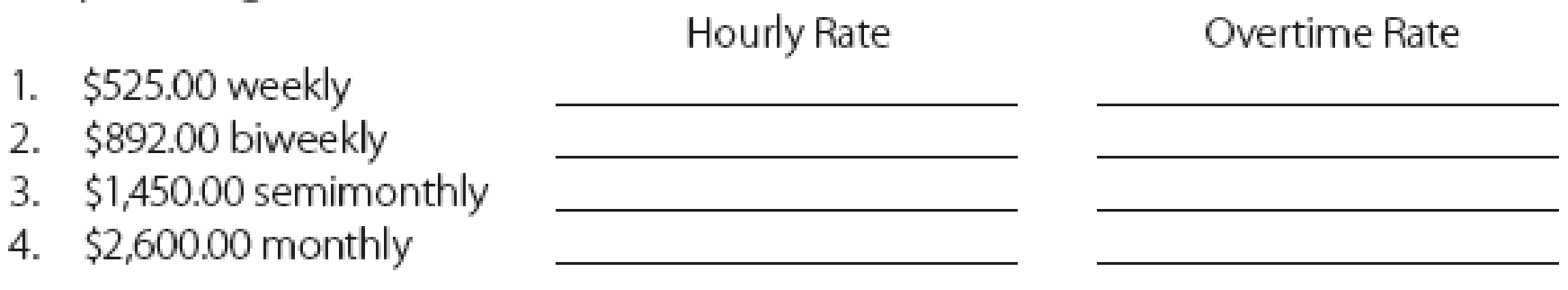

Compute the hourly and overtime rates for a standard 40-hour workweek for the following amounts:

1

Calculate the hourly rate and overtime rate for earnings $525 weekly.

Explanation of Solution

Regular earnings: Generally, employees in a firm work in pre-determined hours (40 hours) and get paid accordingly. The amount of earnings that is calculated based on predetermined hours is called as regular earnings of an employee.

Overtime Earnings: If an employee works more than the stipulated working hours (more than 40 hours) of the employment then, the employee is mandated to get paid one and a half times more than the normal working pay. This one and half times can be termed as overtime premium or earnings.

Calculate hourly rate.

Calculate the overtime rate.

Hence, the hourly rate and overtime rate for earnings $525 weekly is $13.13 and $19.70 respectively.

2.

Calculate the hourly rate and overtime rate for earnings $892 biweekly.

Explanation of Solution

Calculate hourly wage rate.

Step 1: Calculate regular earnings for a week.

Step 2: Calculate hourly rate.

Calculate the overtime rate.

Hence, the hourly rate and overtime rate for earnings $892 biweekly is $11.15 and $16.73 respectively.

3.

Calculate the hourly rate and overtime rate for earnings $1,450 semimonthly.

Explanation of Solution

Calculate hourly wage rate.

Step 1: Calculate regular earnings for a week.

Step 2: Calculate hourly rate.

Calculate the overtime rate.

Hence, the hourly rate and overtime rate for earnings $1,450 semimonthly is $16.73 and $25.10 respectively.

4.

Calculate the hourly rate and overtime rate for earnings $2,600 monthly.

Explanation of Solution

Calculate hourly wage rate.

Step 1: Calculate regular earnings for a week.

Step 2: Calculate hourly rate.

Calculate the overtime rate.

Hence, the hourly rate and overtime rate for earnings $2,600 monthly is $15 and $22.50 respectively.

Want to see more full solutions like this?

Chapter 2 Solutions

PAYROLL ACCT.,2019 ED.(LL)-TEXT

- How should the company record the transaction?arrow_forwardJimmy Entertainment Corporation was organized on March 1, 2018. During 2020, Jimmy Entertainment issued 30,000 shares at $12 per share, purchased 3,500 shares of treasury stock at $14 per share, and had a net income of $210,000. What is the total amount of stockholders' equity at December 31, 2020?arrow_forwardI need the correct answer to this financial accounting problem using the standard accounting approach.arrow_forward

- I need the correct answer to this general accounting problem using the standard accounting approach.arrow_forwardI need the correct answer to this general accounting problem using the standard accounting approach.arrow_forwardI need help with this general accounting question using standard accounting techniques.arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College