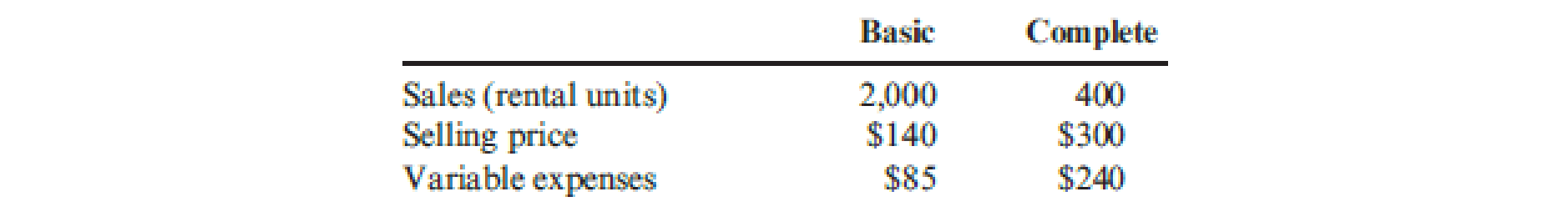

Haysbert Company provides management services for apartments and rental units. In general, Haysbert packages its services into two groups: basic and complete. The basic package includes advertising vacant units, showing potential renters through them, and collecting monthly rent and remitting it to the owner. The complete package adds maintenance of units and bookkeeping to the basic package. Packages are priced on a per-rental unit basis. Actual results from last year are as follows:

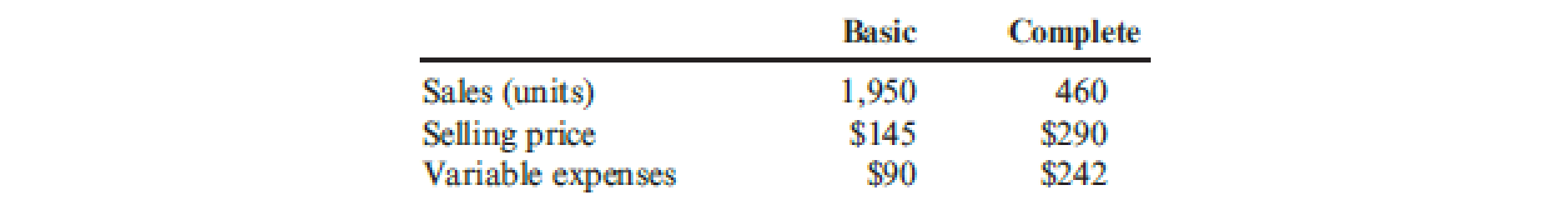

Haysbert had budgeted the following amounts:

Required:

- 1. Calculate the contribution margin variance.

- 2. Calculate the contribution margin volume variance.

- 3. Calculate the sales mix variance.

1.

Compute the contribution margin variance.

Explanation of Solution

Contribution margin variance: Contribution margin variance reflects difference between the actual contribution margin and budgeted contribution margin. It is computed using the given formula:

Compute the contribution margin variance:

| Particulars | Basic | Complete | Total |

| Actual results: | |||

|

Sales: | $280,000 | $120,000 | $400,000 |

|

Less: Variable expenses: | ($170,000) | ($96,000) | ($226,000) |

| Actual Contribution margin | $110,000 | $24,000 | $134,000 |

| Budgeted results: | |||

|

Sales: | $282,750 | $133,400 | $416,150 |

|

Less: Variable expenses: | ($175,500) | ($111,320) | ($286,820) |

| Budgeted Contribution margin | $107,250 | $22,080 | $129,030 |

| Computation of variance | |||

| Actual Contribution margin (A) | $134,000 | ||

| Budgeted Contribution margin (B) | $129,030 | ||

| Contribution margin variance | $4,670 (F) | ||

Table (1)

Since, the actual contribution margin is more than the budgeted contribution margin; the contribution margin variance of $4,670 is favorable (F).

2.

Compute the contribution margin volume variance.

Explanation of Solution

Contribution margin volume variance: Contribution margin volume variance reflects difference between the actual quantity sold and the budgeted quantity sold multiplied by the budgeted average unit contribution margin. It is computed using the given formula:

Compute the contribution margin volume variance:

Therefore, the contribution margin volume variance is $536.64(Unfavorable).

Working note 1: Calculate the budgeted average unit contribution margin:

3.

Compute the sales mix variance.

Explanation of Solution

Sales mix variance: The sales mix represents the part of total sales generated by each product. Sales mix variance is the summation of change in units for each product multiplied by the difference between the budgeted contribution margin and the budgeted average unit contribution margin. It is computed using the given formula:

Compute the basic sales mix:

Compute the complete sales mix:

Compute the sales mix variance:

Want to see more full solutions like this?

Chapter 18 Solutions

EBK CORNERSTONES OF COST MANAGEMENT

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning