Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN: 9781285190907

Author: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 18PC

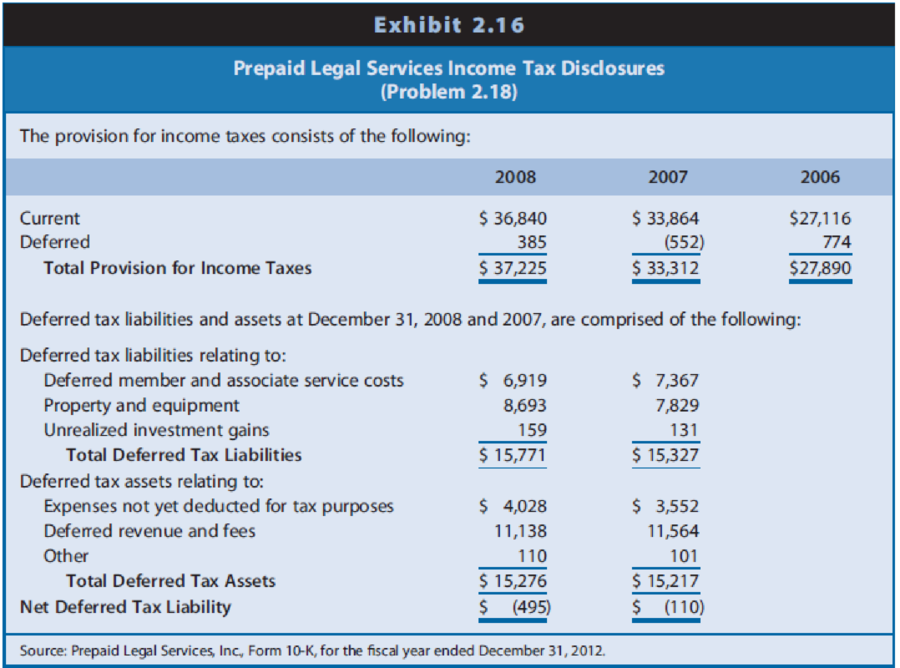

Interpreting Income Tax Disclosures. Prepaid Legal Services (PPD) is a company that sells insurance for legal expenses. Customers pay premiums in advance for coverage ever some specified period. Thus, PPD obtains cash but has unearned revenue until the passage of time over the specified period of coverage. Also, the company pays various costs to acquire customers (such as sales materials, commissions, and prepayments to legal firms who provide services to customers). These upfront payments are expensed over the specified period that customers’ contracts span. Exhibit 2.16 provides information from PPD’s income tax note.

REQUIRED

- a. Assuming that PPD had no significant permanent differences between book income and taxable income, did income before taxes for financial reporting exceed or fall short of taxable income for 2007? For 2008? Explain.

- b. Will the adjustment to net income for

deferred taxes to compute cash flow from operations in the statement of cash flows result in an addition or a subtraction for 2007? For 2008? - c. PPD must report as taxable income premiums collected from customers, although the company defers recognizing them as income for financial reporting purposes until they are earned over the contract period. Why are deferred taxes related to deferred revenue disclosed as a

deferred tax asset instead of adeferred tax liability ? Suggest reasons for the direction of the change in amounts for this deferred tax asset between 2007 and 2008. - d. Firms are generally allowed to deduct cash costs on their tax returns, although they might defer some of these costs for financial reporting purposes. As noted above, PPD defers various costs associated with obtaining customers. Why are deferred taxes related to this item disclosed as a deferred tax liability? Suggest reasons for the direction of the change in amounts for this deferred tax asset between 2007 and 2008.

- e. Like most companies, PPD uses the straight-line

depreciation method for financial reporting and accelerated depredation methods for income tax purposes. Why are deferred taxes related to depredation disclosed as a deferred tax liability? Suggest reasons for the direction of the change in amounts for this deferred tax liability between 2007 and 2008. - f. Based only on the selected disclosures from the income tax footnote provided in Exhibit 2.16 and your responses to Parts d and e above, do you believe that PPD reported growing or declining revenue and profitability in 2008 relative to 2007? Explain.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Q1:

Blossom is 30 years old. She plans on retiring in 25 years, at the age of 55. She believes she will live until she is 105.

In order to live comfortably, she needs a substantial retirement income. She wants to receive a weekly income of $5,000 during retirement. The payments will be made at the beginning of each week during her retirement.

Also, Blossom has pledged to make an annual donation to her favorite charity during her retirement. The payments will be made at the end of each year. There will be a total of 50 annual payments to the charity. The first annual payment will be for $20,000. Blossom wants the annual payments to increase by 3% per year. The payments will end when she dies.

