Concept explainers

Recording Transactions (in a Journal and T-Accounts); Preparing a

Athletic Performance Company (APC) was incorporated as a private company. The company’s accounts included the following at July 1:

During the month of July, the company had the following activities:

- a. Issued 2.000 shares of common stock for $200,000 cash.

- b. Borrowed $30.000 cash from a local bank, payable in two years.

- c. Bought a building for $141,000; paid $41.000 in cash and signed a three-year note for the balance.

- d. Paid cash for equipment that cost $100.000.

- e. Purchased supplies for $ 10,000 on account.

Required:

- 1. Analyze transactions (a)−(e) to determine their effects on the

accounting equation. Use a spreadsheet format with a column for each account, enter the July 1 amounts in the first line under the account headings, and calculate ending balances as shown in Exhibit 2.5.TIP: You won’t need new accounts to record the transactions described above, so have a quick look at the ones listed before you begin.

TIP: In transaction (c), three different accounts are affected.

- 2. Record the transaction effects determined in requirement 1 using journal entries.

- 3. Summarize the

journal entry effects from requirement 2 using T-accounts.TIP: Create a T-account for each account listed above. Enter the July 1 balances as the month's beginning balances.

- 4. Prepare a trial balance at July 31.

- 5. Prepare a classified balance sheet at July 31.

- 6. As of July 31, has the financing for APC's investment in assets primarily come from liabilities or stockholders’ equity?

Requirement – 1

Explanation of Solution

Accounting equation:

Accounting equation is an accounting tool expressed in the form of equation, by creating a relationship between the resources or assets of a company, and claims on the resources by the creditors and the owners. Accounting equation is expressed as shown below:

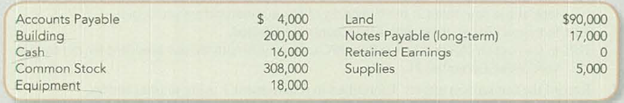

Spreadsheet for accounting transactions is as follows:

Figure (1)

Requirement – 2

To record:The journal entries based on requirement 1.

Explanation of Solution

Journal:

Journal is the method of recording monetary business transactions in chronological order. It records the debit and credit aspects of each transaction to abide by the double-entry system.

Rules of Debit and Credit:

Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

- Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

Journal entries of Company A are as follows:

(a) Issuance of common stock:

| Date | Accounts title and explanation | Ref. | Debit ($) | Credit ($) |

| Cash (+A) | 200,000 | |||

| Common stock (+SE) | 200,000 | |||

| (To record the issuance of common stock) |

Table (1)

- Cash is an assets account and it increased the value of asset by $200,000. Hence, debit the cash account for $200,000.

- Common stock is a component of stockholder’s equity and it increased the value of stockholder’s equity by $200,000, Hence, credit the common stock for $200,000.

(b) Cash borrowed from bank (long term)

| Date | Accounts title and explanation | Ref. | Debit ($) | Credit ($) |

| Cash (+A) | 30,000 | |||

| Notes payable (+L) | 30,000 | |||

| (To record cash borrowed from bank) |

Table (2)

- Cash is an assets account and it increased the value of asset by $30,000. Hence, debit the cash account for $30,000.

- Notes payable is a liability account, and it increased the value of liabilities by $30,000. Hence, credit the notes payable for $30,000.

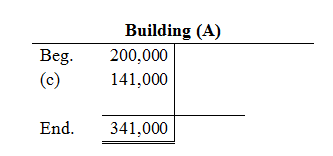

(c) Building purchased on account and in cash:

| Date | Accounts title and explanation | Ref. | Debit ($) | Credit ($) |

| Building (+A) | 141,000 | |||

| Cash (-A) | 41,000 | |||

| Notes payable (+L) | 100,000 | |||

| (To record purchase of building on account and in cash) |

Table (3)

- Building is an assets account and it increased the value of asset by $141,000. Hence, debit the building account for $141,000.

- Cash is an assets account and it decreased the value of asset by $41,000. Hence, credit the cash account for $41,000.

- Notes payable is a liability account, and it increased the value of liabilities by $100,000. Hence, credit the notes payable for $100,000.

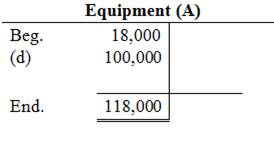

(d) Equipment purchased:

| Date | Accounts title and explanation | Ref. | Debit ($) | Credit ($) |

| Equipment (+A) | 100,000 | |||

| Cash (-A) | 100,000 | |||

| (To record purchase of equipment in cash) |

Table (4)

- Equipment is an assets account and it increased the value of asset by $100,000. Hence, debit the equipment account for $100,000.

