45BP

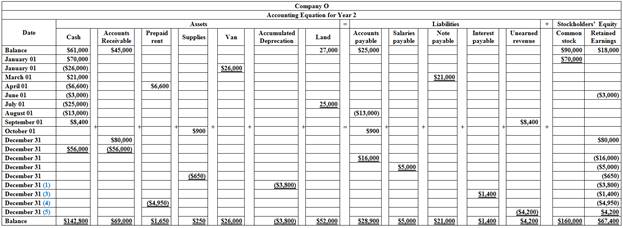

Prepare the transactions in general ledger accounts under the

45BP

Explanation of Solution

Prepare general ledger accounts under the accounting equation.

Table (1)

Working Note:

Determine the amount of

Determine the amount of total interest payable.

Determine the amount of interest payable on note that would be recognized.

Determine the amount of prepaid rent to be recognized.

Determine the amount of recognized revenue.

a.

Identify the four additional adjustments.

a.

Explanation of Solution

The four additional adjustments are as follows:

- 1. Company O has acquired a delivery van on January 01, for that delivery van depreciation expense should be provided using

adjusting entry. - 2. On March 01, Company O issued note payable. Accrued interest expense on note payable should be recognized using adjusting entry.

- 3. On April 01, Company P paid rent in advance. Rent paid in advance should be recognized as rent expense for 9 months using adjusting entry.

- 4. On September 01, Company O received cash in advance. Unearned revenue should be recognized as revenue for 6 months using adjusting entry.

b.

Identify the amount of interest expense that would be reported on the income statement.

b.

Explanation of Solution

The amount of interest expense would be reported on the income statement is $1,400 (3).

c.

Identify the amount of net cash flow from operating activities that would be reported on the statement of

c.

Explanation of Solution

The net cash flow from operating activities would be reported on the statement of cash flows amounts to $44,800 (6).

Determine the amount of net cash flow from operating activities.

d.

Identify the amount of rent expense that would be reported on the income statement.

d.

Explanation of Solution

The amount of rent expense would be reported on the income statement is $4,950 (4).

e.

Identify the amount of total liabilities that would be reported on the

e.

Explanation of Solution

The amount of total liabilities would be reported on the balance sheet $60,500

f.

Identify the amount of supplies expense that would be reported on the balance sheet.

f.

Explanation of Solution

The amount of supplies expense would be reported on the income statement is $650

g.

Identify the amount of unearned revenue that would be reported on the balance sheet.

g.

Explanation of Solution

The amount of unearned revenue that would be reported on the balance sheet is $4,200 (5).

h.

Identify the amount of net cash flow from investing activities that would be reported on the statement of cash flows.

h.

Explanation of Solution

The net cash flow from investing activities that would be reported on the statement of cash flows is ($51,000) (7).

Determine the amount of net cash flow from investing activities.

i.

Identify the amount of interest payable that would be reported on the balance sheet.

i.

Explanation of Solution

The amount of interest payable that would be reported on the balance sheet is $1,400 (3).

j.

Identify the amount of total expense that would be reported on the income statement.

j.

Explanation of Solution

The amount of total expense that would be reported on the income statement is $31,800

k.

Identify the amount of

k.

Explanation of Solution

The retained earnings that would be reported on the balance sheet amounts to $67,600 (8).

Determine the amount of retained earnings.

l.

Identify the amount of service revenue that would be reported on the income statement.

l.

Explanation of Solution

The amount of service revenue that would be reported on the income statement is $84,200

m.

Identify the amount of net cash flow from financing activities that would be reported on the statement of cash flows.

m.

Explanation of Solution

The net cash flow from financing activities that would be reported on the statement of cash flows is $88,000 (9).

Determine the amount of net cash flow from financing activities.

n.

Identify the amount of net income that would be reported on the income statement.

n.

Explanation of Solution

The net income that would be reported on the income statement is $52,400

Want to see more full solutions like this?

Chapter 2 Solutions

Fundamental Financial Accounting Concepts

- What is the residual value guarantee in a lease? [FINANCIAL ACCOUNTING] a) Included in lease liability at present value b) Always excluded from lease payments c) Never included in lease liability d) Only included if provided by lessor answerarrow_forwardCan you help me with accounting questionarrow_forwardI am looking for the correct answer to this financial accounting problem using valid accounting standards.arrow_forward

- Which cost is classified as a product cost? (a) Selling expenses (b) Marketing expenses (c) Administrative expenses (d) Direct materialdarrow_forwardI need help solving this general accounting question with the proper methodology.arrow_forwardwhat is the company's P/E ratio? accounting questionarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education