Concept explainers

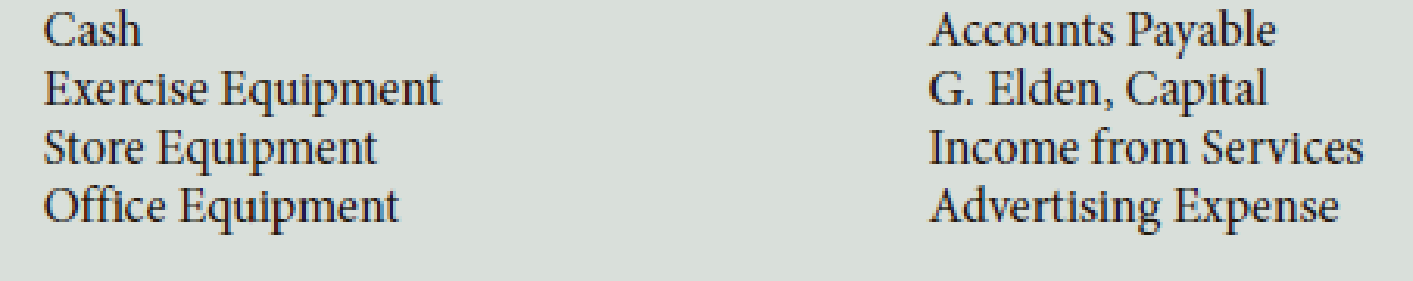

During December of this year, G. Elden established Ginny’s Gym. The following asset, liability, and owner’s equity accounts are included in the chart of accounts:

During December, the following transactions occurred:

- a. Elden deposited $35,000 in a bank account in the name of the business.

- b. Bought exercise equipment for cash, $8,150, Ck. No. 1001.

- c. Bought advertising on account from Hazel Company, $105.

- d. Bought a display rack on account from Cyber Core, $790.

- e. Bought office equipment on account from Office Aids, $185.

- f. Elden invested her exercise equipment with a fair market value of $1,200 in the business.

- g. Made a payment to Cyber Core, $200, Ck. No. 1002.

- h. Sold services for the month of December for cash, $800.

Required

- 1. Write the account classifications (Assets, Liabilities, Capital, Drawing, Revenue, Expense) in the fundamental

accounting equation , as well as the plus and minus signs and Debit and Credit. - 2. Write the account names on the T accounts under the classifications, place the plus and minus signs for each T account, and label the debit and credit sides of the T accounts

- 3. Record the amounts in the proper positions in the T accounts. Write the letter next to each entry to identify the transaction.

- 4. Foot and balance the accounts.

Trending nowThis is a popular solution!

Chapter 2 Solutions

Bundle: College Accounting: A Career Approach (with QuickBooks Online), Loose-leaf Version, 13th + LMS Integrated CengageNOWV2, 1 term (6 months) Printed Access

Additional Business Textbook Solutions

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Intermediate Accounting (2nd Edition)

Horngren's Accounting (12th Edition)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Business Essentials (12th Edition) (What's New in Intro to Business)

- need help this questionsarrow_forwardprovide correct answerarrow_forwardThe following lots of Commodity Z were available for sale during the year. Beginning inventory First purchase Second purchase Third purchase 10 units at $30 25 units at $32 30 units at $34 10 units at $35 The firm uses the periodic inventory system, and there are 20 units of the commodity on hand at the end of the year. What is the ending inventory balance of Commodity Z using the weighted average cost method? a. $620 b. $659 c. $690 d. $655arrow_forward

- Assume that three identical units of merchandise were purchased during October, as follows: Units Cost Oct. 5 Purchase 1 $ 5 12 Purchase 1 13 28 Purchase 1 15 Total 3 $33 One unit is sold on October 31 for $28. Using the table provided, determine the cost of goods sold using the weighted average cost method. a. $11 b. $17 c. $13 d. $22arrow_forwardBoxwood Company sells blankets for $39 each. The following information was taken from the inventory records during May. The company had no beginning inventory on May 1. Boxwood uses a perpetual inventory system.DateBlanketsUnitsCostMay 3Purchase21$1710Sale8 17Purchase36$1920Sale15 23Sale 30Purchase37$20Determine the gross profit for the sale of May 23 using the FIFO inventory costing method.a. $100b. $221c. $95d.$259arrow_forwardGeneral accounting questionarrow_forward

- Nonearrow_forwardChapter 18 Homework i Saved 15 Exercise 18-14 (Algo) Contribution margin income statement LO C2 1 points eBook Hint Sunn Company manufactures a single product that sells for $190 per unit and whose variable costs are $133 per unit. The company's annual fixed costs are $628,000. The sales manager predicts that next year's annual sales of the company's product will be 39,800 units at a price of $198 per unit. Variable costs are predicted to increase to $138 per unit, but fixed costs will remain at $628,000. What amount of income can the company expect to earn under these predicted changes? Prepare a contribution margin income statement for the next year. SUNN COMPANY Contribution Margin Income Statement Units $ per unit 39,800 $ 198 Ask Sales Variable costs 39,800 Print Contribution margin 39,800 Fixed costs Income References Mc Graw Hill $ 7,880,400 138 5,492,400 2,388,000 628,000 $ 1,760,000 Help Save & Exit Submit Check my workarrow_forwardI want to correct answer general accountingarrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub