Research Case 18–4

FASB codification; comprehensive income; locate and extract relevant information and authoritative support for a financial reporting issue; integrative; Cisco Systems

• LO18–2

Real World Financials

Required:

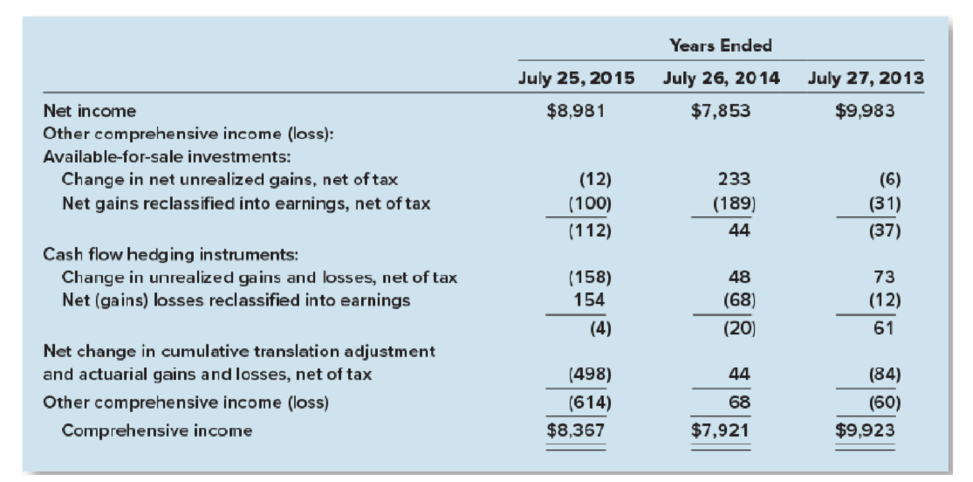

1. Locate the financial statements of Cisco at www.sec.gov or Cisco’s website. Search the 2015 annual report for information about how Cisco accounts for comprehensive income. What does Cisco report in its

2. Access the FASB Accounting Standards Codification at the FASB website (www.fasb.org). Identify the specific citation from the authoritative literature that describes the two alternative formats for reporting comprehensive income.

3. What is comprehensive income? How does it differ from net income? Where is it reported in a balance sheet?

4. One component of Other comprehensive income for Cisco is “net unrealized gains on investments.” What does this mean? From the information Cisco’s financial statements provide, determine how the company calculated the $61 million accumulated other comprehensive income at the end of fiscal 2015.

5. What might be possible causes for the “Other” component of Cisco’s Other comprehensive income? Alcoa is the world’s leading producer of primary aluminum, fabricated aluminum, and alumina. The following is a press release from the company:

Want to see the full answer?

Check out a sample textbook solution

Chapter 18 Solutions

Intermediate Accounting

- What is the total job cost for job k159?arrow_forwardPlease provide the accurate answer to this general accounting problem using valid techniques.arrow_forwardNordica Chemicals produces joint products M and N from Compound Z in a single operation. 800 liters of Compound Z, costing $2,400, produce 500 liters of Product M, selling for $3.50 per liter, and 300 liters of Product N, selling for $6.00 per liter. The portion of the $2,400 cost that should be allocated to Product M using the value basis of allocation is____.arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Accounting Information SystemsFinanceISBN:9781337552127Author:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan HillPublisher:Cengage Learning

Accounting Information SystemsFinanceISBN:9781337552127Author:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan HillPublisher:Cengage Learning Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning  Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Pkg Acc Infor Systems MS VISIO CDFinanceISBN:9781133935940Author:Ulric J. GelinasPublisher:CENGAGE L

Pkg Acc Infor Systems MS VISIO CDFinanceISBN:9781133935940Author:Ulric J. GelinasPublisher:CENGAGE L