In addition, she would like to establish a scholarship at Toronto Metropolitan University. The first payment would be $80,000 and would be made 3 years after she retires. Thereafter, the scholarship payments will be made every year. She wants the payments to continue after her death,…

Could you please help explain what is the research assumptions, research limitations, research delimitations and their intent?

How the research assumptions, research limitations can shape the study design and scope?

How the research delimitations could help focus the study and ensure its feasibility?

What are the relationship between biblical principles and research concepts such as reliability and validity?

What is the concept of the working poor ? Introduction form. Explain.

Chapter 2 Solutions

Financial Reporting, Financial Statement Analysis and Valuation

Ch. 2 - Prob. 1QECh. 2 - Asset Valuation and Income Recognition. Asset...Ch. 2 - Trade-Offs among Acceptable Accounting...Ch. 2 - Income Flows versus Cash Flows. The text states,...Ch. 2 - Prob. 5QECh. 2 - Prob. 6QECh. 2 - Prob. 7QECh. 2 - Prob. 8QECh. 2 - Computation of Income Tax Expense. A firms income...Ch. 2 - Computation of Income Tax Expense. A firms income...

Ch. 2 - Costs to Be Included in Historical Cost Valuation....Ch. 2 - Effect of Valuation Method for Nonmonetary Asset...Ch. 2 - Prob. 13PCCh. 2 - Prob. 14PCCh. 2 - Prob. 15PCCh. 2 - Deferred Tax Assets. Components of the deferred...Ch. 2 - Interpreting Income Tax Disclosures. The financial...Ch. 2 - Interpreting Income Tax Disclosures. Prepaid Legal...Ch. 2 - Interpreting Income Tax Disclosures. The financial...Ch. 2 - Analyzing Transactions. Using the analytical...Ch. 2 - Prob. 21PCCh. 2 - Starbucks The financial statements of Starbucks...Ch. 2 - Prob. 1BICCh. 2 - Prob. 1CICCh. 2 - Prob. 1DICCh. 2 - Prob. 1EICCh. 2 - Prob. 1FICCh. 2 - Starbucks The financial statements of Starbucks...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- What is the most misunderstanding of the working poor? Explain.arrow_forwardProblem Three (15 marks) You are an analyst in charge of valuing common stocks. You have been asked to value two stocks. The first stock NEWER Inc. just paid a dividend of $6.00. The dividend is expected to increase by 60%, 45%, 30% and 15% per year, respectively, in the next four years. Thereafter, the dividend will increase by 4% per year in perpetuity. Calculate NEWER’s expected dividend for t = 1, 2, 3, 4 and 5. The required rate of return for NEWER stock is 14% compounded annually. What is NEWER’s stock price? The second stock is OLDER Inc. OLDER Inc. will pay its first dividend of $10.00 three (3) years from today. The dividend will increase by 30% per year for the following four (4) years after its first dividend payment. Thereafter, the dividend will increase by 3% per year in perpetuity. Calculate OLDER’s expected dividend for t = 1, 2, 3, 4, 5, 6, 7 and 8. The required rate of return for OLDER stock is 16% compounded annually. What is OLDER’s stock price? Now assume that…arrow_forwardProblem Three (15 marks) You are an analyst in charge of valuing common stocks. You have been asked to value two stocks. The first stock NEWER Inc. just paid a dividend of $6.00. The dividend is expected to increase by 60%, 45%, 30% and 15% per year, respectively, in the next four years. Thereafter, the dividend will increase by 4% per year in perpetuity. Calculate NEWER’s expected dividend for t = 1, 2, 3, 4 and 5. The required rate of return for NEWER stock is 14% compounded annually. What is NEWER’s stock price? The second stock is OLDER Inc. OLDER Inc. will pay its first dividend of $10.00 three (3) years from today. The dividend will increase by 30% per year for the following four (4) years after its first dividend payment. Thereafter, the dividend will increase by 3% per year in perpetuity. Calculate OLDER’s expected dividend for t = 1, 2, 3, 4, 5, 6, 7 and 8. The required rate of return for OLDER stock is 16% compounded annually. What is OLDER’s stock price? Now assume that…arrow_forward