- Cash is an assets account and it decreased the value of asset by $100,000. Hence, credit the cash account for $100,000.

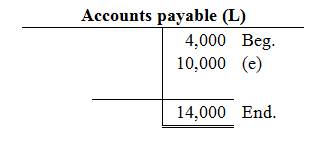

(e) Purchase of supplies on account:

| Date | Accounts title and explanation | Ref. | Debit ($) | Credit ($) |

| Supplies (+A) | 10,000 | |||

| Accounts payable (+L) | 10,000 | |||

| (To record purchase of supplies on account and in cash) |

Table (5)

- Supplies are an assets account and it increased the value of asset by $10,000. Hence, debit the supplies account for $10,000.

- Accounts payable is a liability account and it increased the value of liability by $10,000. Hence, credit the accounts payable by $10,000.

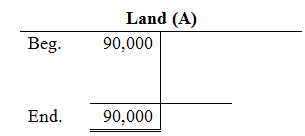

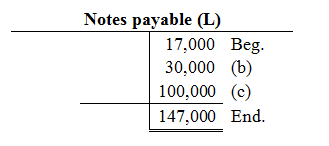

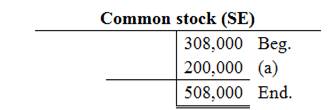

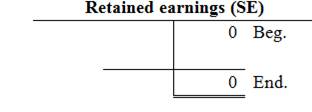

Requirement – 3

To prepare: T-account for each account listed in the spreadsheet.

Explanation of Solution

T-account:

T-account refers to an individual account, where the increasesor decreases in the value of specific asset, liability, stockholder’s equity, revenue, and expenditure items are recorded.

This account is referred to as the T-account, because the alignment of the components of the account resembles the capital letter ‘T’.’ An account consists of the three main components which are as follows:

- (a) The title of the account

- (b) The left or debit side

- (c) The right or credit side

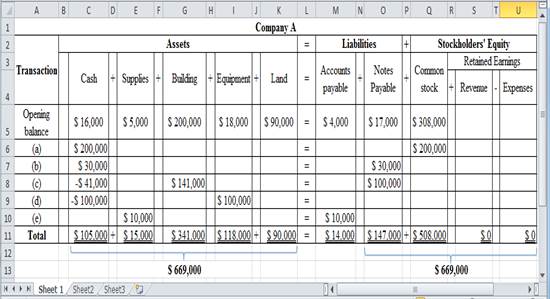

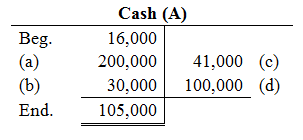

T-accounts of company A are as follows:

Requirement – 4

To prepare: The trial balance of Company A at July 31.

Explanation of Solution

Trial balance:

Trial balance is the summary of accounts, and their debit and credit balances at a given time. It is usually prepared at end of the accounting period. Debit balances are listed in left column and credit balances are listed in right column. The totals of debit and credit column should be equal. Trial balance is useful in the preparation of the financial statements.

Trial balance of Company A is as follows:

| Company A | ||

| Adjusted Trial Balance | ||

| At July, 31 | ||

| Accounts | Debit ($) | Credit ($) |

| Cash | 105,000 | |

| Supplies | 15,000 | |

| Equipment | 118,000 | |

| Building | 341,000 | |

| Land | 90,000 | |

| Accounts payable | 14,000 | |

| Notes payable | 147,000 | |

| Common stock | 508,000 | |

| Retained earnings | 0 | |

| Totals | $669,000 | $669,000 |

Table (6)

Therefore, the total of debit, and credit columns of trial balance is $669,000 and agree.

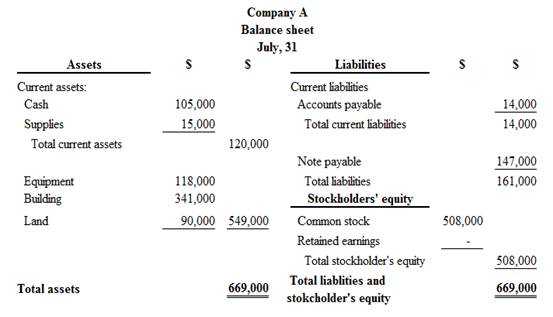

Requirement – 5

To prepare: The classified balance sheet of Company A at July 31.

Explanation of Solution

Classified balance sheet:

This is the financial statement of a company which shows the grouping of similar assets and liabilities under subheadings.

