Fundamentals of Cost Accounting

6th Edition

ISBN: 9781260708783

Author: LANEN, William

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 18, Problem 39E

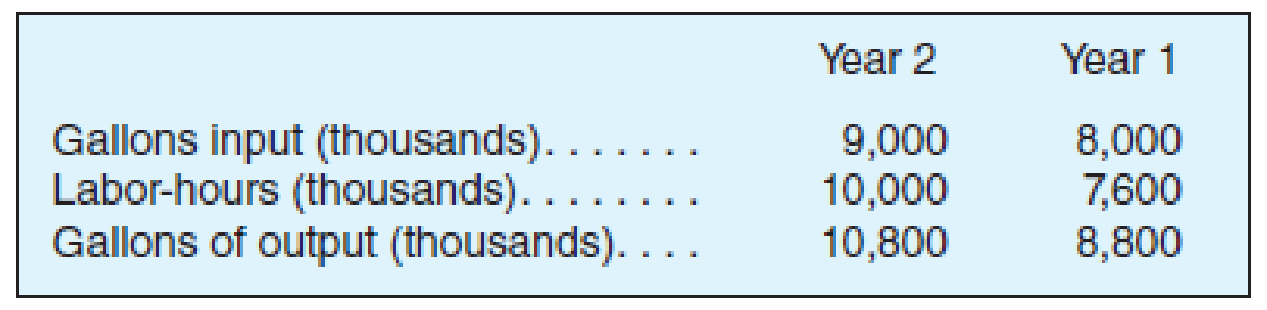

Partial Productivity Measures

As the cost

Required

- a. Compute the partial productivity measures for labor for year 1 and year 2.

- b. Compute the partial productivity measures for material for year 1 and year 2.

- c. Comment on the results. Have the efficiency improvement programs resulted in greater productivity?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

General Accounting

Solve this financial accounting problem

Can you please solve this questions final answer

Chapter 18 Solutions

Fundamentals of Cost Accounting

Ch. 18 - Why is it important for management accountants to...Ch. 18 - A balanced scorecard is a set of two or more...Ch. 18 - What is a business model?Ch. 18 - What are the advantages of financial measures of...Ch. 18 - Prob. 5RQCh. 18 - Why do effective performance evaluation systems...Ch. 18 - What is benchmarking?Ch. 18 - Prob. 8RQCh. 18 - Prob. 9RQCh. 18 - Prob. 10RQ

Ch. 18 - Prob. 11RQCh. 18 - Prob. 12RQCh. 18 - Prob. 13RQCh. 18 - Prob. 14RQCh. 18 - Prob. 15RQCh. 18 - Prob. 16CADQCh. 18 - Prob. 17CADQCh. 18 - Prob. 18CADQCh. 18 - Prob. 19CADQCh. 18 - Prob. 20CADQCh. 18 - Prob. 21CADQCh. 18 - Prob. 22CADQCh. 18 - Prob. 23CADQCh. 18 - Prob. 24CADQCh. 18 - Strategy and Management Accounting Systems Joes...Ch. 18 - Business Strategy Classification Consider the...Ch. 18 - Prob. 27ECh. 18 - Prob. 28ECh. 18 - Prob. 29ECh. 18 - Prob. 30ECh. 18 - Balanced Scorecards and Strategy Maps Crane...Ch. 18 - TechMasters, Inc., has the following mission...Ch. 18 - Benchmarks Match each of the following specific...Ch. 18 - Benchmarks Match each of the following specific...Ch. 18 - Prob. 35ECh. 18 - Manufacturing Cycle Time and Efficiency Bell ...Ch. 18 - Prob. 37ECh. 18 - Partial Productivity Measures Looking for cost...Ch. 18 - Partial Productivity Measures As the cost...Ch. 18 - Prob. 40ECh. 18 - Prob. 41ECh. 18 - Specifying Nonfinancial Measures Write a memo to...Ch. 18 - Manufacturing Cycle Time and Efficiency A...Ch. 18 - Prob. 44ECh. 18 - Core Assets and Capabilities Consider the...Ch. 18 - Write a memo discussing the advantages of each...Ch. 18 - Balanced Scorecards and Strategy Maps Hill Street...Ch. 18 - Balanced Scorecards and Strategy Maps Monroe...Ch. 18 - Benchmarks Write a report to the CEO of Delta...Ch. 18 - Prob. 50PCh. 18 - Performance Measures, Drawing a Business Model...Ch. 18 - Performance Measures, Drawing a Business Model...Ch. 18 - Functional Measures Write a report to the...Ch. 18 - Prob. 54PCh. 18 - Operational Performance Measures Zuma Company...Ch. 18 - Objective and Subjective Performance Measures A...Ch. 18 - Operational Performance Measures Mid-States Metal...Ch. 18 - Prob. 58PCh. 18 - Prob. 59PCh. 18 - Prob. 60PCh. 18 - Balanced Scorecards and Strategy Maps Following...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

What is Cost Allocation? Definition & Process; Author: FloQast;https://www.youtube.com/watch?v=hLhvvHvZ3JM;License: Standard Youtube License