Concept explainers

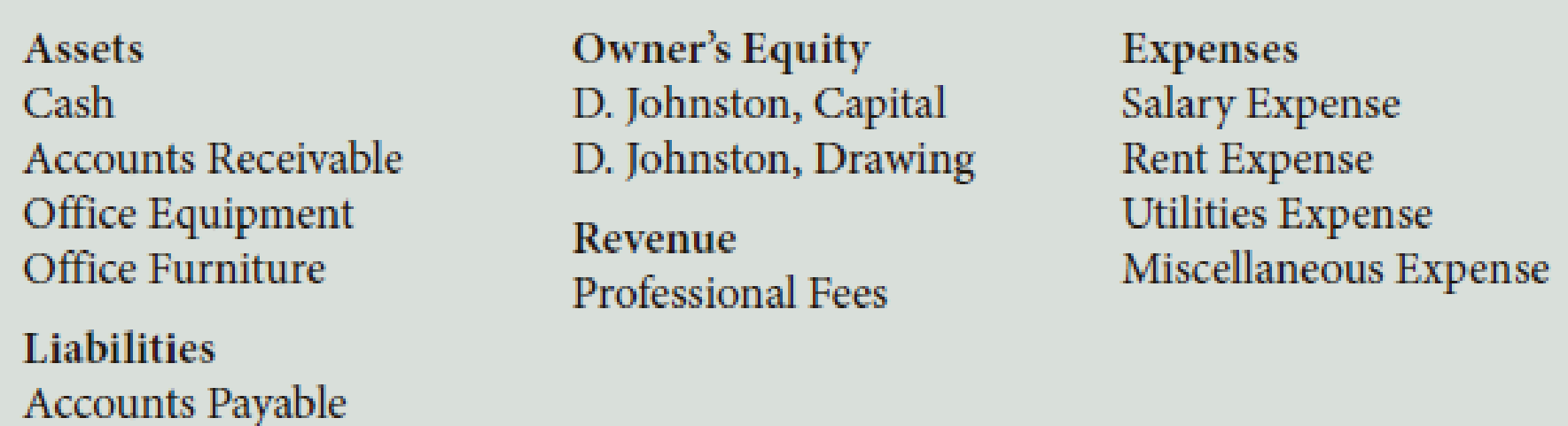

D. Johnston, a physical therapist, opened Johnston’s Clinic. His accountant provided the following chart of accounts:

The following transactions occurred during July of this year:

- a. Johnston deposited $35,000 in a bank account in the name of the business.

- b. Bought filing cabinets on account from Muller Office Supply, $560.

- c. Paid cash for chairs and carpeting for the waiting room, $835, Ck. No. 1000.

- d. Bought a photocopier from Rob’s Office Equipment, $650, paying $250 in cash and placing the balance on account, Ck. No. 1001.

- e. Received and paid the telephone bill, which included installation charges, $185, Ck. No. 1002.

- f. Sold professional services on account, $2,255.

- g. Received and paid the bill for the state physical therapy convention, $445, Ck. No. 1003.

- h. Received and paid the electric bill, $335, Ck. No. 1004.

- i. Received cash on account from credit customers, $1,940.

- j. Paid on account to Muller Office Supply, $250, Ck. No. 1005.

- k. Paid the office rent for the current month, $1,245, Ck. No. 1006.

- l. Sold professional services for cash, $1,950.

- m. Paid the salary of the receptionist, $960, Ck. No. 1007.

- n. Johnston withdrew cash for personal use, $1,200, Ck. No. 1008.

Required

- 1. Record the owner’s name in the Capital and Drawing T accounts.

- 2. Correctly place the plus and minus signs for each T account and label the debit and credit sides of the accounts.

- 3. Record the transactions in the T accounts. Write the letter of each entry to identify the transaction.

- 4. Foot the T accounts and show the balances.

- 5. Prepare a

trial balance as of July 31, 20--. - 6. Prepare an income statement for July 31, 20--.

- 7. Prepare a statement of owner’s equity for July 31, 20--.

- 8. Prepare a

balance sheet as of July 31, 20--.

Trending nowThis is a popular solution!

Chapter 2 Solutions

College Accounting: A Career Approach (with Quickbooks Online), Loose-leaf Version

Additional Business Textbook Solutions

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Horngren's Accounting (12th Edition)

Intermediate Accounting (2nd Edition)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Economics of Money, Banking and Financial Markets, The, Business School Edition (5th Edition) (What's New in Economics)

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

- General accounting questionarrow_forwardHamilton Biotech has a profit margin of 8% and an equity multiplier of 2.8. Its sales are $150 million, and it has total assets of $60 million. What is Hamilton Biotech's Return on Equity (ROE)? Round your answer to two decimal places.arrow_forwardMAX's Auto Repair, a proprietorship, started the year with total assets of $72,000 and total liabilities of $48,500. During the year, the business recorded $120,600 in repair revenues, $65,400 in expenses, and MAX Grant, the owner, withdrew $12,500. MAX’s capital balance at the end of the year?arrow_forward

- Over the past four years, the Dow Jones Industrial Average (DJIA) delivered annual returns of 12%, -3%, 18%, and 9%. What is the arithmetic average annual return per year? a) 10.25% b) 8.50% c) 9.00% d) 9.75%arrow_forwardMAX's Auto Repair, a proprietorship, started the year with total assets of $72,000 and total liabilities of $48,500. During the year, the business recorded $120,600 in repair revenues, $65,400 in expenses, and MAX Grant, the owner, withdrew $12,500. MAX’s capital balance at the end of the year?arrow_forwardPeterson Company estimates that overhead costs for the next year will be $3,600,000 for indirect labor and $910,000 for factory utilities. The company uses machine hours as its overhead allocation base. If 110,000 machine hours are planned for this next year, what is the company's plantwide overhead rate? a) $41.00 per machine hour b) $32.30 per machine hour c) $0.03 per machine hour d) $8.27 per machine hour e) $0.12 per machine hourarrow_forward

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College