MyLab Accounting with Pearson eText -- Access Card -- for Horngren's Financial & Managerial Accounting, The Financial Chapters (My Accounting Lab)

5th Edition

ISBN: 9780133877281

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 2.32AP

Journalizing transactions, posting

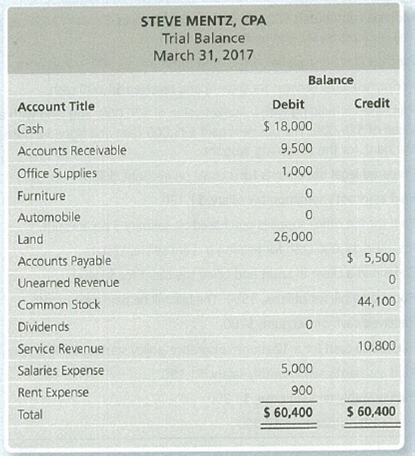

The trial balance of Steve Mentz, CPA, is dated March 31, 2017:

During April, the business completed the following transactions:

| Apr. 4 | Collected $ 1,000 cash from a client on account. |

| 8 | Performed tax services for a client on account, $5,800. |

| 13 | Paid $1,500 on account. |

| 14 | Purchased furniture on account, $4,600. |

| 15 | Mentz contributed his persona l automobile to the business in exchange for common stock. The automobile had a market value of $8,000. |

| 18 | Purchased office supplies on account, $500. |

| 19 | Received $2,900 for tax services performed on April 8. |

| 20 | Paid cash dividends of $8,000. |

| 21 | Received $5,400 cash for consulting work completed. |

| 24 | Received $1,200 cash for accounting services to be completed next month. |

| 27 | Paid office rent, $700. |

| 28 | Paid employee salary, $1,600. |

Requirements

- 1. Record the April transactions in the journal. Use the following accounts: Cash;

Accounts Receivable ; Office Supplies; Furniture; Automobile; Land; Accounts Payable; Unearned Revenue; Common Stock; Dividends; Service Revenue; Salaries Expense; and Rent Expense. Include an explanation for each entry. - 2. Open the four-column ledger accounts listed in the trial balance, together with their balances as of March 31. Use the following account numbers: Cash, 11; Accounts Receivable, 12; Office Supplies, 13; Furniture, 14; Automobile, 15; Land, 16; Accounts Payable, 21; Unearned Revenue, 22; Common Stock, 31;

- 1. Dividends, 33; Service Revenue, 41; Salaries Expense, 51; and Rent Expense, 52.

- 2. Post the journal entries to four-column accounts in the ledger, using dates, account numbers, journal references, and posting references. Assume the journal entries were recorded on page 5 of the journal.

- 3. Prepare the trial balance of Steve Mentz, CPA, at April 30, 2017.

3. Cash Balance $16,700

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Express Delivery Company (EDC) is considering outsourcing its Payroll Department to a payroll processing company for an annual fee of $220,800. An internally prepared report summarizes the Payroll Department’s annual operating costs as follows:

Supplies

$ 30,800

Payroll clerks’ salaries

120,800

Payroll supervisor’s salary

58,800

Payroll employee training expenses

10,800

Depreciation of equipment

20,800

Allocated share of common building operating costs

15,800

Allocated share of common administrative overhead

28,800

Total annual operating cost

$ 286,600

EDC currently rents overflow office space for $36,800 per year. If the company closes its Payroll Department, the employees occupying the rented office space could be brought in-house and the lease agreement on the rented space could be terminated with no penalty.

If the Payroll Department is outsourced the payroll clerks will not be retained; however, the supervisor would be transferred to the company’s Human…

Thalassines Kataskeves, S.A., of Greece makes marine equipment. The company has been experiencing losses on its bilge pump product line for several years. The most recent quarterly contribution format income statement for the bilge pump follows:

Thalassines Kataskeves, S.A.

Income Statement—Bilge Pump

For the Quarter Ended March 31

Sales

$ 410,000

Variable expenses:

Variable manufacturing expenses

$ 123,000

Sales commissions

50,000

Shipping

21,000

Total variable expenses

194,000

Contribution margin

216,000

Fixed expenses:

Advertising (for the bilge pump product line)

27,000

Depreciation of equipment (no resale value)

120,000

General factory overhead

38,000*

Salary of product-line manager

113,000

Insurance on inventories

5,000

Purchasing department

49,000†

Total fixed expenses

352,000

Net operating loss

$ (136,000)

*Common costs allocated on the basis of machine-hours.

†Common costs allocated on the basis of…

Do companies maintain two sets of depreciation schedules, one for financial reporting and the other one for tax purposes?

Chapter 2 Solutions

MyLab Accounting with Pearson eText -- Access Card -- for Horngren's Financial & Managerial Accounting, The Financial Chapters (My Accounting Lab)

Ch. 2 - The detailed record of the changes in a particular...Ch. 2 - Which of the following accounts is a liability? a....Ch. 2 - The left side of an account is used to record...Ch. 2 - Which of the following statements is correct? a....Ch. 2 - Prob. 5QCCh. 2 - Prob. 6QCCh. 2 - Posting a 2,500 purchase of office supplies on...Ch. 2 - Prob. 8QCCh. 2 - Which sequence correctly summarizes the accounting...Ch. 2 - Nathville Laundry reported assets of 800 and...

