Concept explainers

Refer to the following financial statements for Crosby Corporation:

a. Prepare a statement of cash flows for the Crosby Corporation using the general procedures indicated in Table 2-10.

b. Describe the general relationship between net income and net cash flows from operating activities for the firm.

c. Has the buildup in plant and equipment been financed in a satisfactory manner? Briefly discuss.

d. Compute the book value per common share for both 20X1 and 20X2 for the Crosby Corporation.

e. If the market value of a share of common stock is 3.3 times book value for 20X1, what is the firm’s P/E ratio for 20X2?

a.

To prepare: The cash flow statement for Crosby Corporation for the year ending 31st December, 20X2.

Introduction:

Cash Flow Statement (CFS):

The CFS is a core financial statement of a firm that shows the way cash gets affected by any change in any item of the balance sheet and income statement. It also shows the cash position of the company.

Answer to Problem 28P

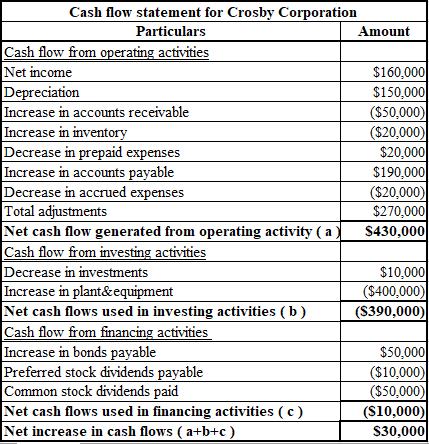

The cash flow statement for Crosby Corporation for the year ending 31st December, 20X2 is as follows.

Hence, the net increase in cash flow is $30,000.

Explanation of Solution

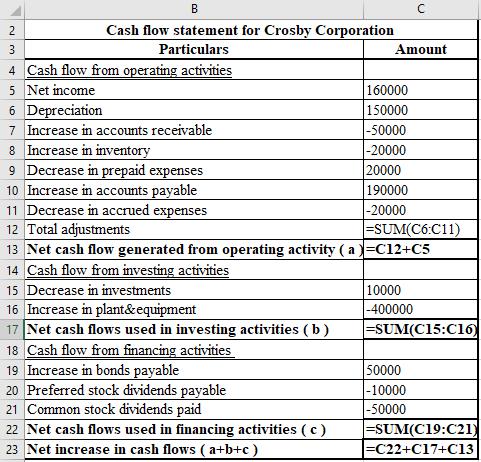

The formulae and calculations used for the preparation of the CFS for Crosby Corporation are shown below.

(b)

To explain:The relationship between net income as well as net cash flows from activities of operating nature.

Introduction:

Cash Flow Statement (CFS):

The CFS is a core financial statement of a firm that shows the way cash gets affected by any change in any item of the balance sheet and income statement. It also shows the cash position of the company.

Answer to Problem 28P

There exists a direct relationship between net income and cash flow from operating activities. If the net income increases, cash flow from operating activities also increases. In the given problem, the net cash flows from activities of operating nature is much more than the net income.

Explanation of Solution

Cash flow from operating activities, in the given problem, exceeds net income as depreciation of $319,000 is added back and there is an increase of $248,000 in accounts payable, which leads to an increase in the cash flow. This provides an understanding of the CFS to the readers, users and the analysts with regard to the cash flows from the corporation’s routine operations.

(c)

To explain:Whether the financing of the addition in plant and equipment has been done satisfactorily or not.

Introduction:

Plant & Equipment:

The fixed assets used by a company for manufacturing or providing services are termed as plant and equipment. These assets are for long-term, and thus, have a life of more than a year. They are depreciable and tangible in nature.

Answer to Problem 28P

The additions in Crosby Corporation’s plant & equipment have largely been financed through accounts payable, which is a short-term source. Such type of financing is not a preferred by any company as short-term sources should only be used for short-term needs.

Explanation of Solution

The financing of the gross buildup in Crosby Corporation’s plant & equipment of $690,000, of which the net buildup is of $371,000, has largely been done by accounts payables worth $248,000, which is a short-term source.

Such type of sourcing is mostly preferred for short-term needs and not long-term assets. If the firm continues to use short-term sources of funds for financing non-current assets rather than choosing options such as long-term debts, the funds might get dried up quickly.

(d)

To calculate: The book value for each share of Crosby corporation for the years 20X1 and 20X2.

