Financial Management: Theory & Practice

16th Edition

ISBN: 9781337909730

Author: Brigham

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 17P

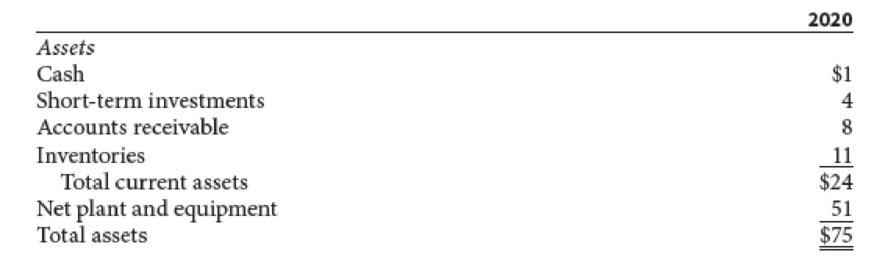

Athenian Venues Inc. just reported the following selected portion of its financial statements for the end of 2020. Your assistant has already calculated the 2020 end-of-year net operating working capital (NOWC) from the full set of financial statements (not shown here), which is $13 million. The total net operating capital for 2019 was $50 million. What was the 2020 net investment in operating capital?

Athenian Venues Inc.: Selected Balance Sheet Information as of December 31

(Millions of Dollars)

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Class

3

5

7

10

15

20

Depreciation

Year n

200%

200%

200%

200%

150%

150%

rate

1

33.33

20.00

14.29

10.00

5.00

3.750

2

44.45

32.00

24.49

18.00

9.50

7.219

3

14.81*

19.20

17.49

14.40

8.55

6.677

4

7.41

11.52*

12.49

11.52

7.70

6.177

5

11.52

8.93

9.22

6.93

5.713

6

5.76

8.92

7.37

6.23

5.285

7

8.93

6.55*

5.90*

4.888

8

4.46

6.55

5.90

4.522

9

6.56

5.91

4.462*

10

6.55

5.90

4.461

11

3.28

5.91

4.462

12

5.90

4.461

Unite Assissment 02 : New City Band

Part 02:

Base & Flexible Budget

Base Budget

Flexible Budget

Fixed or Variable

Revenue

City Contributions

Fixed Annual Contribution

F

Per Concert Contributions

V

Public Contributions

V

Endowment Earnings

F

Total Revenue

Expenses

Conductors Stipend

F

Musicians Stipend

V

Insurance

Fixed Insurance Premium

F

Per-Concert Insurance Premium

V

Music Costs

Music Acquisitions

F

Performance Rights

V

Total Expenses

Surplus/(Deficit)

Sonja Jensen is considering the purchase of a fast-food franchise. Sonja will be operating on a lot that is to be converted into a parking lot in six years,

but that may be rented in the interim for $700 per month. The franchise and necessary equipment will have a total initial cost of $68,000 and a salvage

value of $9,000 (in today's dollars) after six years. Sonja is told that the future annual general inflation rate will be 5%. The projected operating

revenues and expenses (in actual dollars) other than rent and depreciation for the business are given in the table below. Assume that the initial

investment will be depreciated under the five-year MACRS and that Sonja's tax rate will be 30%. Sonja can invest her money at a rate of at least 14%

in other investment activities during this inflation-ridden period.

Click the icon to view the projected operating revenues and expenses.

Click the icon to view the MACRS depreciation schedules.

(a) Determine the cash flows associated with the…

Chapter 2 Solutions

Financial Management: Theory & Practice

Ch. 2 - Define each of the following terms:

Annual report;...Ch. 2 - Prob. 2QCh. 2 - If a typical firm reports 20 million of retained...Ch. 2 - What is operating capital, and why is it...Ch. 2 - Prob. 6QCh. 2 - Prob. 7QCh. 2 - Prob. 8QCh. 2 - An investor recently purchased a corporate bond...Ch. 2 - Corporate bonds issued by Johnson Corporation...Ch. 2 - Hollys Art Galleries recently reported 7.9 million...

Ch. 2 - Nicholas Health Systems recently reported an...Ch. 2 - Kendall Corners Inc. recently reported net income...Ch. 2 - In its most recent financial statements,...Ch. 2 - Prob. 7PCh. 2 - Prob. 8PCh. 2 -

Carter Swimming Pools has $16 million in net...Ch. 2 - Prob. 10PCh. 2 - Prob. 11PCh. 2 - The Shrieves Corporation has 10,000 that it plans...Ch. 2 - The Moore Corporation has operating income (EBIT)...Ch. 2 - The Berndt Corporation expects to have sales of...Ch. 2 - Use the following income statement of Elliott Game...Ch. 2 - Prob. 16PCh. 2 - Athenian Venues Inc. just reported the following...Ch. 2 - Rhodes Corporations financial statements are shown...Ch. 2 - The Bookbinder Company had 500,000 cumulative...Ch. 2 - Begin with the partial model in the file Ch02 P20...Ch. 2 - Begin with the partial model in the file Ch02 P21...Ch. 2 -

