ENTRIES FOR DISSOLUTION OF

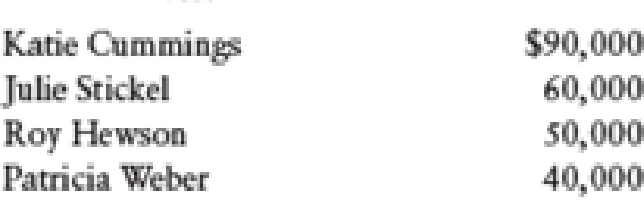

On August 10, after the business had been in operation for several years, Patricia Weber passed away. Mr. Weber wished to sell his wife’s interest for $30,000. After the books were closed, the partners’ capital accounts had credit balances as follows:

REQUIRED

1. Prepare the general

2. Assume instead that Mr. Weber is paid $60,000 for the book value of Patricia Weber’s capital account. Prepare the necessary journal entry.

3. Assume instead that Julie Stickel (with the consent of the remaining partners) purchased Weber’s interest for $70,000 and gave Mr. Weber a personal check for that amount. Prepare the general journal entry for the partnership only.

Trending nowThis is a popular solution!

Chapter 19 Solutions

Bundle: College Accounting, Chapters 1-9, Loose-Leaf Version, 22nd + LMS Integrated for CengageNOWv2, 2 terms Printed Access Card for Heintz/Parry's College Accounting, Chapters 1-27, 22nd

- How?arrow_forwardI need this question answer general Accountingarrow_forwardAccounting: The warehouse supervisor at Emerald Bay Trading must reconcile damaged goods claims. Their policy allows claims within 48 hours of delivery, requires photographic evidence, and management approval for values over $500. Last week, from 45 deliveries worth $28,000, customers reported 8 damages, submitted 6 photos, and 5 claims met the time limit. What is the value of valid claims if each averages $180?arrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning