Financial Management: Theory & Practice

16th Edition

ISBN: 9781337909730

Author: Brigham

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 21SP

Begin with the partial model in the file Ch02 P21 Build a Model.xlsx on the textbook’s Web site.

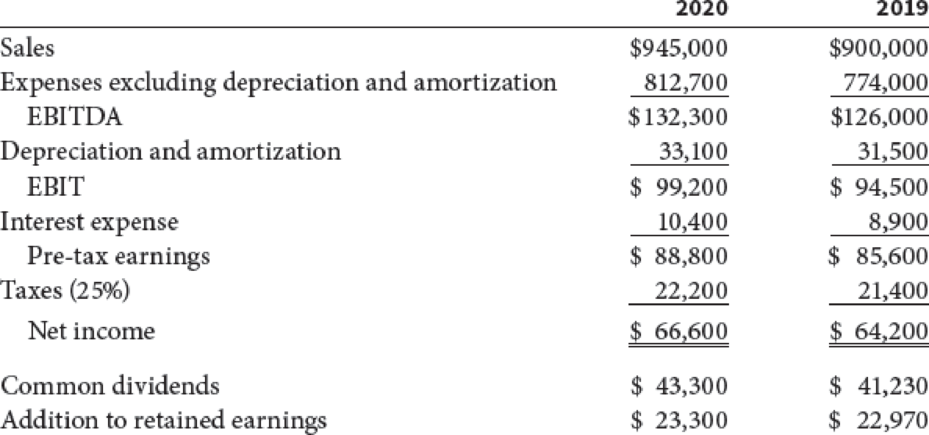

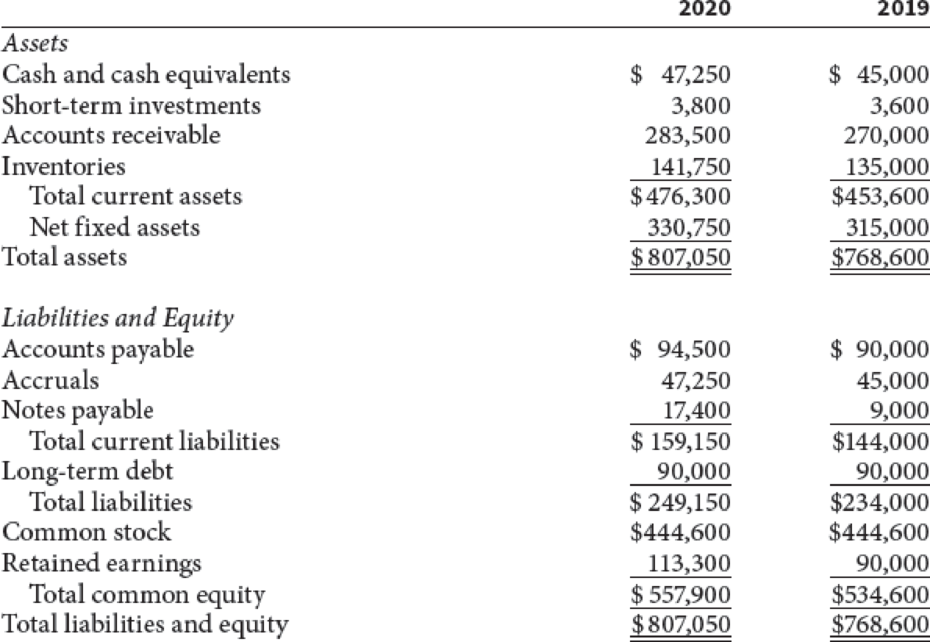

- a. Using the financial statements shown here for Lan & Chen Technologies, calculate net operating working capital, total

net operating capital, net operating profit after taxes,free cash flow , andreturn on invested capital for 2020. The federal-plus-state tax rate is 25%. - b. Assume there were 15 million shares outstanding at the end of 2019, the year-end closing stock price was $65 per share, and the after-tax cost of capital was 10%. Calculate EVA and MVA for 2020.

