Macroeconomics (7th Edition)

7th Edition

ISBN: 9780134738314

Author: R. Glenn Hubbard, Anthony Patrick O'Brien

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 1.A, Problem 6PA

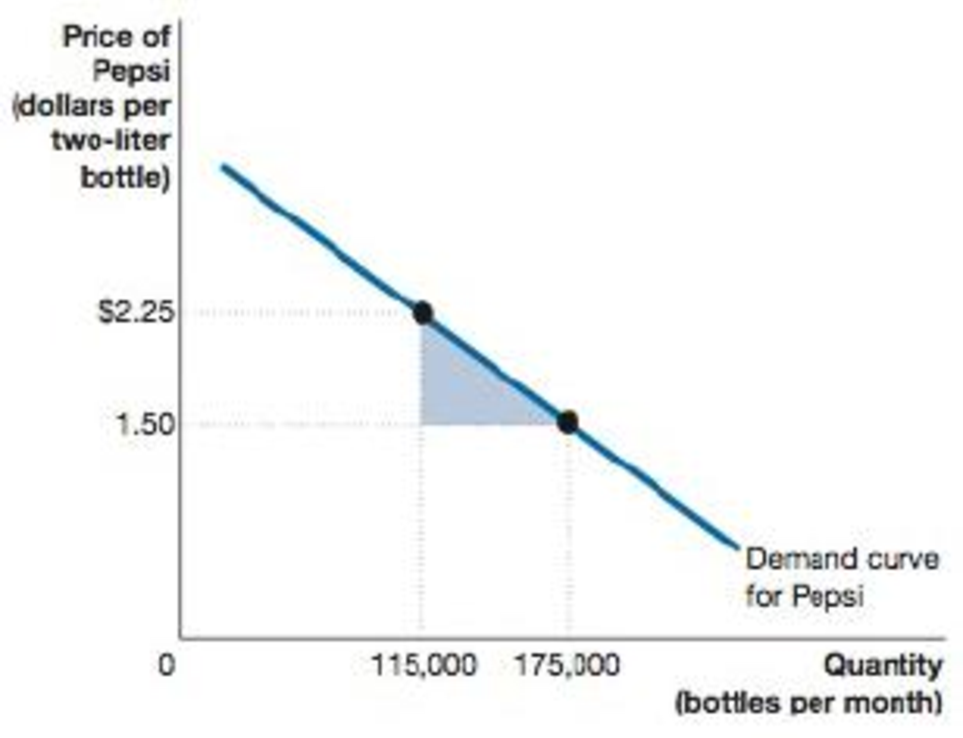

What is the area of the triangle shown in the following figure?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Not use ai please

In the following table, complete the third column by determining the quantity sold in each country at a price of $18 per toy train. Next, complete the

fourth column by calculating the total profit and the profit from each country under a single price.

Price

Single Price

Quantity Sold

Price Discrimination

Country

(Dollars per toy

train)

(Millions of toy

trains)

Profit

(Millions of

dollars)

Price

(Dollars per toy

train)

Quantity Sold

(Millions of toy

trains)

Profit

(Millions of

dollars)

France

18

Russia

18

Total

N/A

N/A

N/A

N/A

Suppose that as a profit-maximizing firm, Le Jouet decides to price discriminate by charging a different price in each market, while its marginal cost of

production remains $8 per toy.

Complete the last three columns in the previous table by determining the profit-maximizing price, the quantity sold at that price, the profit in each

country, and total profit if Le Jouet price discriminates.

Le Jouet charges a lower price in the market with a relatively

elastic…

Not use ai please

Chapter 1 Solutions

Macroeconomics (7th Edition)

Ch. 1.A - Prob. 1PACh. 1.A - Prob. 2PACh. 1.A - Prob. 3PACh. 1.A - Prob. 4PACh. 1.A - Prob. 5PACh. 1.A - What is the area of the triangle shown in the...Ch. 1.A - Prob. 7PACh. 1 - Prob. 1TCCh. 1 - Prob. 2TCCh. 1 - Prob. 1.1.1RQ

