Hide-It (HI), a family-owned business based in Tombstone, Arizona, builds custom homes with special features, such as hidden rooms and hidden wall safes. Hide-It has been an audit client for three years.

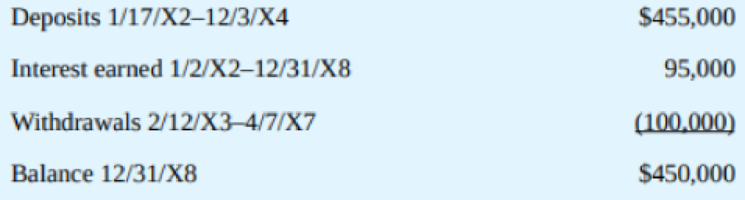

You are about to sign off on a “clean” opinion on HI’s current annual financial statements when Art Hyde, the VP-Finance, calls to tell you that the Arizona Department of Revenue has seized control of a Hide-It bank account that includes about $450,000 of company funds; the account is not currently recorded in the accounting system and you had been unaware of it. In response to your questions about the origin of the funds, Art assures you that the funds, though not recorded as revenue, had been obtained legitimately. He explains that all of the money came from separately billed but unrecorded change orders to items in contracts completed before you became HI’s auditor, and before he or any members of current management became involved with the company. You subsequently determine that there is insufficient evidence to allow you to reconstruct the nature of these cash transactions, although the following analysis is available from the Arizona Department of Revenue:

Art also informs you that HI has agreed to pay a combined tax and penalty of 12 percent on the total funds deposited within 120 days as required by a recently enacted rule that provides amnesty for tax evaders. Furthermore, he states that negotiations with the Internal Revenue Service are in process.

Required:

- a. The professional standards define errors as unintentional misstatements or omissions of amounts or disclosures in the financial statements. Is the situation described an error?

- b. The professional standards state that fraud relates to intentional misstatements or omissions of amounts or disclosures in the financial statements. Misstatements due to fraud may occur due to either (1) fraudulent financial reporting or (2) misappropriation of assets. Does the situation appear to be fraud? If so, is it fraudulent financial reporting, misappropriation of assets, or both?

- c. The professional standards outline certain auditor responsibilities relating to identifying client noncompliance with laws and distinguish between laws with a “direct effect” on the financial statements and other laws. Does the situation herein relate to noncompliance with laws as discussed within the auditing standards? If so, is the noncompliance related to a law with a direct effect on the financial statements or another law.

- d. Should the CPA firm resign in this situation? If the decision is not clear-cut, what additional information would you desire before deciding?

Trending nowThis is a popular solution!

Chapter 2 Solutions

Principles Of Auditing & Other Assurance Services

- Financial Accounting Questionarrow_forwardWhat is the investment turnover for this financial accounting question?arrow_forwardSuppose you take out a five-year car loan for $14000, paying an annual interest rate of 4%. You make monthly payments of $258 for this loan. Complete the table below as you pay off the loan. Months Amount still owed 4% Interest on amount still owed (Remember to divide by 12 for monthly interest) Amount of monthly payment that goes toward paying off the loan (after paying interest) 0 14000 1 2 3 + LO 5 6 7 8 9 10 10 11 12 What is the total amount paid in interest over this first year of the loan?arrow_forward

- Suppose you take out a five-year car loan for $12000, paying an annual interest rate of 3%. You make monthly payments of $216 for this loan. mocars Getting started (month 0): Here is how the process works. When you buy the car, right at month 0, you owe the full $12000. Applying the 3% interest to this (3% is "3 per $100" or "0.03 per $1"), you would owe 0.03*$12000 = $360 for the year. Since this is a monthly loan, we divide this by 12 to find the interest payment of $30 for the month. You pay $216 for the month, so $30 of your payment goes toward interest (and is never seen again...), and (216-30) = $186 pays down your loan. (Month 1): You just paid down $186 off your loan, so you now owe $11814 for the car. Using a similar process, you would owe 0.03* $11814 = $354.42 for the year, so (dividing by 12), you owe $29.54 in interest for the month. This means that of your $216 monthly payment, $29.54 goes toward interest and $186.46 pays down your loan. The values from above are included…arrow_forwardSuppose you have an investment account that earns an annual 9% interest rate, compounded monthly. It took $500 to open the account, so your opening balance is $500. You choose to make fixed monthly payments of $230 to the account each month. Complete the table below to track your savings growth. Months Amount in account (Principal) 9% Interest gained (Remember to divide by 12 for monthly interest) Monthly Payment 1 2 3 $500 $230 $230 $230 $230 + $230 $230 10 6 $230 $230 8 9 $230 $230 10 $230 11 $230 12 What is the total amount gained in interest over this first year of this investment plan?arrow_forwardGiven correct answer general Accounting questionarrow_forward

- On 1st May, 2024 you are engaged to audit the financial statement of Giant Pharmacy for the period ending 30th December 2023. The Pharmacy is located at Mgeni Nani at the outskirts of Mtoni Kijichi in Dar es Salaam City. Materiality is judged to be TZS. 200,000/=. During the audit you found that all tests produced clean results. As a matter of procedures you drafted an audit report with an unmodified opinion to be signed by the engagement partner. The audit partner reviewed your file in October, 2024 and concluded that your audit complied with all requirements of the international standards on auditing and that; sufficient appropriate audit evidence was in the file to support a clean audit opinion. Subsequently, an audit report with an unmodified opinion was issued on 1st November, 2024. On 18th January 2025, you receive a letter from Dr. Fatma Shemweta, the Executive Director of the pharmacy informing you that their cashier who has just absconded has been arrested in Kigoma with TZS.…arrow_forwardNonearrow_forwardNeed help this questionarrow_forward

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning