(a)

The equation for Total cost and total revenue.

Explanation of Solution

Given information:

P = -0.25D + 250

P = unit sales price

D = annual quantity demanded for the product.

Total Cost (TC) = Fixed Cost+ Variable cost

Total Revenue (TR) − Quantity demanded X Price

Total Profit = Total Revenue − Total Costs

The cost and revenue details of the company are given below:

The variable costs per unit are $20.00 and the fixed costs are $10.875.00

The price-

Here,

P = unit sales price

D = annual quantity demanded for the product.

The following three formulas were also provided to assist you with the problem as wll.

Total Cost (TC) = Fixed Cost+ Variable cost

Total Revenue (TR) − Quantity demanded× Price

Total Profit = Total Revenue − Total Costs

To determine the total cost of the problem, it should be noted that TC is equal to the combination of both fixed costs and variable costs.

Total Costs (TC) - $10,875.00+20.00D

Where, D is the quantity demanded or sold.

Total Revenue can be calculated by the multiplying price with quantity

Total Revenue = Price × Quantity Demanded

=(-0.25D+250)×D

= -0.25D2 + 250D

Total Revenue = -0.25D2 + 250D.

(b)

Breakeven quantity.

Explanation of Solution

Breakeven point for units is that one would need to produce inorder to achieve no profit or loss. In this case, set the formula,

Total Cost = Total Revenue

$10,875+20.00D = -0.25D2 +250D

0.25D2 -250D+20.00D+$10,875.00=0

0.25D2 -230D+$10,875.00=0

The standard formula that assists in getting the correct answer.

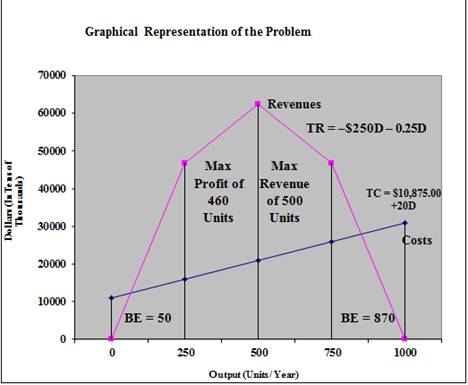

Thus, the break even points for this situation are both 50 units and 870 units respectively. It can be said that anything above 870 units and below 50 units could constitute a loss whereas anything between would be profitable to profitable.

(c)

Number of units the company would want to produce if they wanted to maximize the revenues.

Explanation of Solution

Total Revenue = -0.25D2 +250D

Revenue maximization:

Revenue is maximized when MR equals to zero.

Revenue maximization;

Thus to maximize revenue, the company must produce 500 units.

(d)

Total Profit at revenue maximization point of 500 units:

Explanation of Solution

Total Profit = Total Revenue- Total Costs

Thus, the total profit at revenue maximization point of 500 units is $41,625.

The company’s maximum profit is obtained when marginal revenue equals to marginal cost.

Marginal Cost (MC) is calculated as shown below:

Profit maximization is at MR = MC

Thus, maximum profit is obtained at 460 units.

Total Profit = Total Revenue − Total Costs

Maximum possible profit is $42,025.

(e)

Graphical Representation:

Explanation of Solution

Graphical Representation:

Want to see more full solutions like this?

Chapter 2 Solutions

Engineering Economic Analysis

- When the price of a good or a service increases, _______? Group of answer choices The demand curve shifts in the same direction. The supply curve shifts in the opposite direction. The demand curve shifts in the opposite direction. There is a movement along the demand curve.arrow_forwardA foreign country to which we export but from which we do not import would do ______ according the Circular Flow Diagram? Group of answer choices Sell and Buy (or Rent). Sell, but does not buy. Buys, but does not sell. Does not sell nor buys.arrow_forwardNot use ai pleasearrow_forward

- After the holiday season, many of us find ourselves thinking, “What will I do with another case for my iPad?” Often, both the gift giver and gift receiver could be made better off (that is, receive a higher level of utility or happiness) if cash had been given instead. To understand the economic rationale behind this, economists turn to the basic consumer theory model of budget constraints and indifference curves. Recall that an indifference curve maps out all possible consumption bundles of goods that yield the same level of utility to a given consumer. Indifference curves tell us nothing about what we can afford, but rather tell us how happy a particular bundle will make us. On the other hand, a budget constraint shows the consumption bundles that we can buy given our income and the prices of goods. Similarly, a budget constraint says nothing about what we would like to buy, but rather what we can afford. Suppose you consume only two types of goods: magazines and food. You have $300…arrow_forwardCho is a truck driver living in Miami who performs freelance health consulting to supplement her normal income. At an hourly wage rate of $45, she is willing to consult 5 hours per week. Upping the wage to $65 per hour, she is willing to consult 14 hours per week. Using the midpoint method, the elasticity of Cho’s labor supply between the wages of $45 and $65 per hour is approximately , which means that Cho’s supply of labor over this wage range is .arrow_forwardWhere do I draw the demand and supply linearrow_forward

- It would be inefficient but possible for this economy to produce? 100 1dryers 90 80 C 70 A 60 50 D B 40 30 20 10 10 20 30 40 50 60 70 80 washers O 90 dryers and 20 washers. 50 dryers and 50 washers. O Two of the answers are correct. O 60 dryers and 20 washers.arrow_forwardignore what i put and find the correct answerarrow_forwardA foreign country to which we export but from which we do not import would _____ according the Circular Flow Diagram? • Sell and Buy (or Rent). • Does not sell nor buys. • Sell, but does not buy. • Buys, but does not sell.arrow_forward

- For a certain health insurance policy, losses are uniformly distributed on the interval [0, b].The policy has a deductible of $180 and the expected value of the non-reimbursed portionof a loss is $144. Calculate barrow_forwardfacebook (not Mark Zuckerberg) would do which action according the Circular Flow diagram? Buys, but does not sell. Does not sell nor buys. Sell, but does not buy. Sell and Buy (or Rent).arrow_forwardIt would be impossible for this economy to produce? dryers 100 90 C 80 70 A 60 50 D B 40 30+ 20- 10 10 20 30 40 50 60 70 80 OD C OA B washers 13arrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education