Jenny Cochran, a graduate of the University of...Ch. 2 - Jenny Cochran, a graduate of the University of...Ch. 2 - Jenny Cochran, a graduate of the University of...Ch. 2 - What is Computrons net operating profit after...Ch. 2 - What is Computron’s free cash flow? What are...Ch. 2 - Calculate Computron’s return on invested capital...Ch. 2 - Jenny Cochran, a graduate of the University of...Ch. 2 - What happened to Computron’s Market Value Added...Ch. 2 - Prob. 9MCCh. 2 - Prob. 10MCCh. 2 - Prob. 11MCCh. 2 - Prob. 12MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Sonja Jensen is considering the purchase of a fast-food franchise. Sonja will be operating on a lot that is to be converted into a parking lot in six years, but that may be rented in the interim for $700 per month. The franchise and necessary equipment will have a total initial cost of $68,000 and a salvage value of $9,000 (in today's dollars) after six years. Sonja is told that the future annual general inflation rate will be 5%. The projected operating revenues and expenses (in actual dollars) other than rent and depreciation for the business are given in the table below. Assume that the initial investment will be depreciated under the five-year MACRS and that Sonja's tax rate will be 30%. Sonja can invest her money at a rate of at least 14% in other investment activities during this inflation-ridden period. Click the icon to view the projected operating revenues and expenses. Click the icon to view the MACRS depreciation schedules. (a) Determine the cash flows associated with the…arrow_forwardUnit 02 Part 3: New City BandAs the volunteer business manager for the New City Band (City Band), you are responsible for preparing the operating budget for the organization’s upcoming summer concert season. Each year, City Band presents up to 20 weekend performances, depending on weather conditions. The concerts are free to the public,but the band hangs a pot from the bandstand and people leave small donations in it. On average, City Band gets $100 in donations at each of its performances. In addition to donations, New City pays the band $3,000 per season plus $125 for each performance.City Band also has a small endowment of $100,000 on which it expects to earn 3.5 percent in the coming fiscal year. City Band’s trustees have decided to use that money to pay for operating expenses if they need to.City Band pays its conductor $3,000 for the summer season and has aninsurance policy to protect it against any loss of equipment or damage to the bandstand. That policy costs the band…arrow_forwardhow to solvearrow_forward

- How much working capital does Airbnb have for the year 2024? Discuss the components of working capital and calculations. What is the amount of the total assets that Airbnb reported for the year 2024? List the assets included. What is the amount of the total liabilities that tAirbnb reported for the year 2024? List the liabilities included.arrow_forwardHow much working capital does Airbnb have for the year 2024? State the components of working capital and calculations. What is the amount of the total assets that Airbnb reported for the year of 2024 and list the assets?arrow_forwardWhat is an account that requires present value calculations. State both the account name and the amount for the account you select. What inventory method does Airbnb employ and explain how this method works? Calculate Airbnb inventory turnover for the year 2024. What does inventory turnover tells an investor?arrow_forward

- What was the free cash flow for the year 2024 for Airbnb and formula used for their calculations? Explain the importance of free cash flow.arrow_forwardWhat is the useful lives for the various types of property, plant, and equipment owned by Airbnb?arrow_forwardWhat depreciation method does Airbnb employ and how does this depreciation method works? Does Airbnb have any impaired assets?arrow_forward

- New City BandAs the volunteer business manager for the New City Band (City Band), you are responsible for preparing the operating budget for the organization’s upcoming summer concert season. Each year, City Band presents up to 20 weekend performances, depending on weather conditions. The concerts are free to the public,but the band hangs a pot from the bandstand and people leave small donations in it. On average, City Band gets $100 in donations at each of its performances. In addition to donations, New City pays the band $3,000 per season plus $125 for each performance.City Band also has a small endowment of $100,000 on which it expects to earn 3.5 percent in the coming fiscal year. City Band’s trustees have decided to use that money to pay for operating expenses if they need to.City Band pays its conductor $3,000 for the summer season and has aninsurance policy to protect it against any loss of equipment or damage to the bandstand. That policy costs the band $500 for the summer plus…arrow_forwardWhat are asset type and the useful lives for a company mean?arrow_forwardWhat was the amount of cash (and cash equivalents) that Airbnb reported for the year of 2024? State the amounts for each item you included in this number. How much working capital does Airbnb have for the year 2024? State the components of working capital and calculations. What is the amount of the total assets that Airbnb reported for the year of 2024 and list the assets?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License