a.

To show: The adjustments to be made in capital accounts of Ace Products in order to payout a stock dividend of 10%.

Introduction:

Stock Dividend:

When a company pays dividends to its shareholders not in cash but in the form of additional shares, such a dividend is termed as stock dividend. This form is generally paid out when company falls short of cash.

a.

Answer to Problem 18P

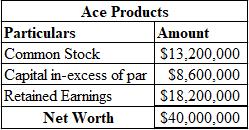

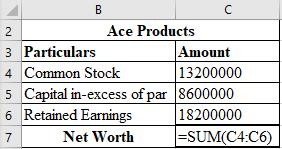

The adjustments that would be made to the capital account for payment of 10% stock dividend are as follows:

Explanation of Solution

The calculation used for making required adjustments to capital account is shown below:

Working Notes:

Calculation of Stock Dividend in numbers:

Calculation of additional capital in-excess of par:

Calculation of Capital in-excess of par:

Calculation of closing balance of

b.

To show: The adjustments to be made to the EPS as well as the stock price of Ace Products, assuming the P/E ratio to remain the same.

Introduction:

Earnings per share (EPS):

It is the profit earned by shareholders on each share. A higher EPS indicates higher value of the company because investors are ready to pay higher price for one share of the company.

Stock Price:

The highest price of one share of a company that an investor is willing to pay is termed as the stock’s price. It is current price used for the trading of such share.

b.

Answer to Problem 18P

The EPS of Ace Products after stock dividend is $1.82 and the price of its stocks is $18.20.

Explanation of Solution

Calculation of the EPS of Ace Products after stock dividends:

Calculation of the price of stock:

Working Note:

Calculation of Number of shares after stock dividend:

c.

To calculate: The number of shares a shareholder would have if he originally owns 70 shares.

Introduction:

Stockholder:

Also termed as a shareholder, the person who own shares or capital stock in a corporation is the stockholder. In other words, a shareholder is the one who partly owns a company, limited to the amount of his shares.

c.

Answer to Problem 18P

The number of shares that a shareholder originally holding 70 shares will after the declaration of stock dividend have 77 shares.

Explanation of Solution

Calculation of the number of shares of one of the shareholders after stock dividend:

d.

To calculate: The worth of the total investments of an investor before as well as after the stock dividend, the P/E ratio being constant.

Introduction:

Stock Dividend:

When a company pays dividends to its shareholders not in cash but in the form of additional shares, such a dividend is termed as stock dividend. This form is generally paid out when company falls short of cash.

d.

Answer to Problem 18P

The P/E ratio remaining constant, the worth of the total investments of an investor before the declaration of stock dividends is $1,400 and after the stock dividend is $1,401.

Explanation of Solution

Calculation of the value of an investors total investments before the declaration of stock dividends:

Calculation of the value of an investors total investments after the declaration of stock dividends:

Want to see more full solutions like this?

Chapter 18 Solutions

EBK FOUNDATIONS OF FINANCIAL MANAGEMENT

- Suppose three countries’ per capita Gross Domestic Products (GDPs) are £1000, £2000, and £3000. What is the average of each pair of countries’ GDPs per capita? (b) What is the difference between each of the individual observations and the overall average? What is the sum of these differences? (c) Suppose instead of three countries, we had a sample of 100 countries with the same sample average GDP per capita as the overall average for the three observations above, with the standard deviation of these 100 observations being £1000. Form the 95% confidence interval for the population mean. (d) What might explain differences in GDP across countries? Consider the following regression equation, where Earnings is measured in £/hour, and Experience is measured in years in a particular job, with standard errors in parentheses: Earnings \ = −0.25 (−0.5) + 0.2 (0.1) Experience, One of these numbers has been reported incorrectly - it shouldn’t be negative. Which one and why? (b)…arrow_forwardI need answer typing clear urjent no chatgpt used pls i will give 5 Upvotes.arrow_forwardYou want to buy equipment that is available from 2 companies. The price of the equipment is the same for both companies. Silver Research would let you make quarterly payments of $9,130 for 3 years at an interest rate of 3.27 percent per quarter. Your first payment to Silver Research would be today. Island Research would let you make monthly payments of $3,068 for 3 years at an interest rate of X percent per month. Your first payment to Island Research would be in 1 month. What is X? Input instructions: Input your answer as the number that appears before the percentage sign. For example, enter 9.86 for 9.86% (do not enter .0986 or 9.86%). Round your answer to at least 2 decimal places. percentarrow_forward

- Make sure you're using the right formula and rounding correctly I have asked this question four times and all the answers have been incorrect.arrow_forwardYou plan to retire in 3 years with $911,880. You plan to withdraw $X per year for 18 years. The expected return is 18.56 percent per year and the first regular withdrawal is expected in 3 years. What is X? Input instructions: Round your answer to the nearest dollar. $arrow_forwardPlease make sure you're using the right formula and rounding correctly I have asked this question four times and all the answers have been incorrect.arrow_forward

- You want to buy equipment that is available from 2 companies. The price of the equipment is the same for both companies. Orange Furniture would let you make quarterly payments of $12,540 for 6 years at an interest rate of 1.26 percent per quarter. Your first payment to Orange Furniture would be in 3 months. River Furniture would let you make X monthly payments of $41,035 at an interest rate of 0.73 percent per month. Your first payment to River Furniture would be today. What is X? Input instructions: Round your answer to at least 2 decimal places.arrow_forwardYou want to buy equipment that is available from 2 companies. The price of the equipment is the same for both companies. Silver Leisure would let you make quarterly payments of $3,530 for 7 years at an interest rate of 2.14 percent per quarter. Your first payment to Silver Leisure would be today. Pond Leisure would let you make X monthly payments of $18,631 at an interest rate of 1.19 percent per month. Your first payment to Pond Leisure would be in 1 month. What is X? Input instructions: Round your answer to at least 2 decimal places.arrow_forwardYou plan to retire in 4 years with $659,371. You plan to withdraw $100,000 per year for 12 years. The expected return is X percent per year and the first regular withdrawal is expected in 4 years. What is X? Input instructions: Input your answer as the number that appears before the percentage sign. For example, enter 9.86 for 9.86% (do not enter .0986 or 9.86%). Round your answer to at least 2 decimal places. percentarrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education