Ch. 1 - Prob. 1.1.2RQCh. 1 - Prob. 1.1.3PACh. 1 - Prob. 1.1.4PACh. 1 - Prob. 1.1.5PACh. 1 - Prob. 1.1.6PACh. 1 - Prob. 1.1.7PACh. 1 - Prob. 1.1.8PACh. 1 - Prob. 1.1.9PACh. 1 - Prob. 1.1.10PACh. 1 - Prob. 1.1.11PACh. 1 - Prob. 1.2.1RQCh. 1 - Prob. 1.2.2RQCh. 1 - Prob. 1.2.3RQCh. 1 - Prob. 1.2.4RQCh. 1 - Prob. 1.2.5PACh. 1 - Prob. 1.2.6PACh. 1 - Prob. 1.2.7PACh. 1 - Prob. 1.2.8PACh. 1 - Prob. 1.2.9PACh. 1 - Prob. 1.2.10PACh. 1 - Prob. 1.2.11PACh. 1 - Prob. 1.2.12PACh. 1 - Prob. 1.2.13PACh. 1 - Prob. 1.3.1RQCh. 1 - Prob. 1.3.2RQCh. 1 - Prob. 1.3.3RQCh. 1 - Prob. 1.3.4PACh. 1 - Prob. 1.3.5PACh. 1 - Prob. 1.3.6PACh. 1 - Prob. 1.3.7PACh. 1 - Prob. 1.3.8PACh. 1 - Prob. 1.3.9PACh. 1 - Prob. 1.3.10PACh. 1 - Prob. 1.3.11PACh. 1 - Prob. 1.4.1RQCh. 1 - Prob. 1.4.2RQCh. 1 - Prob. 1.4.3PACh. 1 - Prob. 1.4.4PACh. 1 - Prob. 1.1CTECh. 1 - Prob. 1.2CTE

Additional Business Textbook Solutions

Find more solutions based on key concepts

1-1. Define marketing and outline the steps in the marketing process. (AASCB: Communication)

Marketing: An Introduction (13th Edition)

Assume you are a CFO of a company that is attempting to race additional capital to finance an expansion of its ...

Financial Accounting, Student Value Edition (5th Edition)

List five asset accounts, three liability accounts, and five expense accounts included in the acquisition and p...

Auditing And Assurance Services

10-10 What challenges do managers face in managing global teams? How should those challenges be handled?

Fundamentals of Management (10th Edition)

Risk Premiums and Discount Rates. Top hedge fund manager Sally Buffit believes that a stock with the same marke...

FUNDAMENTALS OF CORPORATE FINANCE

11-9. Identify a company with a product that interests you. Consider ways the company could use customer relati...

Business Essentials (12th Edition) (What's New in Intro to Business)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Not dhdjdjdjduudnxnxjfjfi feverarrow_forwardDiscuss the different types of resources (natural, human, capital) and how they are allocated in an economy. Identify which resources are scarce and which are abundant, and explain the implications of this scarcity or abundance.arrow_forwardNot use ai pleasearrow_forward

- Not use ai please letarrow_forwardLocation should be in GWAGWALADA Abuja Nigeria Use the Internet to do itarrow_forwardUsing data from 1988 for houses sold in Andover, Massachusetts, from Kiel and McClain (1995), the following equation relates housing price (price) to the distance from a recently built garbage incinerator (dist): = log(price) 9.40 + 0.312 log(dist) n = 135, R2 = 0.162. Interpretation of the slope coefficient? ► How would our interpretation of the slope coefficient change if distance were measured in metres instead of kilometres?arrow_forward

- If GDP goes up by 1% and the investment component of GDPgoes up by more than 1%, how is the investment share ofGDP changing in absolute terms?▶ In economics, what else is expressed as relative percentagechanges?arrow_forwardCEO Salary and Firm SalesWe can estimate a constant elasticity model relating CEO salary to firm sales. The data set is the same one used in Example 2.3, except we now relate salary to sales. Let sales be annual firm sales, measured in millions of dollars. A constant elasticity model is[2.45]ßßlog (salary) = ß0 + ß0log (sales) + u,where ß1 is the elasticity of salary with respect to sales. This model falls under the simple regression model by defining the dependent variable to be y = log(salary) and the independent variable to be x = log1sales2. Estimating this equation by OLS gives[2.46]log (salary)^=4.822 + 0.257 (sales) n = 209, R2 = 0.211.The coefficient of log(sales) is the estimated elasticity of salary with respect to sales. It implies that a 1% increase in firm sales increases CEO salary by about 0.257%—the usual interpretation of an elasticity.arrow_forwardSolvearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Microeconomics: Principles & PolicyEconomicsISBN:9781337794992Author:William J. Baumol, Alan S. Blinder, John L. SolowPublisher:Cengage Learning

Microeconomics: Principles & PolicyEconomicsISBN:9781337794992Author:William J. Baumol, Alan S. Blinder, John L. SolowPublisher:Cengage Learning

Macroeconomics: Principles and Policy (MindTap Co...EconomicsISBN:9781305280601Author:William J. Baumol, Alan S. BlinderPublisher:Cengage Learning

Macroeconomics: Principles and Policy (MindTap Co...EconomicsISBN:9781305280601Author:William J. Baumol, Alan S. BlinderPublisher:Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:9781337617383

Author:Roger A. Arnold

Publisher:Cengage Learning

Microeconomics: Principles & Policy

Economics

ISBN:9781337794992

Author:William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:Cengage Learning

Macroeconomics: Principles and Policy (MindTap Co...

Economics

ISBN:9781305280601

Author:William J. Baumol, Alan S. Blinder

Publisher:Cengage Learning

Forecasting: Exponential Smoothing, MSE; Author: Joshua Emmanuel;https://www.youtube.com/watch?v=k_HN0wOKDd0;License: Standard Youtube License