Ch. 2 - Identify the three categories of the accounting...Ch. 2 - What is the purpose of the chart of accounts?...Ch. 2 - What does a ledger show? Whats the difference...Ch. 2 - Prob. 4RQCh. 2 - Prob. 5RQCh. 2 - Prob. 6RQCh. 2 - When are credits increases? When are credits...Ch. 2 - Prob. 8RQCh. 2 - What are source documents? Provide examples of...Ch. 2 - Prob. 10RQCh. 2 - Explain the five steps in journalizing and posting...Ch. 2 - Prob. 12RQCh. 2 - Prob. 13RQCh. 2 - What is the purpose of the trial balance?Ch. 2 - Prob. 15RQCh. 2 - If total debits equal total credits on the trial...Ch. 2 - What is the calculation for the debt ratio?...Ch. 2 - Identifying accounts Consider the following...Ch. 2 - Identifying increases and decreases in accounts...Ch. 2 - Identifying normal balances For each account,...Ch. 2 - Prob. 2.4SECh. 2 - Journalizing transactions Arkansas Sales...Ch. 2 - Prob. 2.6SECh. 2 - Prob. 2.7SECh. 2 - Preparing a trial balance Henderson Floor...Ch. 2 - Calculating debt ratio Vacuum Magic Carpet Care...Ch. 2 - Using accounting vocabulary March the accounting...Ch. 2 - Creating a chart of accounts Raymond Autobody Shop...Ch. 2 - Identifying accounts, increases in accounts, and...Ch. 2 - Identifying increases and decreases in accounts...Ch. 2 - Identifying source documents For each transaction,...Ch. 2 - Analyzing and journalizing transactions As the...Ch. 2 - Use the following information to answer Exercises...Ch. 2 - Use the following information to answer Exercises...Ch. 2 - Use the following information to answer Exercises...Ch. 2 - Use the following information to answer Exercises...Ch. 2 - Analyzing transactions from T-accounts The first...Ch. 2 - Journalizing transactions from T-accounts In...Ch. 2 - Preparing a trial balance The accounts of Aker...Ch. 2 - Preparing a trial balance from T-accounts The...Ch. 2 - Journalizing transactions, posting journal entries...Ch. 2 - Prob. 2.25ECh. 2 - Prob. 2.26ECh. 2 - Correcting errors in a trial balance The following...Ch. 2 - Prob. 2.28ECh. 2 - Problems Group A Journalizing transactions,...Ch. 2 - Journalizing transactions, posting journal entries...Ch. 2 - Journalizing transactions, posting journal entries...Ch. 2 - Journalizing transactions, posting journal entries...Ch. 2 - Correcting errors in a trial balance The trial...Ch. 2 - Preparing financial statements from the trial...Ch. 2 - Journalizing transactions, posting journal entries...Ch. 2 - Journalizing transactions, posting journal entries...Ch. 2 - Journalizing transactions, posting journal entries...Ch. 2 - Prob. 2.38BPCh. 2 - Prob. 2.39BPCh. 2 - Prob. 2.40BPCh. 2 - Journalizing transactions, posting to T-accounts,...Ch. 2 - Journalizing transactions, posting to T-accounts,...Ch. 2 - Your friend, Dean McChesney, requested that you...Ch. 2 - Prob. 2.1CTEICh. 2 - Roy Akins was the accounting manager at Zelco, a...Ch. 2 - Prob. 2.1CTFSCCh. 2 - In 35 words or fewer, explain the difference...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- none ??arrow_forwardNeed help with this accounting questionsarrow_forwardCarichem Company produces sanitation products after processing specialized chemicals. The following relates to its activities: 1 Kilogram of chemicals purchased for $4000 and with an additional $2000 is processed into 400 grams of Crystals and 80 litres of a Cleaning agent. At split-off, a gram of Crystal can be sold for $2 and the Cleaning agent can be sold for $8 per litre. At an additional cost of $800, Carichem can process the 400 grams of Crystal into 500 grams of Detergent that can be sold for $4 per gram. The 80 litres of Cleaning agent is packaged at an additional cost of $600 and made into 200 packs of Softener that can be sold for $4 per pack. Required: 1. Allocate the joint cost to the Detergent and the Softener using the following: a. Sales value at split-off method b. NRV method 2. Should Carichem have processed each of the products further? What effect does the allocation method have on this decision?arrow_forward

- Please provide correct solution this financial accounting questionarrow_forwardAllocate the two support departments’ costs to the two operating departments using the following methods: a. Direct method b. Step-down method (allocate HR first) c. Step-down method (allocate IS first) d. The Algebraic method.arrow_forwardCan you help me with accounting questionsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

The ACCOUNTING EQUATION For BEGINNERS; Author: Accounting Stuff;https://www.youtube.com/watch?v=56xscQ4viWE;License: Standard Youtube License