FUNDAMENTALS OF FINANCIAL ACCOUNTING

6th Edition

ISBN: 9781260664386

Author: PHILLIPS, LIBB

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 12ME

Reporting a Classified

Given the transactions in M2-9 (including the sample), prepare a classified balance sheet for Spot- lighter, Inc., as of January 31.

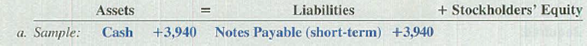

M1-9 Determining Financial Statement Effects of Several Transactions

For each of the following transactions of Spotlighter, Inc., for the month of January, indicate the accounts, amounts, and direction of the effects on the

- a. (Sample) Borrowed $3,940 from a local bank on a note due in six months.

- b. Received $4,630 cash from investors and issued common stock to them.

- c. Purchased $1,000 in equipment, paying $200 cash and promising the rest on a note due in one year.

- d. Paid $300 cash for supplies.

- e. Bought and received $700 of supplies on account.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

choose best answer plz

Subject: accounting

ans

Chapter 2 Solutions

FUNDAMENTALS OF FINANCIAL ACCOUNTING

Ch. 2 - Define the following: a. Asset b. Current asset c....Ch. 2 - Define a transaction anti give an example of each...Ch. 2 - For accounting purposes, what is an account?...Ch. 2 - What is the basic accounting equation?Ch. 2 - Prob. 5QCh. 2 - Prob. 6QCh. 2 - Prob. 7QCh. 2 - What is a journal entry? What is the typical...Ch. 2 - What is a T-account? What is its purpose?Ch. 2 - Prob. 10Q

Ch. 2 - Prob. 11QCh. 2 - Which of the following is not an asset account? a....Ch. 2 - Which of the following statements describe...Ch. 2 - Total assets on a balance sheet prepared on any...Ch. 2 - The duality of effects can best be described as...Ch. 2 - The T-account is used to summarize which of the...Ch. 2 - Prob. 6MCCh. 2 - A company was recently formed with 50,000 cash...Ch. 2 - Which of the following statements would be...Ch. 2 - Prob. 9MCCh. 2 - Prob. 10MCCh. 2 - Prob. 1MECh. 2 - Prob. 2MECh. 2 - Matching Terms with Definitions Match each term...Ch. 2 - Prob. 4MECh. 2 - Prob. 5MECh. 2 - Prob. 6MECh. 2 - Prob. 7MECh. 2 - Identifying Events as Accounting Transactions Half...Ch. 2 - Determining Financial Statement Effects of Several...Ch. 2 - Preparing Journal Entries For each of the...Ch. 2 - Posting to T-Accounts For each of the transactions...Ch. 2 - Reporting a Classified Balance Sheet Given the...Ch. 2 - Prob. 13MECh. 2 - Prob. 14MECh. 2 - Identifying Transactions and Preparing Journal...Ch. 2 - Prob. 16MECh. 2 - Prob. 17MECh. 2 - Prob. 18MECh. 2 - Prob. 19MECh. 2 - Prob. 20MECh. 2 - Prob. 21MECh. 2 - Prob. 22MECh. 2 - Prob. 23MECh. 2 - Prob. 24MECh. 2 - Prob. 25MECh. 2 - Prob. 1ECh. 2 - Identifying Account Titles The following are...Ch. 2 - Classifying Accounts and Their Usual Balances As...Ch. 2 - Determining Financial Statement Effects of Several...Ch. 2 - Recording Journal Entries Refer to E2-4. Required:...Ch. 2 - Prob. 6ECh. 2 - Recording Journal Entries Refer to E2-6. Required:...Ch. 2 - Analyzing the Effects of Transactions in...Ch. 2 - Inferring Investing and Financing Transactions and...Ch. 2 - Analyzing Accounting Equation Effects, Recording...Ch. 2 - Recording Journal Entries and Preparing a...Ch. 2 - Analyzing the Effects of Transactions Using...Ch. 2 - Explaining the Effects of Transactions on Balance...Ch. 2 - Calculating and Evaluating the Current Ratio...Ch. 2 - Prob. 15ECh. 2 - Determining Financial Statement Effects of Various...Ch. 2 - Recording Transactions (in a Journal and...Ch. 2 - Recording Transactions (in a Journal and...Ch. 2 - Prob. 1PACh. 2 - Recording Transactions (in a Journal and...Ch. 2 - Recording Transactions (in a Journal and...Ch. 2 - Determining Financial Statement Effects of Various...Ch. 2 - Prob. 2PBCh. 2 - Recording Transactions (in a Journal and...Ch. 2 - Finding and Analyzing Financial Information Refer...Ch. 2 - Finding and Analyzing Financial Information Refer...Ch. 2 - Prob. 4SDCCh. 2 - Prob. 5SDCCh. 2 - Accounting for the Establishment of a Business...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What was the total amount of cash paid for operating activities?arrow_forwardPhoenix Industries has twelve million shares outstanding, generates free cash flows of $75 million each year, and has a cost of capital of 12%. It also has $50 million of cash on hand. Phoenix wants to decide whether to repurchase stock or invest the cash in a project that generates free cash flows of $3 million each year. Should Phoenix invest or repurchase the shares? A) Repurchase B) Invest C) Indifferent between options D) Cannot say for sure I want answerarrow_forwardNeed correct answer general Accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License