Corporate Finance: The Core (4th Edition) (Berk, DeMarzo & Harford, The Corporate Finance Series)

4th Edition

ISBN: 9780134202648

Author: Jonathan Berk, Peter DeMarzo

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 18, Problem 6P

Suppose Alcatel-Lucent has an equity cost of capital of 10%, market capitalization of $10.8 billion, and an enterprise value of $14.4 billion. Suppose Alcatel-Lucent’s debt cost of capital is 6.1% and its marginal tax rate is 35%.

- a. What is Alcatel-Lucent’s WACC?

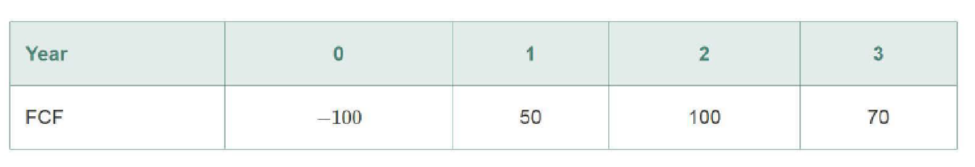

- b. If Alcatel-Lucent maintains a constant debt-equity ratio, what is the value of a project with average risk and the following expected

free cash flows ?

- c. If Alcatel-Lucent maintains its debt-equity ratio, what is the debt capacity of the project in part b?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

I need help checking my spreadsheet.

Q: Assume that Temp Force’s dividend is expected to experience supernormal growth of 73%from Year 0 to Year 1, 47% from Year 1 to Year 2, 32% from Year 2 to Year 3 and 21% from year3 to year 4. After Year 4, dividends will grow at a constant rate of 2.75%. What is the stock’sintrinsic value under these conditions? What are the expected dividend yield and capital gainsyield during the first year? What are the expected dividend yield and capital gains yield duringthe fifth year (from Year 4 to Year 5)?

what are the five components of case study design? Please help explain with examples

Commissions are usually charged when a right is exercised. a warrant is exercised. a right is sold. all of the above will have commissions A and B are correct, C is not correct

Chapter 18 Solutions

Corporate Finance: The Core (4th Edition) (Berk, DeMarzo & Harford, The Corporate Finance Series)

Ch. 18.1 - What are the three methods we can use to include...Ch. 18.1 - Prob. 2CCCh. 18.2 - Prob. 1CCCh. 18.2 - Prob. 2CCCh. 18.3 - Prob. 1CCCh. 18.3 - Prob. 2CCCh. 18.4 - Prob. 1CCCh. 18.4 - Prob. 2CCCh. 18.5 - How do we estimate a projects unlevered cost of...Ch. 18.5 - What is the incremental debt associated with a...

