1.

Calculate the effect of change in inventory on the value stream profits of DVD.

1.

Answer to Problem 60P

Option c.

Explanation of Solution

Calculate the ending inventory.

| Particulars | DVD Group | TV Group |

| Beginning inventory | 200 | 700 |

| Price | $55 | $46 |

| Sold | $13,500 | $15,600 |

| Actual production | 14,000 | 15,000 |

| Budgeted production | 14,000 | 15,000 |

| Ending inventory | 700 (1) | 100 (2) |

Table (1)

Therefore, the ending inventory is 700 units for DVD group and 100 units for TV group respectively.

Working notes:

1) Calculate the ending inventory of DVD group:

2) Calculate the ending inventory of TV group:

Calculate the effect of change in inventory.

| Particulars | DVD group ($) | TV group ($) | Total |

| Unit variable cost | |||

| Manufacturing | 30 | 16 | |

| Selling and administrative | 5 | 5 | |

| Traceable fixed cost | |||

| Manufacturing | 140,000 | 258,000 | 398,000 |

| Selling and administrative | 10,000 | 10,000 | 20,000 |

| Non traceable fixed cost | |||

| Manufacturing | 130,000 | ||

| Selling and administrative | 85,000 | ||

| Change in inventory (3) | 5,000 | (10,320) |

Table (2)

Therefore, the effect change in inventory is $5,000 increase in DVD group and $10,320 decrease in TV group.

Working note:

3) Calculate the change in inventory of DVD and TV group:

For DVDs

For TVs

Hence, the correct option is c which is $5,000 increase.

2.

Determine the value stream profit of TV groups.

2.

Answer to Problem 60P

Option b.

Explanation of Solution

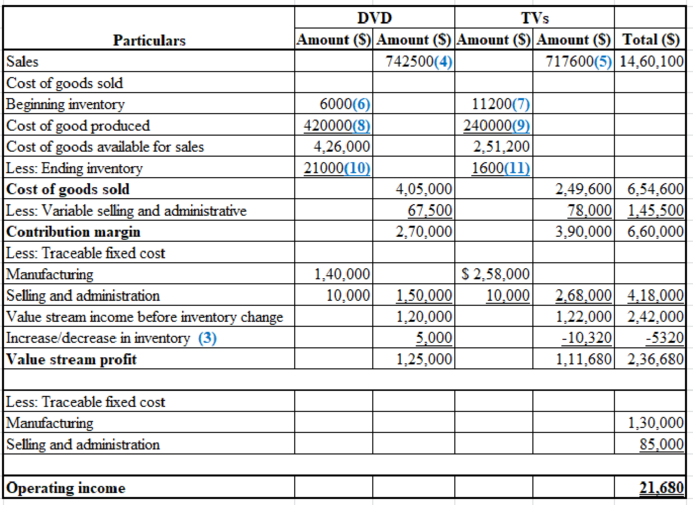

Determine the value stream profits of TV groups.

Table (3)

Therefore, the value stream profit of TVs is $236,680.

Working notes:

4) Calculate the sales for DVDs:

5) Calculate the sales for TVs

6) Calculate the beginning inventory for DVDs:

7) Calculate the beginning inventory for TVs:

8) Calculate the cost of goods produced for DVDs:

9) Calculate the cost of goods produced for TVs:

10) Calculate the ending inventory for DVDs:

11) Calculate the ending inventory for TVs

Hence, the correct option is b which is $111,680.

3.

Provide information on the results obtained from the value stream income statement.

3.

Explanation of Solution

The value stream income statement is prepared with the full costing income statement. The value of change in inventory has increased by $5,000 for the DVDs and decreased by $10,320 for the TVs. Non traceable fixed cost are not allocated but are subtracted from the profits to get a operating income of $21,680.

The income statement show that both are profitable but the TVs are relatively less when compared to DVDs, the reason is that there is a negative change in the value of inventory that is $10,320 while DVDs have an increase of $5,000.

4.

Describe the benefits of using value stream for evaluating profits.

4.

Explanation of Solution

The value stream income statement comprises of both variable and full costing income statement, which shows the effect of change in inventory. This provides the management the additional information for more complete and informative evaluation of products.

Want to see more full solutions like this?

Chapter 18 Solutions

Cost Management

- Can you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forwardCan you help me solve this general accounting question using the correct accounting procedures?arrow_forwardI need help with this general accounting question using standard accounting techniques.arrow_forward

- What was Gabriel's cost of goods sold for the year?arrow_forwardNonearrow_forwardCompany Y reported FIFO ending inventory of $126,500 and a beginning inventory of $119,200 for 2021. Inventory purchases for 2021 were $265,300, and the change in the LIFO reserve for 2020 was an increase in the LIFO reserve of $890. Calculate the value of COGS LIFO for Company Y in 2021.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education