Lan & Chen Technologies: Income Statements for Year Ending December 31 (Millions of Dollars)

Lan & Chen Technologies: December 31 Balance Sheets (Thousands of Dollars)

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Can you solve this financial accounting question

Hi expert please given correct answer with financial accounting question

Don't use ai given answer with financial accounting question

Chapter 2 Solutions

Financial Management: Theory & Practice

Ch. 2 - Define each of the following terms:

Annual report;...Ch. 2 - Prob. 2QCh. 2 - If a typical firm reports 20 million of retained...Ch. 2 - What is operating capital, and why is it...Ch. 2 - Prob. 6QCh. 2 - Prob. 7QCh. 2 - Prob. 8QCh. 2 - An investor recently purchased a corporate bond...Ch. 2 - Corporate bonds issued by Johnson Corporation...Ch. 2 - Hollys Art Galleries recently reported 7.9 million...

Ch. 2 - Nicholas Health Systems recently reported an...Ch. 2 - Kendall Corners Inc. recently reported net income...Ch. 2 - In its most recent financial statements,...Ch. 2 - Prob. 7PCh. 2 - Prob. 8PCh. 2 -

Carter Swimming Pools has $16 million in net...Ch. 2 - Prob. 10PCh. 2 - Prob. 11PCh. 2 - The Shrieves Corporation has 10,000 that it plans...Ch. 2 - The Moore Corporation has operating income (EBIT)...Ch. 2 - The Berndt Corporation expects to have sales of...Ch. 2 - Use the following income statement of Elliott Game...Ch. 2 - Prob. 16PCh. 2 - Athenian Venues Inc. just reported the following...Ch. 2 - Rhodes Corporations financial statements are shown...Ch. 2 - The Bookbinder Company had 500,000 cumulative...Ch. 2 - Begin with the partial model in the file Ch02 P20...Ch. 2 - Begin with the partial model in the file Ch02 P21...Ch. 2 -

Jenny Cochran, a graduate of the University of...Ch. 2 - Jenny Cochran, a graduate of the University of...Ch. 2 - Jenny Cochran, a graduate of the University of...Ch. 2 - What is Computrons net operating profit after...Ch. 2 - What is Computron’s free cash flow? What are...Ch. 2 - Calculate Computron’s return on invested capital...Ch. 2 - Jenny Cochran, a graduate of the University of...Ch. 2 - What happened to Computron’s Market Value Added...Ch. 2 - Prob. 9MCCh. 2 - Prob. 10MCCh. 2 - Prob. 11MCCh. 2 - Prob. 12MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 15. Unearned Revenue is classified as a:A. RevenueB. AssetC. LiabilityD. Contra Revenuearrow_forwardGet correct answer with financial accounting questionarrow_forwardDarla owes the government $1,800 in taxes this year. She earns a tax credit for childcare for $1, 500, $678 for earned income tax, and $250 for an energy-efficient home. How much will Darla owe the government for taxes this year?arrow_forward

- I need help with financial accounting questionarrow_forwardGiven the solution and financial accounting questionarrow_forwardReflection on how public budgets influence community outcomes (e.g., housing, education, public safety). Identify one real city, school district, or agency where budget decisions have created inequities or made a positive impact.arrow_forward

- 19. A company’s weighted average cost of capital (WACC) includes:A. Only equityB. Only debtC. Both equity and debtD. Only retained earnings need helparrow_forwardA company’s weighted average cost of capital (WACC) includes:A. Only equityB. Only debtC. Both equity and debtD. Only retained earningsarrow_forwardNo AI A company’s weighted average cost of capital (WACC) includes:A. Only equityB. Only debtC. Both equity and debtD. Only retained earningsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Economic Value Added EVA - ACCA APM Revision Lecture; Author: OpenTuition;https://www.youtube.com/watch?v=_3hpcMFHPIU;License: Standard Youtube License