a.

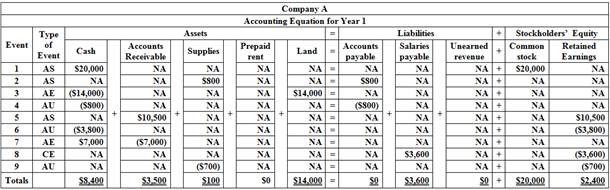

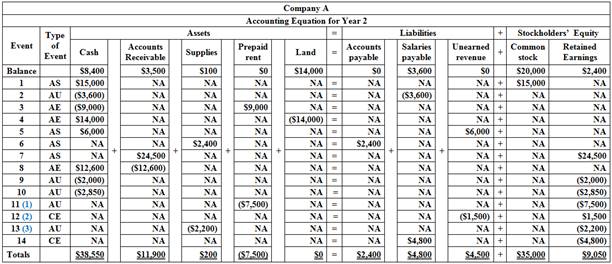

Indicate each event affecting the Year 1 and Year 2 accounting periods as asset source (AS), asset use (AU), asset exchange (AE) or claims exchange (CE). Record the effects of each event under the appropriate general ledger account headings of the

a.

Answer to Problem 43AP

Indicate each event affecting the Year 1 and Year 2 accounting periods as asset source (AS), asset use (AU), asset exchange (AE) or claims exchange (CE) and record the effects of each event under the appropriate general ledger account headings of the

Table (1)

Table (2)

Note:

AE refers to asset exchange.

AS refer to asset source.

AU refers to asset used.

CE refers to claims exchange.

NA refers to does not affected.

Explanation of Solution

Asset source transactions are the transactions that results in an increase of both the asset and claims on assets.

Asset use transactions are the transactions that results in a decrease of both the asset and claims on assets.

Asset exchange transactions are the transactions that results in increase in one asset and decrease in the other asset.

Claim exchange transactions are the transactions that results in decrease of one claim and increase of other claims; thereby the total claims remains unchanged.

Working Note:

Determine the amount of prepaid rent recognized at the end of year 2.

Determine the amount of unearned revenue realized at the end of year.

Determine the amount of supplies used at the end of year.

b.

Prepare the statement of income, statement of changes in

b.

Explanation of Solution

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and stockholders (stockholders’ equity) over those resources. The resources of the company are assets which include money contributed by stockholders and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and stockholders’ equity.

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Statement of changes in the stockholders’ equity: This statement reflects whether the components of stockholders’ equity have increased or decreased during the period.

Statement of cash flows: This statement reports all the cash transactions involves for inflow and outflow of cash, and the result of these transactions is reported as an ending balance of cash at the end of reported period.

Prepare the statement of income of Company A for the year ended December 31, Year 1 and Year 2.

| Company A | ||

| Statement of income | ||

| For the year ended December 31, Year 1 and Year 2 | ||

| Particulars | Amount | |

| Year 1 | Year 2 | |

| Service revenue | $10,500 | $26,000 |

| Total revenue (A) | $10,500 | $26,000 |

| Expenses | ||

| Operating expenses | ($3,800) | ($2,850) |

| Supplies expenses | ($700) | ($2,200) |

| Salaries expense | ($3,600) | ($4,800) |

| Rent expense | $0 | ($7,500) |

| Total expenses (B) | ($8,100) | ($17,350) |

| Net income |

$2,400 | $8,650 |

Table (3)

Hence, the net income of Company A for the year ended December 31, Year 1 and Year 2 are $2,400 and $8,650 respectively.

Prepare the statement of changes in stockholders’ equity of Company A for the year ended December 31, Year 1 and Year 2.

| Company A | ||

| Statement of changes in stockholders' equity | ||

| For the year ended December 31, Year 1 and Year 2 | ||

| Particulars | Amount | |

| Year 1 | Year 2 | |

| Beginning Common Stock | $0 | $20,000 |

| Add: Stock Issued | $20,000 | $15,000 |

| Ending Common Stock (A) | $20,000 | $35,000 |

| Beginning |

$0 | $2,400 |

| Add/Less: Net Income (Loss) | $2,400 | $8,650 |

| Less: Dividends | $0 | ($2,000) |

| Ending Retained Earnings (B) | $2,400 | $9,050 |

| Total stockholder's equity |

$22,400 | $44,050 |

Table (4)

Hence, the total stockholders’ equity of Company A for the year ended December 31, Year 1 and Year 2 are $22,400 and $44,050 respectively.

Prepare the Balance sheet of Company A as on December 31, Year 1 and Year 2.

| Company A | ||

| Balance sheet | ||

| As on December 31, Year 1 and Year 2 | ||

| Assets | Year 1 | Year 2 |

| Cash | $8,400 | $38,550 |

| $3,500 | $15,400 | |

| Supplies | $100 | $300 |

| Prepaid Rent | $0 | $1,500 |

| Land | $14,000 | $0 |

| Total Assets | $26,000 | $55,750 |

| Liabilities and stockholders' equity | ||

| Liabilities | ||

| Accounts Payable | $0 | $2,400 |

| Salaries Payable | $3,600 | $4,800 |

| Unearned Revenue | $0 | $4,500 |

| Total Liabilities | $3,600 | $11,700 |

| Stockholders’ Equity | ||

| Common Stock | $20,000 | $35,000 |

| Retained Earnings | $2,400 | $9,050 |

| Total Stockholders’ Equity | $22,400 | $44,050 |

| Total liabilities and stockholders' equity | $26,000 | $55,750 |

Table (5)

Hence, the assets and liabilities of Company A as on December 31, Year 1 and Year 2 are $26,000 and $55,750 respectively.

Prepare the statement of cash flows of Company A for the year ended December 31, Year 1 and Year 2.

| Company A | ||

| Statement of cash flows | ||

| For the year ended December 31, Year 1 and Year 2 | ||

| Particulars | Amount | |

| Year 1 | Year 2 | |

| Cash flow from operating activities: | ||

| Cash Receipts from Customers (4) | $20,000 | $35,000 |

| Cash payments for expenses (5) | (5) ($4,600) | (6) ($15,450) |

| Net Cash Flow from Operating Activities | $2,400 | $3,150 |

| Cash Flows From Investing Activities: | ||

| Cash Payment for Land | ($14,000) | $0 |

| Cash Proceeds from Sale of Land | $0 | $14,000 |

| Net Cash Flow From Investing Activities | ($14,000) | $14,000 |

| Cash Flows From Financing Activities: | ||

| Cash Receipts from Stock Issue | $20,000 | $15,000 |

| Cash Payment for Dividends | $0 | ($2,000) |

| Net Cash Flow From Financing Activities | $20,000 | $13,000 |

| Net Change in Cash | $8,400 | $30,150 |

| Add: Beginning Cash Balance | $0 | $8,400 |

| Ending Cash Balance | $8,400 | $38,550 |

Table (6)

Hence, the net change in the cash during the Year 1 and Year 2 are $8,400 and $38,550.

Working Note:

Determine the amount of cash receipts from customers for Year 2.

Determine the amount of cash paid for operating expense for Year 1

Determine the amount of cash paid for operating expense for Year 2.

Want to see more full solutions like this?

Chapter 2 Solutions

Fundamental Financial Accounting Concepts

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education