- Your father is 50 years old and will retire in 10 years. He expects to live for 25 years after he retires, until he is 85. He wants a fixed retirement income that has the same purchasing power at the time he retires as $45,000 has today. (The real value of his retirement income will decline annually after he retires.) His retirement income will begin the day he retires, 10 years from today, at which time he will receive 24 additional annual payments. Annual inflation is expected to be 4%. He currently has $240,000 saved, and he expects to earn 8% annually on his savings. Required annuity payments Retirement income today $45,000 Years to retirement 10 Years of retirement 25 Inflation rate 4.00% Savings $240,000 Rate of return 8.00% Calculate value of…arrow_forwardProblem Three (15 marks) You are an analyst in charge of valuing common stocks. You have been asked to value two stocks. The first stock NEWER Inc. just paid a dividend of $6.00. The dividend is expected to increase by 60%, 45%, 30% and 15% per year, respectively, in the next four years. Thereafter, the dividend will increase by 4% per year in perpetuity. Calculate NEWER’s expected dividend for t = 1, 2, 3, 4 and 5. The required rate of return for NEWER stock is 14% compounded annually. What is NEWER’s stock price? The second stock is OLDER Inc. OLDER Inc. will pay its first dividend of $10.00 three (3) years from today. The dividend will increase by 30% per year for the following four (4) years after its first dividend payment. Thereafter, the dividend will increase by 3% per year in perpetuity. Calculate OLDER’s expected dividend for t = 1, 2, 3, 4, 5, 6, 7 and 8. The required rate of return for OLDER stock is 16% compounded annually. What is OLDER’s stock price? Now assume that…arrow_forwardProblem Three (15 marks) You are an analyst in charge of valuing common stocks. You have been asked to value two stocks. The first stock NEWER Inc. just paid a dividend of $6.00. The dividend is expected to increase by 60%, 45%, 30% and 15% per year, respectively, in the next four years. Thereafter, the dividend will increase by 4% per year in perpetuity. Calculate NEWER’s expected dividend for t = 1, 2, 3, 4 and 5. The required rate of return for NEWER stock is 14% compounded annually. What is NEWER’s stock price? The second stock is OLDER Inc. OLDER Inc. will pay its first dividend of $10.00 three (3) years from today. The dividend will increase by 30% per year for the following four (4) years after its first dividend payment. Thereafter, the dividend will increase by 3% per year in perpetuity. Calculate OLDER’s expected dividend for t = 1, 2, 3, 4, 5, 6, 7 and 8. The required rate of return for OLDER stock is 16% compounded annually. What is OLDER’s stock price? Now assume that…arrow_forward

- Problem Three (15 marks) You are an analyst in charge of valuing common stocks. You have been asked to value two stocks. The first stock NEWER Inc. just paid a dividend of $6.00. The dividend is expected to increase by 60%, 45%, 30% and 15% per year, respectively, in the next four years. Thereafter, the dividend will increase by 4% per year in perpetuity. Calculate NEWER’s expected dividend for t = 1, 2, 3, 4 and 5. The required rate of return for NEWER stock is 14% compounded annually. What is NEWER’s stock price? The second stock is OLDER Inc. OLDER Inc. will pay its first dividend of $10.00 three (3) years from today. The dividend will increase by 30% per year for the following four (4) years after its first dividend payment. Thereafter, the dividend will increase by 3% per year in perpetuity. Calculate OLDER’s expected dividend for t = 1, 2, 3, 4, 5, 6, 7 and 8. The required rate of return for OLDER stock is 16% compounded annually. What is OLDER’s stock price? Now…arrow_forwardYou are considering a 10-year, $1,000 par value bond. Its coupon rate is 11%, and interest is paid semiannually. Bond valuation Years to maturity 10 Par value of bond $1,000.00 Coupon rate 11.00% Frequency interest paid per year 2 Effective annual rate 8.78% Calculation of periodic rate: Formulas Nominal annual rate #N/A Periodic rate #N/A Calculation of bond price: Formulas Number of periods #N/A Interest rate per period 0.00% Coupon payment per period #N/A Par value of bond $1,000.00 Price of bond #N/Aarrow_forwardHow much do investor psychology and market sentiment play into stock price movements? Do these emotional reactions having a bigger impact on short-term swings, or do they also shape long-term trends in a meaningful way?arrow_forward

- Explain The business of predatory tax return preparation, including: How they deceive the working poor,The marketing tactics the preparers use, and Other than paying high fees, what negative impact can the use of these unqualified and unregulated preparers have on the taxpayer?arrow_forwardExplain the changes in tax return preparation you would like to see in Alabama, based on what has been successful in other states.arrow_forwardExplain the understanding (or misunderstanding) of the working poor with tax return preparation within one page report.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Business/Professional Ethics Directors/Executives...AccountingISBN:9781337485913Author:BROOKSPublisher:Cengage

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Business/Professional Ethics Directors/Executives...

Accounting

ISBN:9781337485913

Author:BROOKS

Publisher:Cengage

Auditing: A Risk Based-Approach to Conducting a Q...

Accounting

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:South-Western College Pub

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Chapter 19 Accounting for Income Taxes Part 1; Author: Vicki Stewart;https://www.youtube.com/watch?v=FMjwcdZhLoE;License: Standard Youtube License