Concept explainers

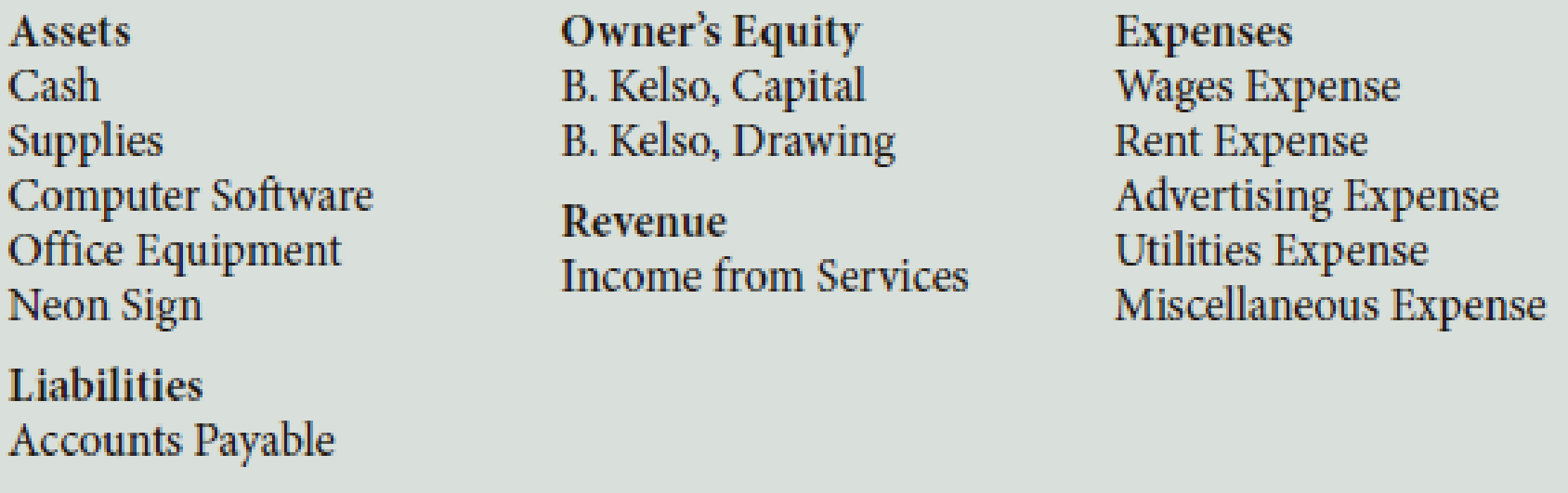

B. Kelso established Computer Wizards during November of this year. The accountant prepared the following chart of accounts:

The following transactions occurred during the month:

- a. Kelso deposited $45,000 in a bank account in the name of the business.

- b. Paid the rent for the current month, $1,800, Ck. No. 2001.

- c. Bought office desks and filing cabinets for cash, $790, Ck. No. 2002.

- d. Bought a computer and printer from Cyber Center for use in the business, $2,700, paying $1,700 in cash and placing the balance on account, Ck. No. 2003.

- e. Bought a neon sign on account from Signage Co., $1,350.

- f. Kelso invested her personal computer software with a fair market value of $600 in the business.

- g. Received a bill from Country News for newspaper advertising, $365.

- h. Sold services for cash, $1,245.

- i. Received and paid the electric bill, $345, Ck. No. 2004.

- j. Paid on account to Country News, a creditor, $285, Ck. No. 2005.

- k. Sold services for cash, $1,450.

- l. Paid wages to an employee, $925, Ck. No. 2006.

- m. Received and paid the bill for the city business license, $75, Ck. No. 2007.

- n. Kelso withdrew cash for personal use, $850, Ck. No. 2008.

- o. Kelso withdrew cash for personal use, $850, Ck. No. 2008.

Required

- 1. Record the owner’s name in the Capital and Drawing T accounts.

- 2. Correctly place the plus and minus signs for each T account and label the debit and credit sides of the accounts.

- 3. Record the transactions in T accounts. Write the letter of each entry to identify the transaction.

- 4. Foot the T accounts and show the balances.

- 5. Prepare a

trial balance , with a three-line heading, dated November 30, 20--.

Trending nowThis is a popular solution!

Chapter 2 Solutions

Bundle: College Accounting: A Career Approach (with QuickBooks Online), Loose-leaf Version, 13th + LMS Integrated CengageNOWV2, 1 term (6 months) Printed Access

Additional Business Textbook Solutions

Horngren's Accounting (12th Edition)

Intermediate Accounting (2nd Edition)

Economics of Money, Banking and Financial Markets, The, Business School Edition (5th Edition) (What's New in Economics)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Financial Accounting, Student Value Edition (5th Edition)

- Give me solutionarrow_forwardFinancial Accounting Questionarrow_forwardOn January 1, 2020, Nexus Technologies purchased a machine for $15,000. The machine was estimated to have a 10-year useful life and a residual value of $800. Straight-line depreciation is used. On January 1, 2022, the machine was exchanged for office equipment with a fair value of $12,500. Assuming that the exchange had commercial substance, how much would be recorded as a gain on disposal of the machine on January 1, 2022?arrow_forward

- Variable and Absorption Costing Summarized data for the first year of operations for Gorman Products, Inc., are as follows: Sales (70,000 units) Production costs (80,000 units) Direct material Direct labor Manufacturing overhead: Variable Fixed Operating expenses: Variable $2,800,000 880,000 720,000 544,000 320,000 175,000 Fixed 240,000 Depreciation on equipment 60,000 Real estate taxes 18,000 Personal property taxes (inventory & equipment) 28,800 Personnel department expenses 30,000 a. Prepare an income statement based on full absorption costing. Only use a negative sign with your answer for net income (loss), if the answer represents a net loss. Otherwise, do not use negative signs with any answers. Round answers to the nearest whole number, when applicable. Sales Cost of Goods Sold: Absorption Costing Income Statement Beginning Inventory $ 2,800,000 Direct materials Direct labor Manufacturing overhead Less: Ending Inventory Cost of Goods Sold Gross profit $ 880,000 720,000 864,000…arrow_forwardAccurate answerarrow_forwardanswer plzarrow_forward

- What is the sales margin for the division of the financial accounting?arrow_forwardMartin Corporation incurs a cost of $38.65 per unit, of which $22.35 is variable, to make a product that normally sells for $60.50. A foreign wholesaler offers to buy 6,100 units at $34.20 each. Martin will incur additional costs of $2.85 per unit to imprint a logo and to pay for shipping. Compute the increase or decrease in net income Martin will realize by accepting the special order, assuming the company has sufficient excess operating capacity.arrow_forwardTitan Industries purchased a machine for $40,000 with a residual value of $6,000 and an estimated useful life of 12 years. What is the annual depreciation under the straight-line method?arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT