Concept explainers

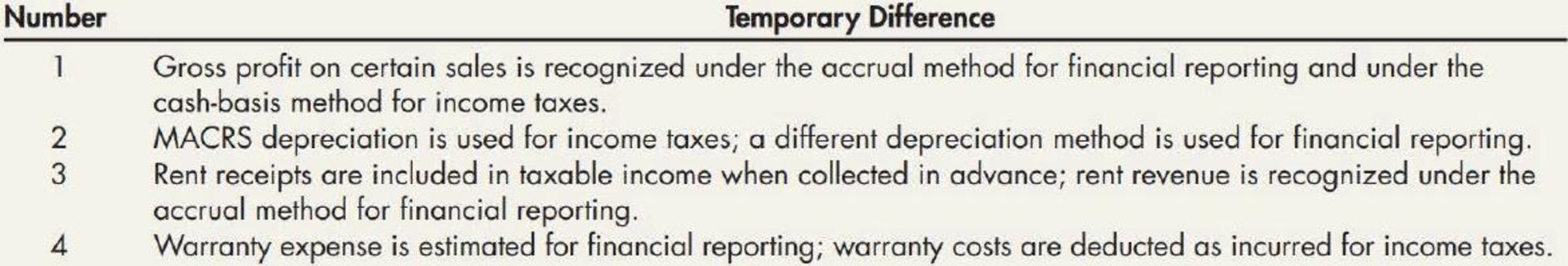

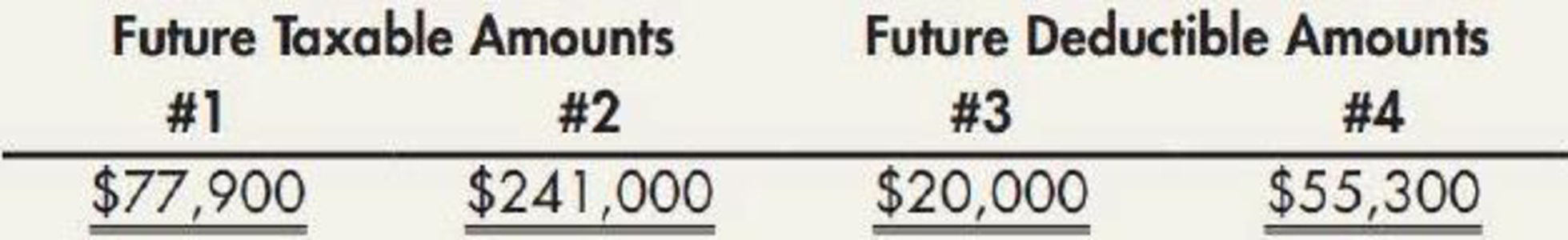

Interperiod Tax Allocation Klerk Company had four temporary differences between its pretax financial income and its taxable income during 2019 as follows:

At the beginning of 2019, Klerk had a

The company has a history of earning income and expects to be profitable in the future. The income tax rate for 2019 is 40%, but in 2018 Congress enacted a 30% tax rate for 2020 and future years.

During 2019, for

Required:

- 1. Prepare Klerk’s income tax

journal entry for 2019. - 2. Prepare a condensed 2019 income statement for Klerk.

- 3. Show how the income tax items are reported on Klerk’s December 31, 2019,

balance sheet .

1.

Prepare journal to record the entry for income tax of Company K at the end of 2019.

Explanation of Solution

Deferred tax asset When the Income Tax Expense account is more than the Income Tax Payable account, this difference is known as Deferred Tax Asset.

Deferred tax liability When the Income Tax Expense account is less than the Income Tax Payable account, this difference is known as Deferred Tax Liability.

Prepare journal to record the entry for income tax of Company K at the end of 2019:

| Date | Account title and Explanation | Post ref. | Amount | |

| Debit | Credit | |||

| 2019 | ||||

| December 31 | Income tax expense (balancing figure) | $117,870 | ||

| Deferred tax asset (1) | $6,000 | |||

| Deferred tax liability (2) | $12,000 | |||

| Income tax payable (3) | $108,000 | |||

| Deferred tax liability (4) | $23,370 | |||

| Deferred tax asset (5) | $4,500 | |||

| (To record the income tax payable) | ||||

Table (1)

- Income Tax Expense is a component of stockholders’ equity and decreases, so debt it for $117,870.

- Deferred Tax Asset is an asset and increases, so debit it for $6,000.

- Deferred Tax Liability is a liability and decreases, so debit it for $12,000.

- Income Tax Payable is a liability and increases, so credit it for $108,000.

- Deferred Tax Liability is a liability and increases, so credit it for $23,370.

- Deferred Tax Asset is an asset and decreases, so credit it for $4,500.

Working note 1: Determine the deferred tax asset:

Working note 2: Determine the Deferred tax liability:

Working note 3: Determine the income tax payable:

Working note 4: Determine the deferred tax liability:

Working note 5: Determine the deferred tax asset:

2.

Prepare the condensed income statement of Company K.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare the condensed income statement of Company K.

| Particulars | Amount |

| Revenues | $750,000 |

| Less: Expenses | ($447,100) |

| Income before income taxes | $302,900 |

| Income tax expense | ($117,870) |

| Net income | $185,030 |

Table (2)

Thus, the net income of Company K is $185,030.

3.

Explain the manner of reporting income tax items in the balance sheet of Company K.

Explanation of Solution

Balance sheet: Balance Sheet is one of the financial statements that summarize the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Prepare balance sheet of Company K as on December 31, 2019:

| Company K | |

| Balance sheet (partial) | |

| As on December 31, 2019 | |

| Assets | Amount |

| Total assets | |

| Liabilities | |

| Current liabilities: | |

| Income tax payable | $108,000 |

| Non- Current liabilities: | |

| Deferred tax liability (6) | $73,080 |

| Total liabilities | $181,080 |

Table (3)

Thus, the total liabilities as on December 31, 2019 for Company K are $181,080.

Working Note 6: Determine the net deferred tax liability reported in balance sheet:

Want to see more full solutions like this?

Chapter 18 Solutions

Intermediate Accounting: Reporting And Analysis

- Cost Accounting: Mehta Telecom offers a data plan with a base cost of $40, which includes 5GB of data. Additional data usage is charged as follows: the first 3GB beyond the base is priced at $6 per GB, the next 5GB is priced at $5 per GB, and any usage beyond that is charged at $4 per GB. Calculate the total cost for using 15GB of data in a billing cycle. a) $87 b) $89 c) $93 d) $91arrow_forwardDon't want wrong answerarrow_forwardHii ticher please given answer general accounting questionarrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning