Concept explainers

Agassi Company uses a job order cost system in each of its three manufacturing departments. Manufacturing

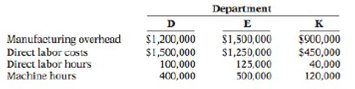

In establishing the predetermined overhead rates for 2017, the following estimates were made for the year.

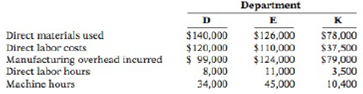

During January, the

Instructions

(a) Compute the predetermined overhead rate for each department.

(b) Compute the total

(c) Compute the under- or overapplied overhead for each department at January 31.

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

Managerial Accounting: Tools for Business Decision Making 7e Binder Ready Version + WileyPLUS Registration Card

Additional Business Textbook Solutions

Management (14th Edition)

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

Marketing: An Introduction (13th Edition)

Horngren's Accounting (12th Edition)

Intermediate Accounting (2nd Edition)

Fundamentals of Management (10th Edition)

- A firm has net working capital of $980, net fixed assets of $4,418, sales of $9,250, and current liabilities of $1,340. How many dollars worth of sales are generated from every $1 in total assets? Need Answer general Accountingarrow_forwardFinancial Accountingarrow_forwardPlease give me true answer this financial accounting questionarrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning