Fundamentals of Cost Accounting

5th Edition

ISBN: 9781259565403

Author: William N. Lanen Professor, Shannon Anderson Associate Professor, Michael W Maher

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 18, Problem 31E

Benchmarks

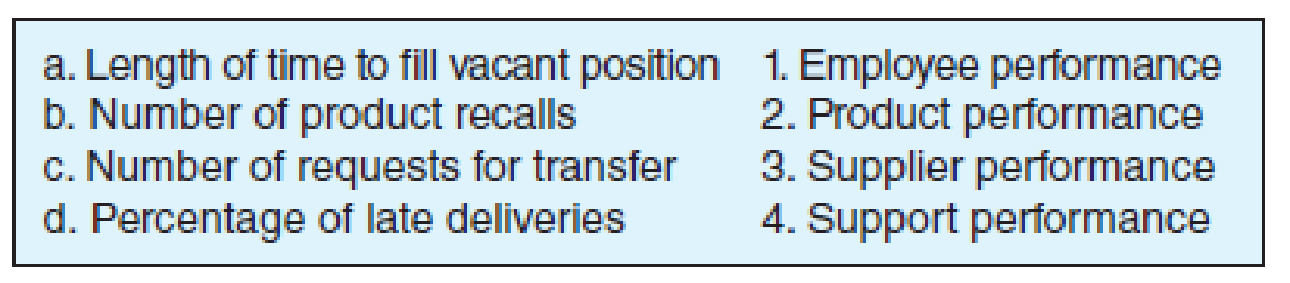

Match each of the following specific measurements to its benchmark category.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Need help

The accounting cycle begins with:A. Posting to the ledgerB. Journalizing transactionsC. Preparing the financial statementsD. Adjusting entries

No AI

The accounting cycle begins with:A. Posting to the ledgerB. Journalizing transactionsC. Preparing the financial statementsD. Adjusting entries

4. The accounting cycle begins with:A. Posting to the ledgerB. Journalizing transactionsC. Preparing the financial statementsD. Adjusting entries

Chapter 18 Solutions

Fundamentals of Cost Accounting

Ch. 18 - Why is it important for management accountants to...Ch. 18 - A balanced scorecard is a set of two or more...Ch. 18 - What is a business model?Ch. 18 - What are the advantages of financial measures of...Ch. 18 - Prob. 5RQCh. 18 - Why do effective performance evaluation systems...Ch. 18 - What is benchmarking?Ch. 18 - Prob. 8RQCh. 18 - Prob. 9RQCh. 18 - Prob. 10RQ

Ch. 18 - Prob. 11RQCh. 18 - Prob. 12RQCh. 18 - Prob. 13RQCh. 18 - Prob. 14RQCh. 18 - Prob. 15RQCh. 18 - Prob. 16CADQCh. 18 - Prob. 17CADQCh. 18 - Prob. 18CADQCh. 18 - Prob. 19CADQCh. 18 - Prob. 20CADQCh. 18 - Prob. 21CADQCh. 18 - Prob. 22CADQCh. 18 - Prob. 23CADQCh. 18 - Prob. 24CADQCh. 18 - Strategy and Management Accounting Systems Joes...Ch. 18 - Business Strategy Classification Consider the...Ch. 18 - Prob. 27ECh. 18 - Prob. 28ECh. 18 - Balanced Scorecards and Strategy Maps Crane...Ch. 18 - TechMasters, Inc., has the following mission...Ch. 18 - Benchmarks Match each of the following specific...Ch. 18 - Benchmarks Match each of the following specific...Ch. 18 - Prob. 33ECh. 18 - Manufacturing Cycle Time and Efficiency Bell ...Ch. 18 - Prob. 35ECh. 18 - Partial Productivity Measures Looking for cost...Ch. 18 - Partial Productivity Measures As the cost...Ch. 18 - Specifying Nonfinancial Measures Write a memo to...Ch. 18 - Manufacturing Cycle Time and Efficiency A...Ch. 18 - Prob. 40ECh. 18 - Core Assets and Capabilities Consider the...Ch. 18 - Balanced Scorecards and Strategy Maps Hill Street...Ch. 18 - Balanced Scorecards and Strategy Maps Monroe...Ch. 18 - Benchmarks Write a report to the CEO of Delta...Ch. 18 - Prob. 45PCh. 18 - Performance Measures, Drawing a Business Model...Ch. 18 - Performance Measures, Drawing a Business Model...Ch. 18 - Functional Measures Write a report to the...Ch. 18 - Prob. 49PCh. 18 - Operational Performance Measures Zuma Company...Ch. 18 - Objective and Subjective Performance Measures A...Ch. 18 - Operational Performance Measures Mid-States Metal...Ch. 18 - Prob. 53PCh. 18 - Prob. 54PCh. 18 - Balanced Scorecards and Strategy Maps Following...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ivanhoe Equipment Company sells computers for $1,620 each and also gives each customer a 2-year warranty that requires the company to perform periodic services and to replace defective parts. In 2025, the company sold 860 computers on account. Based on experience, the company has estimated the total 2-year warranty costs as $40 for parts and $60 for labor per unit. (Assume sales all occur at December 31, 2025.) In 2026, Ivanhoe incurred actual warranty costs relative to 2025 computer sales of $13,200 for parts and $19,800 for labor. Record the entries to reflect the above transactions (accrual method) for 2025 and 2026. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Date Account Titles and Explanation 2025 2026 2025 Cash Sales Revenue (To record sale of computers) Warranty Expense Warranty…arrow_forwardNeed Answer of this Accounting Subject Relevant Questionarrow_forwardHellow Dear Teacher Please Help to Solve This Financial Accounting Problemarrow_forward

- Walthaus Corporation's standard cost sheet is as follows: Direct material 4 feet at $ 5.00 per foot Direct labor 3 hours at $ 10.00 per hour Variable overhead 3 hours at $ 2.00 per hour Fixed overhead 3 hours at $ 1.00 per hour Additional information: Actual results: purchased 30,000 feet of material at $5.25 per foot. (there were no beginning or ending material inventories); direct labor cost incurred was 26,000 hours at $9.75 per hour; actual variable overhead incurred, $50,000; and actual fixed overhead incurred $43,000. Overhead is applied to work-in-process on the basis of direct labor hours. The company produced 8,000 units of product during the period. The number of estimated hours for computing the fixed overhead application rate totaled 45,000 hours. What are the fixed overhead price and production volume variances? Multiple Choice $2,000 F; $23,000 U. $4,000 F; $25,000 U. $2,000 U; $23,000 F. None of the choices is correct.…arrow_forwardNo Ai 3. What is the purpose of depreciation?A. Track the market value of assetsB. Match the cost of an asset to the periods it benefitsC. Allocate cash flowsD. Record the decrease in asset liquidity need helparrow_forwardFinancial Accounting Question Solution with Detailed Explanation and Correct Answerarrow_forward

- I need help 3. What is the purpose of depreciation?A. Track the market value of assetsB. Match the cost of an asset to the periods it benefitsC. Allocate cash flowsD. Record the decrease in asset liquidityarrow_forwardImpact Window Company makes storm-resistant windows. The company's sales manager estimated the sales volume to be 160,000 windows. Due to the increased hurricane activity this year, the total demand for this type of window increased from 800,000 windows to 1,000,000 windows. At the same time the company's market share fell from 20 percent to 15 percent. The company's standard contribution margin is $15.00 per window. What is the company's market share variance? Multiple Choice $740,000 favorable $740,000 unfavorable $750,000 unfavorable None of these. $750,000 favorablearrow_forwardNo chatgpt 3. What is the purpose of depreciation?A. Track the market value of assetsB. Match the cost of an asset to the periods it benefitsC. Allocate cash flowsD. Record the decrease in asset liquidityarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Topic 6 - Financial statement analysis; Author: drdavebond;https://www.youtube.com/watch?v=uUnP5qkbQ20;License: Standard Youtube License