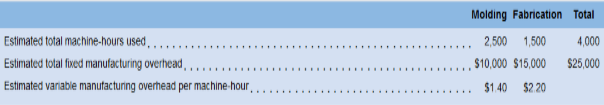

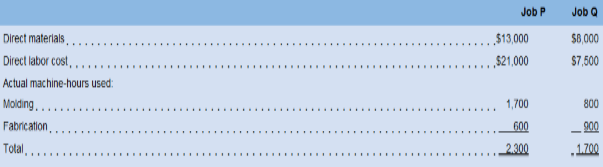

Sweeten Company bad no jobs in progress at the beginning of March and no beginning inventories. The company has two manufacturing departments-Molding and Fabrication. It started, completed, and sold only two jobs during March—Job P and Job Q. The following additional information is available for the company as a whole and for Jobs P and Q (all data and questions relate to the month of March):

Sweeten Company bad no under applied or over applied

Required:

For questions 1-8, assume that Sweeten Company uses a plant wide predetermined overhead rate with machine-hours as the allocation base.

For questions 9-15, assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments.

6. If Job Q included 30 units; what was its unit product cost?

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

INTRO MGRL ACCT LL W CONNECT

- Which financial reporting framework is most commonly used internationally? A) GAAPB) IFRSC) IRSD) SOXcorrectarrow_forwardWhich financial reporting framework is most commonly used internationally? A) GAAPB) IFRSC) IRSD) SOXneedarrow_forwardWhich financial reporting framework is most commonly used internationally? A) GAAPB) IFRSC) IRSD) SOXarrow_forward

- What is the primary objective of internal controls? A) To maximize profitB) To ensure financial statements are published on timeC) To safeguard assets and ensure accurate reportingD) To speed up inventory turnoverno aiarrow_forwardWhat is the primary objective of internal controls? A) To maximize profitB) To ensure financial statements are published on timeC) To safeguard assets and ensure accurate reportingD) To speed up inventory turnoverneedarrow_forwardWhat is the primary objective of internal controls? A) To maximize profitB) To ensure financial statements are published on timeC) To safeguard assets and ensure accurate reportingD) To speed up inventory turnoverarrow_forward

- What is a lease classified as under current accounting standards (ASC 842/IFRS 16)? A) Expense onlyB) Always an operating leaseC) Either finance or operating lease with asset/liability recognitionD) Not recorded on the balance sheetneedarrow_forwardWhen a company invests in cryptocurrency, it is most often classified as: A) InventoryB) Intangible assetC) Cash equivalentD) Financial liabilityneedarrow_forwardWhat is a lease classified as under current accounting standards (ASC 842/IFRS 16)? A) Expense onlyB) Always an operating leaseC) Either finance or operating lease with asset/liability recognitionD) Not recorded on the balance sheetarrow_forward

- When a company invests in cryptocurrency, it is most often classified as: A) InventoryB) Intangible assetC) Cash equivalentD) Financial liabilityarrow_forwardWhat is the purpose of fair value accounting? A) To record historical costs accuratelyB) To inflate asset valuesC) To reflect current market conditions in financial statementsD) To standardize depreciationneedarrow_forwardWhat is the purpose of fair value accounting? A) To record historical costs accuratelyB) To inflate asset valuesC) To reflect current market conditions in financial statementsD) To standardize depreciationarrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning