Concept explainers

You are on your way to an important budget meeting. In the elevator, you review the project valuation analysis you had your summer associate prepare for one of the projects to be discussed:

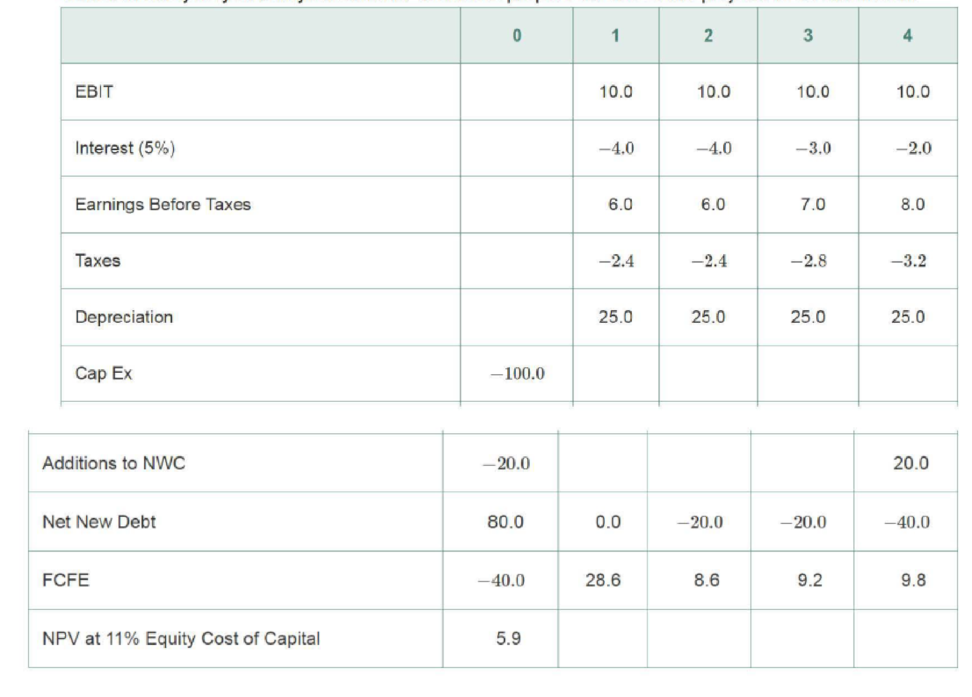

Looking over the spreadsheet, you realize that while all of the cash flow estimates are correct, your associate used the flow-to-equity valuation method and discounted the cash flows using the company’s equity cost of capital of 11%. While the project's risk is similar to the firm’s, the project’s incremental leverage is very different from the company's historical debt-equity ratio of 0.20: For this project, the company will instead borrow $80 million upfront and repay $20 million in year 2, $20 million in year 3, and $40 million in year 4. Thus, the project's equity cost of capital is likely to be higher than the firm’s, not constant over time-invalidating your associate’s calculation.

Clearly, the FTE approach is not the best way to analyze this project. Fortunately, you have your calculator with you, and with any luck you can use a better method before the meeting starts.

- a. What is the

present value of the interest tax shield associated with this project? - b. What are the

free cash flows of the project? - c. What is the best estimate of the project’s value from the information given?

Want to see the full answer?

Check out a sample textbook solution

Chapter 18 Solutions

EBK CORPORATE FINANCE

- As a recent graduate of the UWIOC, The General Manager of the company has hired you to work alongside the Financial Controller of the company to help determine whether the company should invest in the new product line. He has provided you with the following questions to guide you in your assessment of the project and to present your findings to the Company. 1. Determine the weighted average cost of capital (WACC) for Vigour Pharmaceuticals. (Formula to be used is attached)arrow_forwardPlease Answer sub-parts D,E & F Thnak you.arrow_forwardAs a recent graduate of the UWIOC, The General Manager of the company has hired you to work alongside the Financial Controller of the company to help determine whether the company should invest in the new product line. He has provided you with the following questions to guide you in your assessment of the project and to present your findings to the Company. 1. Determine the weighted average cost of capital (WACC) for Vigour Pharmaceuticals. (Formula to be used below)arrow_forward

- Please show all work on excel. You just got hired by McKinsey & Company as a financial consultant and they’re paying you an egregious amount of money. Accordingly, they have you working on the tough projects – like this one… Consider the following two mutually exclusive projects available to the firm. Free cash flows for Projects A and B are provided below. Assume the two projects have essentially the same level of riskiness, and your prior analysis indicates that the appropriate risk-adjusted hurdle rate (i.e., the WACC) is 7.45% for both projects. Perform the analysis below and make a recommendation as to which project to pursue. Year 0 1 2 3 4 5 6 Project A -$3,200 $700 $700 $700 $700 $700 $700 Project B -$600 $58 $58 $695 B. Compute the NPV for both projects using the crossover rate as the discount rate. What do you find? c. Compute the NPV for each project (using the WACC of 7.45% as the discount rate). Based on NPV, which project should be selected? Note:-…arrow_forwardAs a financial analyst, you are tasked with evaluating a capital-budgeting project. You were instructed to use the IRR method, and you need to determine an appropriate hurdle rate. The risk-free rate is 4%, and the expected market rate of return is 11%. Your company has a beta of 0.75, and the project that you are evaluating is considered to have risk equal to the average project that the company has accepted in the past. According to CAPM, the appropriate hurdle rate would be A. 15%. B. 9.25%. C. 4%. D. 11%. E. 0.75%arrow_forwardA company manager asked you to evaluate an investment opportunity. Select and explain two (2) investment criteria you will use to make a decision as to whether to accept or reject the opportunity. You are the CFO of Midas Mining Ltd and the company is looking to expand its mining operations. Your staff have narrowed it down to two (2) projects, with the cash flows presented in the table below. However, given the substantial cash outlay, your company can only choose one of the projects (A or B). Information Project A Project B Cost $5 550 000 $6 640 000 Required: a) Perform a project evaluation, using the Net Present Value (NPV) The prevailing discount rate is 12%. b) Identify which project (if any) should be accepted by Midas Mining Ltd.arrow_forward

- Travellers Inn (Millions of Dollars) Cash $ 10 Accounts payable $ 10 Accounts 20 Accruals 15 receivable Inventories 20 Short-term debt Current assets $ 50 Current liabilities $ 25 Net fixed assets 50 Long-term debt 30 Preferred stock (50,000 shares) 5 Common equity Common stock (3,800,000 shares) $ 10 Retained earnings 30 Total common equity $ 40 Total assets $100 Total liabilities and equity $100 The following facts also apply to TII: 1. The long-term debt consists of 29,412 bonds, each having a 20-year maturity, semiannual payments, a coupon rate of 7.8%, and a face value of $1,000. Currently, these bonds provide investors with a yield to maturity of 11.8%. If new bonds were sold, they would have an 11.8% yield to maturity. 2. TII's perpetual preferred stock has a $100 par value, pays a quarterly dividend per share of $2, and has a yield to investors of 8%. New perpetual preferred stock would have to provide the same yield to investors, and the company would incur a 3.55% flotation…arrow_forwardYour firm is evaluating a capital budgeting project. The estimated cash flows appear below. The board of directors wants to know the expected impact on shareholder wealth. Knowing that the estimated impact on shareholder wealth equates to net present value (NPV), you use your handy calculator to compute the value. What is the project's NPV? Assume that the cash flows occur at the end of each year. The discount rate (i.e., required rate of return, hurdle rate) is 15.1%. (Round to nearest penny) Year 0 cash flow -118,000 Year 1 cash flow 52,000 Year 2 cash flow 44,000 Year 3 cash flow 60,000 O Year 4 cash flow 47,000 Year 5 cash flow 28,000arrow_forwardhelps in their capital budgeting decisions. Green Caterpillar Garden Supplies is a small firm, and several of its managers are worried about how soon the firm will be able to recover its initial investment from Project Alpha's expected future cash flows. To answer this question, Green Caterpillar's CFO has asked that you compute the project's payback period using the following expected net cash flows and assuming that the cash flows are received evenly throughout each year. Complete the following table by computing the project's conventional payback period. (Hint: For full credit, complete the entire table. Round the conventional payback period to the nearest two decimal places. If your answer is negative use a minus sign.) Expected cash flow Cumulative cash flow Year 0 -$5,000,000 $ Year 1 $2,000,000 Year 2 Year 3 $4,250,000 $1,750,000 $ Conventional payback period: years The conventional payback period ignores the time value of money, and this concerns Green Caterpillar's CFO. He has…arrow_forward

- Please the question in its entirety! 3. Understanding the IRR and NPV The net present value (NPV) and internal rate of return (IRR) methods of investment analysis are interrelated and are sometimes used together to make capital budgeting decisions. Consider the case of Cold Goose Metal Works Inc.: Last Tuesday, Cold Goose Metal Works Inc. lost a portion of its planning and financial data when both its main and its backup servers crashed. The company’s CFO remembers that the internal rate of return (IRR) of Project Omicron is 13.8%, but he can’t recall how much Cold Goose originally invested in the project nor the project’s net present value (NPV). However, he found a note that detailed the annual net cash flows expected to be generated by Project Omicron. They are: Year Cash Flow Year 1 $2,400,000 Year 2 $4,500,000 Year 3 $4,500,000 Year 4 $4,500,000 The CFO has asked you to compute Project Omicron’s initial investment using the information currently…arrow_forwardBelow are four cases that you will have to solve using Excel spreadsheets. 1st case The company COMERCIAL SA has two investment alternatives that present the following information: PROJECT A B It is requested Initial investment. $25,000 $22,000 Cash flows year 1 1. Determine the internal rate of return. 2. Determine the present value. $7,000 $12,000 The discount rate for the project will be 10% and the MARR will be 20%. 3. Determine the recovery period. 4. Define which is the most viable project. Year 2 cash flows $15,000 $8,000 Year 3 cash flows $18,000 $12,000arrow_forwardNOTE: Provide a format and show your work (example: N = 6, PV = XXX, I = X%, etc.) 1. As the project manager at Jelz, Inc., you are considering a project that will cost $4,276 and produce cash flows of $1,050 in year 1, $1,250 in year 2, $1,250 in year 3, and $1,550 in year 4. Find the rate of return for the project and determine if you should take the project if your required rate of return is 7.15%. (This is a 2 part question, make sure you answer both parts. Numerical answers should be rounded to 2 decimal places.) 2. You are looking to buy a car. You can afford $550 in monthly payments for five years. In addition to the loan, you can make a $6,000 down payment. If interest rates are 7.25 percent APR, what price of car can you afford (loan plus down payment)? (Do not round intermediate calculations and round your final answer to 2 decimal places.)arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning