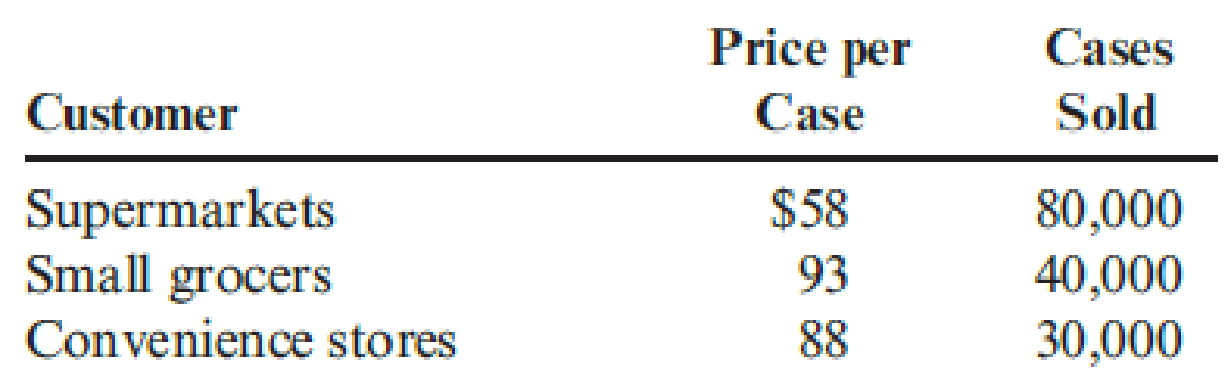

Kaune Food Products Company manufactures canned mixed nuts with an average

The supermarkets require special labeling on each can costing $0.04 per can. They order through electronic data interchange (EDI), which costs Kaune about $61,000 annually in operating expenses and depreciation. Kaune delivers the nuts to the stores and stocks them on the shelves. This distribution costs $45,000 per year.

The small grocers order in smaller lots that require special picking and packing in the factory; the special handling adds $25 to the cost of each case sold. Sales commissions to the independent jobbers who sell Kaune products to the grocers average 8 percent of sales.

Convenience stores also require special handling that costs $30 per case. In addition, Kaune is required to co-pay advertising costs with the convenience stores at a cost of $15,000 per year. Frequent stops are made to each convenience store by Kaune delivery trucks at a cost of $30,000 per year.

Required:

- 1. Calculate the total cost per case for each of the three customer classes. (Round unit costs to four significant digits.)

- 2. Using the costs from Requirement 1, calculate the profit per case per customer class. Does the cost analysis support the charging of different prices? Why or why not?

- 3. What if Kaune charged the average price per case to all customer classes? How would that affect the profit percentages?

Trending nowThis is a popular solution!

Chapter 18 Solutions

EBK CORNERSTONES OF COST MANAGEMENT

- ?!!arrow_forwardWhich of the following choice is the correct status of manufacturing overhead at year end ?.arrow_forwardMadison Corporation began 2025 with $24,000 in stockholders' equity. Of this amount, $15,000 was in common stock, and there were no changes in the common stock account during 2025. At December 31, 2025, Madison had $28,000 in stockholders' equity. Madison paid out $9,000 in dividends during the year. How much was its net income in 2025? correct answerarrow_forward

- Madison Corporation began 2025 with $24,000 in stockholders' equity. Of this amount, $15,000 was in common stock, and there were no changes in the common stock account during 2025. At December 31, 2025, Madison had $28,000 in stockholders' equity. Madison paid out $9,000 in dividends during the year. How much was its net income in 2025?arrow_forward4 POINTSarrow_forwardRiver stone Co. had the following consignment... Please answer the financial accounting questionarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning