Concept explainers

Cornerstone Exercise 2-22 Transaction Analysis

The Mendholm Company entered into the following transactions:

- Performed services on account, 521,500.

- Collected $9,500 from client related to services performed in Item a.

- Find $500 dividend to stockholders.

- Paid salaries of $4,000 for the current month.

(Continued)

Required:

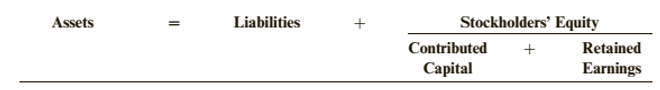

Show the effect of each transaction using the following model:

Concept Introduction:

Transaction Analysis- Every transaction is first analyzed by accountant with the help of accounting equation to see transactions that affects the business event. This is known as transaction analysis which states that each transaction is analyzed to determine the effect of each transaction in two parts or dual effect on each element of an accounting equation so that the equation is in balance. The accounting equation is shown as:

Requirement 1:

To show the effect on Mendholm Company when it performed services on account for $21500.

Answer to Problem 22CE

In this situation, when Mendholm Company performed services on account for $21500, it will increase assets and increases shareholder’s equity by $21500.

Explanation of Solution

When Mendholm Company performed services for which payment will be made later, this is known as ‘sale on account’. This creates an asset called accounts receivable which will be increased by $21500because payment is due from client. Also, revenue is recorded when service is performed and not when cash is received. Thus, retained earnings will also increase by $21500. This effect in accounting equation will be shown as:

Concept Introduction:

Transaction Analysis- Every transaction is first analyzed by accountant with the help of accounting equation to see transactions that affects the business event. This is known as transaction analysis which states that each transaction is analyzed to determine the effect of each transaction in two parts or dual effect on each element of an accounting equation so that the equation is in balance. The accounting equation is shown as:

Requirement 2:

To show the effect on Mendholm Companywhen cash of $9500 is collected from client for services performed on account.

Answer to Problem 22CE

When cash of $9500 is collected from client for services performed on account, it will increase assets for cash received and reduce assets at the same for decrease in accounts receivable created earlier.

Explanation of Solution

In this case, cash is collected from a client for services performed earlier on account which means that asset in the form of cash received has increased for Mendholm Company by $9500. Also, accounts receivable was increased at the time when the services were performed. So, now at the time pf payment, this will be reduced by $9500. Thus, the effect of this transaction on accounting equation will be shown as:

Concept Introduction:

Transaction Analysis- Every transaction is first analyzed by accountant with the help of accounting equation to see transactions that affects the business event. This is known as transaction analysis which states that each transaction is analyzed to determine the effect of each transaction in two parts or dual effect on each element of an accounting equation so that the equation is in balance. The accounting equation is shown as:

Requirement 3:

Toshow the effect on Mendholm Company whendividend of $500 is paid to stock holders.

Answer to Problem 22CE

In this case, if dividend is paid to stock holders, it will decrease assets(cash) and retained earnings from stockholder’s equity by $500.

Explanation of Solution

Dividends when declared are distributed from retained earnings as a contribution in stockholder’s equity fund. Thus, when Mendholm Company is paying dividend it will reduce the retained earnings by $500. Also, since it is cash dividend to stockholders, therefore, it will reduce assets in the form of cash by $500. This will be reflected in accounting equation as:

Concept Introduction:

Transaction Analysis- Every transaction is first analyzed by accountant with the help of accounting equation to see transactions that affects the business event. This is known as transaction analysis which states that each transaction is analyzed to determine the effect of each transaction in two parts or dual effect on each element of an accounting equation so that the equation is in balance. The accounting equation is shown as:

Requirement 4:

To show the effect on Mendholm Company whensalaries of $4000 is paid for current month.

Answer to Problem 22CE

In this case, salaries paid for current month will reduce assets by $4000 and decrease retained earnings by 4000.

Explanation of Solution

Since expense is a cost of asset consumed as a part of operating activity, so salaries are treated as an expense which when paid will reduce the retained earnings. Thus, retained earnings will be reduced by $4000. Also, since salaries are paid in cash, it will reduce assets by $4000. According to expense recognition principle, expenses are recorded in the same period when it helped to generate revenue. Since this transaction is related to Mendholm Company’s operations, therefore, it is classified as an operating activity. This will be shown in accounting equation as:

Want to see more full solutions like this?

Chapter 2 Solutions

Cornerstones of Financial Accounting

- Can you solve this general accounting problem using accurate calculation methods?arrow_forwardPlease provide the answer to this general accounting question using the right approach.arrow_forwardI am looking for the correct answer to this general accounting question with appropriate explanations.arrow_forward

- I need help with this general accounting problem using proper accounting guidelines.arrow_forwardCan you solve this general accounting problem using accurate calculation methods?arrow_forwardI need help finding the accurate solution to this general accounting problem with valid methods.arrow_forward

- Please provide the accurate answer to this general accounting problem using valid techniques.arrow_forwardPlease explain the solution to this general accounting problem using the correct accounting principles.arrow_forwardI am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forward

- Please provide the correct answer to this general accounting problem using valid calculations.arrow_forwardI need help with this general accounting problem using proper accounting guidelines.arrow_forwardI need help with this general accounting question using the proper accounting approach.arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning