Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN: 9781305654174

Author: Gary A. Porter, Curtis L. Norton

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

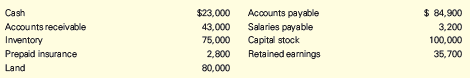

Chapter 2, Problem 2.5AP

The

Required

- Determine the current ratio and working capital.

- Kapinski appears to have a positive current ratio and a large net working capital. Why would it have trouble paying bills as they come due?

- Suggest three things that Kapinski can do to help pay its bills on time.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Give me solution

hello teacher please solve questions

Accounting answer me

Chapter 2 Solutions

Financial Accounting: The Impact on Decision Makers

Ch. 2 - Read each definition below and write the number of...Ch. 2 - Prob. 2.1ECh. 2 - The Operating Cycle Two Wheeler Cycle Shop buys...Ch. 2 - Classification of Financial Statement Items Regal...Ch. 2 - Current Ratio Baldwin Corp. reported the following...Ch. 2 - Classification of Assets and Liabilities Indicate...Ch. 2 - Selling Expenses and General and Administrative...Ch. 2 - Prob. 2.7ECh. 2 - Income Statement Ratio The income statement of...Ch. 2 - Statement of Retained Earnings Landon Corporation...

Ch. 2 - Components of the Statement of Cash Flows Identify...Ch. 2 - Prob. 2.11ECh. 2 - Prob. 2.12MCECh. 2 - Prob. 2.13MCECh. 2 - Prob. 2.14MCECh. 2 - Materiality Joseph Knapp, a newly hired accountant...Ch. 2 - Costs and Expenses The following costs are...Ch. 2 - Prob. 2.3PCh. 2 - Prob. 2.4PCh. 2 - Working Capital and Current Ratio The balance...Ch. 2 - Single-Step Income Statement The following income...Ch. 2 - Multiple-Step Income Statement and Profit Margin...Ch. 2 - Statement of Cash Flows Colorado Corporation was...Ch. 2 - Basic Elements of Financial Reports Comparative...Ch. 2 - Prob. 2.10MCPCh. 2 - Prob. 2.11MCPCh. 2 - Prob. 2.12MCPCh. 2 - Prob. 2.1APCh. 2 - Prob. 2.2APCh. 2 - Prob. 2.3APCh. 2 - Prob. 2.4APCh. 2 - Working Capital and Current Ratio The balance...Ch. 2 - Single-Step Income Statement The following income...Ch. 2 - Prob. 2.7APCh. 2 - Prob. 2.8APCh. 2 - Prob. 2.9APCh. 2 - Comparability and Consistency in Income Statements...Ch. 2 - Prob. 2.12AMCPCh. 2 - Prob. 2.1DCCh. 2 - Prob. 2.2DCCh. 2 - Analysis of Cash Flow for a Small Business...Ch. 2 - Prob. 2.4DCCh. 2 - The Expenditure Approval Process Roberto is the...Ch. 2 - Prob. 2.6DC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License