Introduction:

Book value per share:

It is a metric used by investors to know whether the price of the share is undervalued or overvalued by comparing it to the market value per share. If a company’s book value per share is lower than the market value per share, the stock is overvalued and, if the book value per share is higher than the market value, it is undervalued.

Answer to Problem 28P

The book value per share of Crosby Corporation for the year 20X1 is $8.58 and that for the year 20X2 is $9.42.

Explanation of Solution

The calculation of the book value per share for the year 20X1 is as follows.

Hence, the book value for each share in the year 20X1 is $8.58.

The calculation of the book value per share for the year 20X2 is as follows.

Hence, the book value for each share in the year 20X2 is $9.42.

(e)

To calculate:The P/E ratio of the firm in the year 20X2, the market value per share being 3.3 times its book value.

Introduction:

Market value per share

Market value per share is the current value of each share of a company assigned by the market. It is computed by dividing the total market value of the company by the number of its outstanding shares.

Earnings per share (EPS):

It is the profit earned by shareholders on each share. A higher EPS indicates a higher value of the company because investors are ready to pay a higher price for one share of the company.

P/E ratio:

Price earnings ratio is calculated by dividing a company’s current share price by its EPS. It helps value the present as well as future profitability of a company.

Answer to Problem 28P

The P/E ratio of Crosby Corporation for the year 20X2 is 24.87.

Explanation of Solution

Explanation:

The calculation of P/E ratio:

Hence, the P/E ratio is 24.87.

Working Note:

The calculation of the market value of each share:

Want to see more full solutions like this?

Chapter 2 Solutions

Loose Leaf for Foundations of Financial Management Format: Loose-leaf

- D. (1) Consider the following cash inflows of a financial product. Given that the market interest rate is 12%, what price would you pay for these cash flows? Year 0 1 2 3 4 Cash Flow 160 170 180 230arrow_forwardExplain why financial institutions generally engage in foreign exchange tradingactivities. Provide specific purposes or motivations behind such activities.arrow_forwardA. In 2008, during the global financial crisis, Lehman Brothers, one of the largest investment banks, collapsed and defaulted on its corporate bonds, causing significant losses for bondholders. This event highlighted several risks that investors in corporate bonds might face. What are the key risks an investor would encounter when investing in corporate bonds? Explain these risks with examples or academic references. [15 Marks]arrow_forward

- Two companies, Blue Plc and Yellow Plc, have bonds yielding 4% and 5.3%respectively. Blue Plc has a credit rating of AA, while Yellow Plc holds a BB rating. If youwere a risk-averse investor, which bond would you choose? Explain your reasoning withacademic references.arrow_forwardB. Using the probabilities and returns listed below, calculate the expected return and standard deviation for Sparrow Plc and Hawk Plc, then justify which company a risk- averse investor might choose. Firm Sparrow Plc Hawk Plc Outcome Probability Return 1 50% 8% 2 50% 22% 1 30% 15% 2 70% 20%arrow_forward(2) Why are long-term bonds more susceptible to interest rate risk than short-term bonds? Provide examples to explain. [10 Marks]arrow_forward

- Don't used Ai solutionarrow_forwardDon't used Ai solutionarrow_forwardScenario one: Under what circumstances would it be appropriate for a firm to use different cost of capital for its different operating divisions? If the overall firm WACC was used as the hurdle rate for all divisions, would the riskier division or the more conservative divisions tend to get most of the investment projects? Why? If you were to try to estimate the appropriate cost of capital for different divisions, what problems might you encounter? What are two techniques you could use to develop a rough estimate for each division’s cost of capital?arrow_forward

- Scenario three: If a portfolio has a positive investment in every asset, can the expected return on a portfolio be greater than that of every asset in the portfolio? Can it be less than that of every asset in the portfolio? If you answer yes to one of both of these questions, explain and give an example for your answer(s). Please Provide a Referencearrow_forwardHello expert Give the answer please general accountingarrow_forwardScenario 2: The homepage for Coca-Cola Company can be found at coca-cola.com Links to an external site.. Locate the most recent annual report, which contains a balance sheet for the company. What is the book value of equity for Coca-Cola? The market value of a company is (# of shares of stock outstanding multiplied by the price per share). This information can be found at www.finance.yahoo.com Links to an external site., using the ticker symbol for Coca-Cola (KO). What is the market value of equity? Which number is more relevant to shareholders – the book value of equity or the market value of equity?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:CengagePrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:CengagePrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College