Ch. 18.6 - Prob. 1CCCh. 18.6 - Prob. 2CCCh. 18.7 - How do we deal with issuance costs and security...Ch. 18.7 - Prob. 2CCCh. 18.8 - When a firm has pre-determined tax shields, how do...Ch. 18.8 - Prob. 2CCCh. 18 - Prob. 1PCh. 18 - Prob. 2PCh. 18 - In 2015, Intel Corporation had a market...Ch. 18 - Prob. 4PCh. 18 - Suppose Goodyear Tire and Rubber Company is...Ch. 18 - Suppose Alcatel-Lucent has an equity cost of...Ch. 18 - Acort Industries has 10 million shares outstanding...Ch. 18 - Prob. 8PCh. 18 - Prob. 9PCh. 18 - Consider Alcatel-Lucents project in Problem 6. a....Ch. 18 - Consider Alcatel-Lucents project in Problem 6. a....Ch. 18 - In year 1, AMC will earn 2000 before interest and...Ch. 18 - Prokter and Gramble (PKGR) has historically...Ch. 18 - Amarindo, Inc. (AMR), is a newly public firm with...Ch. 18 - Remex (RMX) currently has no debt in its capital...Ch. 18 - You are evaluating a project that requires an...Ch. 18 - Prob. 17PCh. 18 - You are on your way to an important budget...Ch. 18 - Your firm is considering building a 600 million...Ch. 18 - Prob. 20PCh. 18 - DFS Corporation is currently an all-equity firm,...Ch. 18 - Prob. 22PCh. 18 - Prob. 23PCh. 18 - Prob. 24PCh. 18 - XL Sports is expected to generate free cash flows...Ch. 18 - Propel Corporation plans to make a 50 million...Ch. 18 - Gartner Systems has no debt and an equity cost of...Ch. 18 - Revtek, Inc., has an equity cost of capital of 12%...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Don't used Ai solutionarrow_forwardDon't used Ai solutionarrow_forwardQuestion 25 Jasmine bought a house for $225 000. She already knows that for the first $200 000, the land transfer tax will cost $1650. Calculate the total land transfer tax. (2 marks) Land Transfer Tax Table Value of Property Rate On the first $30 000 0% On the next $60 000 0.5% (i.e., $30 001 to $90 000) On the next $60 000 1.0% (i.e., $90 001 to $150 000) On the next $50 000 1.5% (i.e., $150 001 to $200 000) On amounts in excess of $200 000 2.0% 22 5000–200 000. 10 825000 2.5000.00 2 x 25000 =8500 2 maarrow_forward

- Question 25 Jasmine bought a house for $225 000. She already knows that for the first $200 000, the land transfer tax will cost $1650. Calculate the total land transfer tax. (2 marks) Land Transfer Tax Table Value of Property Rate On the first $30 000 0% On the next $60 000 0.5% (i.e., $30 001 to $90 000) On the next $60 000 1.0% (i.e., $90 001 to $150 000) On the next $50 000 1.5% (i.e., $150 001 to $200 000) On amounts in excess of $200 000 2.0% 225000–200 000 = 825000 25000.002 × 25000 1= 8500 16 50+ 500 2 marksarrow_forwardSuppose you deposit $1,000 today (t = 0) in a bank account that pays an interest rate of 7% per year. If you keep the account for 5 years before you withdraw all the money, how much will you be able to withdraw after 5 years? Calculate using formula. Calculate using year-by-year approach. Find the present value of a security that will pay $2,500 in 4 years. The opportunity cost (interest rate that you could earn from alternative investments) is 5%. Calculate using the formula. Calculate using year-by-year discounting approach. Solve for the unknown in each of the following: Present value Years Interest rate Future value $50,000 12 ? $152,184 $21,400 30 ? $575,000 $16,500 ? 14% $238,830 $21,400 ? 9% $213,000 Suppose you enter into a monthly deposit scheme with Chase, where you have your salary account. The bank will deduct $25 from your salary account every month and the first payment (deduction) will be made…arrow_forwardPowerPoint presentation of a financial analysis that includes the balance sheet, income statement, and statement of cash flows for Nike and Adidas. Your analysis should also accomplish the following: Include the last three years of data, and evaluate the trends in the data. Summarize the footnotes on each of the statements. Compute the earnings per share for the three years. Compare the two companies and determine the insights gathered from the trend analysis.arrow_forward

- In addition to the customer affairs department of the insurance company the insurance policy must identify which other following on the policy Name of the producer Current director of insurance Policyholder satisfaction rating for paying claims 4. Financial rating from a recognized financial rating servicearrow_forwardIn addition to the customer affairs department of the insurance company the insurance policy must identify which other following on the policy Name of the producer Current director of insurance Policyholder satisfaction rating for paying claims D. Financial rating from a recognized financial rating servicearrow_forwardUnearned premium refunds for insurance policies cancelled when an insurance company is covered by the Illinois Insurance guaranty fund is subject to a MAXIMUM premium refund of what amount? A.$ 100.00 B.$ 1000.00 C.$10,000.00 D.$ 100,000.00arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Discounted cash flow model; Author: Edspira;https://www.youtube.com/watch?v=7PpWneOBJls;License: Standard YouTube License, CC-BY