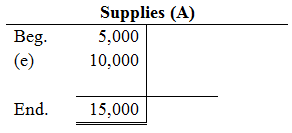

Classified balance sheet of Company A is as follows:

Figure (2)

Therefore, the total assets of Company A are$669,000, and the total liabilities and stockholders’ equity are $669,000.

Requirement – 6

Explanation of Solution

The invested amount of assets are primarily come from stockholder’s’ equity of Company A, because the stockholder’s equity (common stock) financed $508,000 of the Company A’s total assets, and liabilities financed $161,000.

Want to see more full solutions like this?

Chapter 2 Solutions

FUNDAMENTALS OF FINANCIAL ACCOUNTING

- Which account is a contra-asset?A. Accounts PayableB. Accumulated DepreciationC. Notes ReceivableD. Prepaid Rentneedarrow_forwardIf cash is received before services are provided, what is the journal entry?A. Debit Revenue, Credit CashB. Debit Unearned Revenue, Credit CashC. Debit Cash, Credit Unearned RevenueD. Debit Accounts Receivable, Credit RevenueCorrectarrow_forwardIf cash is received before services are provided, what is the journal entry?A. Debit Revenue, Credit CashB. Debit Unearned Revenue, Credit CashC. Debit Cash, Credit Unearned RevenueD. Debit Accounts Receivable, Credit Revenuecorrectarrow_forward

- GAP Corp. is a calendar year S corporation with three shareholders. George and Anna each own 49 percent of the stock. Peter owns 2 percent of the stock. The corporation was formed on January 2, Year 1, and has been an S corporation since its inception. Using the exhibits, prepare a schedule of GAP's income, gain, loss, and deduction items for Year 2. In column B, enter the amount for federal income tax purposes. In column C, enter the amount included in GAP's Form 1120S ordinary business income (OBI) or loss. In column D, enter the amount included on GAP's Schedule K as a taxable or deductible separately stated item. Each item may have amounts entered in ordinary business income, separately stated items, or both. Enter income and gain amounts as positive numbers. Enter losses and deductions as negative numbers. If the amount is zero, enter a zero (0). A B C D 1 Income, Gain, Loss, and Deduction Items Amount for Federal Income Tax Purposes Ordinary Business Income…arrow_forwardIf cash is received before services are provided, what is the journal entry?A. Debit Revenue, Credit CashB. Debit Unearned Revenue, Credit CashC. Debit Cash, Credit Unearned RevenueD. Debit Accounts Receivable, Credit Revenue need helparrow_forwardDennis Green and Peter Olinto are equal partners in Foxy Partnership. Peter is an active general partner. Dennis is a limited partner and is not involved in the operations of the business. Foxy Partnership's Year 2 financial statements are provided in the exhibits. Using the information provided, enter the appropriate amounts to be reported on page 1 of Foxy Partnership's income tax return in the table below. Enter all amounts as positive whole values. If a response is zero, enter a zero (0). A B 1 Gross receipts or sales 2 Cost of goods sold 3 Salaries and wages 4 Guaranteed payments to partners 5 Repairs and maintenance 6 Bad debts 7 Rent 8 Depreciation 9 Other deductions 10 Ordinary business income (loss)arrow_forward

- Dennis Green and Peter Olinto are equal partners in Foxy PartneDennis Green and Peter Olinto are equal partners in Foxy Partnership. Peter is an active general partner. Dennis is a limited partner and is not involved in the operations of the business. Foxy Partnership's Year 2 financial statements are provided in the exhibits. Using the information provided, enter the appropriate amounts to be reported on page 1 of Foxy Partnership's income tax return in the table below. Enter all amounts as positive whole values. If a response is zero, enter a zero (0). 2. Cost of goods sold 3. Salaries and wages 4. Guaranteed payments to partners 5. Repairs and maintenance 6. Bad debts 7. Rent 8. Depreciation 9. Other deductions 10. Ordinary business income (loss)arrow_forwardIf a business pays off a loan, which of the following will occur?A. Assets and liabilities increaseB. Assets and liabilities decreaseC. Only liabilities increaseD. Equity decreasesarrow_forwardWhich financial statement lists revenues and expenses?A. Balance SheetB. Cash Flow StatementC. Income StatementD. Retained Earnings Statementneedarrow_forward

- No chatgpt! Which financial statement lists revenues and expenses?A. Balance SheetB. Cash Flow StatementC. Income StatementD. Retained Earnings Statementarrow_forwardWhich financial statement lists revenues and expenses?A. Balance SheetB. Cash Flow StatementC. Income StatementD. Retained Earnings StatementNo Aiarrow_forwardWhich financial statement lists revenues and expenses?A. Balance SheetB. Cash Flow StatementC. Income StatementD. Retained Earnings Statementarrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage