Concept explainers

1.

Cost-Volume-Profit Analysis: It is a method followed to analyze the relationship between the sales, costs, and the related profit or loss at various levels of units sold. In other words, it shows the effect of the changes in the cost and the sales volume on the operating income of the company.

To prepare: an estimated income statement for 20Y7.

1.

Explanation of Solution

Prepare an estimated income statement for 20Y7.

| Company B | |||

| Estimated Income Statement | |||

| For the year ended December 31, 20Y8 | |||

| Particulars | Amount ($) | Amount ($) | Amount ($) |

| Sales (1) | 2,880,000 | ||

| Less: Cost of Goods sold: | |||

| Direct Materials (2) | 600,000 | ||

| Direct Labor (3) | 360,000 | ||

| Factory |

422,000 | ||

| Cost of Goods Sold | (1,382,000) | ||

| Gross Profit | 1,498,000 | ||

| Less: Expenses: | |||

| Selling expenses: | |||

| Sales salaries and commissions (5) | 388,000 | ||

| Advertising | 116,000 | ||

| Travel | 4,000 | ||

| Miscellaneous selling expense (6) | 14,300 | ||

| Total selling expenses | 522,300 | ||

| Administrative expenses: | |||

| Office and Officers’ salaries | 325,000 | ||

| Supplies (7) | 54,000 | ||

| Miscellaneous administrative expenses (8) | 20,700 | ||

| Total administrative expenses | 399,700 | ||

| Total expenses | (922,000) | ||

| Income from operations | 576,000 | ||

Table (1)

Working notes:

Determine sales.

Number of units to be sold =12,000 units

Selling price per unit =$240 per unit

Determine the cost of direct materials.

Number of units to be sold =12,000 units

Direct Materials cost per unit =$50 per unit

Determine the cost of direct labor.

Number of units to be sold =12,000 units

Direct labor cost per unit =$30 per unit

Determine the cost of factory overhead.

Factory overhead-Fixed =$350,000

Number of units to be sold =12,000 units

Factory overhead-Variable cost per unit =$6 per unit

Determine the sales salaries and commissions.

Sales salaries and commissions-Fixed =$340,000

Number of units to be sold =12,000 units

Sales salaries and commissions-Variable cost per unit =$4 per unit

Determine the miscellaneous selling expense.

Miscellaneous selling expense-Fixed =$2,300

Number of units to be sold =12,000 units

Miscellaneous selling expense-Variable cost per unit =$1 per unit

Determine the supplies.

Supplies-Fixed =$6,000

Number of units to be sold =12,000 units

Supplies-Variable cost per unit =$4 per unit

Determine the miscellaneous administrative expense.

Miscellaneous administrative expense-Fixed =$8,700

Number of units to be sold =12,000 units

Miscellaneous administrative expense-Variable cost per unit =$1 per unit

2.

the expected contribution margin ratio.

2.

Explanation of Solution

Determine the expected contribution margin ratio.

Sales =$2,880,000 (1)

Variable cost =$1,152,000 (9)

Working note:

Determine the variable cost.

Number of units to be sold =12,000 units

Variable cost per unit =$96 per unit

Therefore, the expected contribution margin ratio is 60%.

3.

the break-even sales in units and dollars.

3.

Explanation of Solution

Determine the break-even sales in units.

Fixed cost =$1,152,000

Contribution margin per unit =$144 per unit (10)

Working note:

Compute the contribution margin per unit.

Selling price per unit =$240 per unit

Variable cost per unit =$96 per unit

Determine the break-even sales in dollars.

Fixed cost =$1,152,000

Contribution margin ratio =60% (refer Part 2)

Therefore, the break-even sales in units is 8,000 units and dollars is $1,920,000.

4.

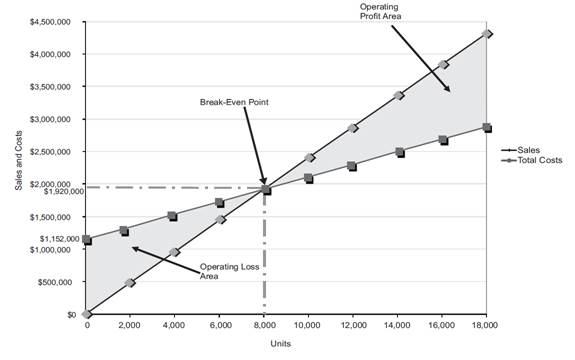

To construct: a cost-volume-profit chart indicating the break-even sales.

4.

Explanation of Solution

Construct a cost-volume-profit chart indicating the break-even sales.

Figure (1)

The volume in units of sales is shown on the horizontal axis. The maximum relevant range is 18,000 units. The sales and the total costs (fixed cost and variable cost) in dollars is shown on the vertical axis. The maximum relevant range of sales and total costs is $4,500,000.

The total sales line is drawn right upward by connecting the first point at $0 to the second point at $4,320,000

The total cost line is drawn right upward by connecting the first point at $1,152,000 (fixed cost) on the vertical axis to the second point at

The break-even point is the intersection point where the total sales line and total cost line meet. The vertical dotted line drawn downward from the intersection point reaches at 8,000 units. It indicates the break-even sales (units). The horizontal line drawn to the left towards the vertical axis reaches at $1,920,000. It indicates the break-even sales (dollars). Refer Part 3 for the break-even values.

The operating profit area is the area where the total sales line exceeds the total cost line. However, the operating loss area is the area where the total cost exceeds the total sales line.

5.

the expected margin of safety in dollars and as a percentage of sales.

5.

Explanation of Solution

Determine the expected margin of safety in dollars.

Sales =$2,880,000 (1)

Sales at break-even point =$1,920,000 (refer Part 3)

Determine the expected margin of safety as a percentage of sales.

Sales =$2,880,000 (1)

Margin of Safety in dollars =$960,000

Therefore, the expected margin of safety in dollars is $960,000 and as a percentage of sales is 33.3%.

6.

the operating leverage.

6.

Explanation of Solution

Determine the operating leverage.

Contribution margin =$1,728,000 (11)

Income from operations =$576,000 (refer Table 1)

Working note:

Determine the contribution margin

Sales =$2,880,000 (1)

Variable cost =$1,152,000 (9)

Therefore, the operating leverage is 3.

Want to see more full solutions like this?

Chapter 19 Solutions

Bundle: Financial & Managerial Accounting, Loose-Leaf Version, 14th + CengageNOWv2, 2 terms Printed Access Card

- Can you help me with accounting questionsarrow_forwardDuring its first year, Yutsang Enterprises showed a $22 per-unit profit under absorption costing but would have reported a total profit of $20,000 less under variable costing. Suppose production exceeded sales by 600 units and an average contribution margin of 58% was maintained. a. What is the fixed cost per unit? b. What is the sales price per unit? c. What is the variable cost per unit? d. What is the unit sales volume if total profit under absorption costing was $240,000?arrow_forwardWood Manufacturing uses a job-order costing system and a predetermined overhead rate based on direct labor-hours to apply manufacturing overhead to jobs. Manufacturing overhead cost and direct labor hours were estimated at $120,000 and 50,000 hours, respectively, for the year. In August, Job #527 was completed at a cost of $6,200 in direct materials and $3,000 in direct labor. The labor rate is $7 per hour. By the end of the year, Wood had worked a total of 55,000 direct labor-hours and had incurred $130,500 in actual manufacturing overhead cost. If Job #527 contained 250 units, the unit product cost on the completed job cost sheet would be___. Answerarrow_forward

- please solve this problemarrow_forwardA B C D 8 After analyzing expenses, the company has determined the following cost patterns. 9 Cost of Goods Sold (per unit) 10 Sales Commissions (per dollar of sales) 11 Administrative Salaries (per quarter) 12 Rent Expense (per quarter) 13 Depreciation Expense (per quarter) 14 $29.00 9.50% $45,000 $27,000 $36,000 15 Shipping has been determined to be a mixed cost with the following to tal costs and units: E F G H 16 17 2022 18 Quarter 1 19 Quarter2 20 Quarter 3 21 Quarter 4 22 2023 23 Quarter 1 24 Quarter2 25 Quarter 3 26 Quarter 4 27 28 Use the data to answer the following. 29 30 31 Total Cost Units $67,000 12,500 $94,000 21,000 $89,800 13,800 $92,600 20,000 $72,500 13,700 $80,000 14,000 $84,000 14,300 $100,000 22,500 (Use cells A4 to C26 from the given Information to complete this question. All answers should be input and displayed as positive values.) 321. Using the high-low method, determine a cost formula for shipping costs. 33 34 35 High level of activity 36 Low level of…arrow_forwardCalculate the predetermined overhead......? Accountingarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College