Intermediate Accounting

9th Edition

ISBN: 9781259722660

Author: J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 18, Problem 18.1E

Comprehensive income

• LO18–2

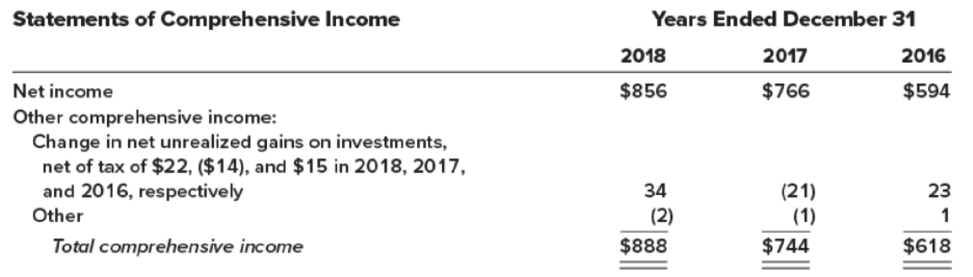

The following is from the 2018 annual report of Kaufman Chemicals, Inc.:

Kaufman reports accumulated other comprehensive income in its

| ($ in millions) | 2018 | 2017 |

| Shareholders’ equity: | ||

| Common stock | 355 | 355 |

| Additional paid-in capital | 8,567 | 8,567 |

| 6,544 | 5,988 | |

| Accumulated other comprehensive income | 107 | 75 |

| Total shareholders’ equity | $15,573 | $14,985 |

Required:

1. What is comprehensive income and how does it differ from net income?

2. How is comprehensive income reported in a balance sheet?

3. Why is Kaufman’s 2018 balance sheet amount different from the 2018 amount reported in the disclosure note? Explain.

4. From the information provided, determine how Kaufman calculated the $107 million accumulated other comprehensive income in 2018.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Accounting discuss

Can you explain the correct approach to solve this general accounting question?

General accounting question ?

Chapter 18 Solutions

Intermediate Accounting

Ch. 18 - Identify and briefly describe the two primary...Ch. 18 - Prob. 18.2QCh. 18 - Prob. 18.3QCh. 18 - Prob. 18.4QCh. 18 - Prob. 18.5QCh. 18 - Prob. 18.6QCh. 18 - Prob. 18.7QCh. 18 - What is meant by a shareholders preemptive right?Ch. 18 - Terminology varies in the way companies...Ch. 18 - Most preferred shares are cumulative. Explain what...

Ch. 18 - The par value of shares historically indicated the...Ch. 18 - Prob. 18.12QCh. 18 - How do we report components of comprehensive...Ch. 18 - The balance sheet reports the balances of...Ch. 18 - At times, companies issue their shares for...Ch. 18 - Prob. 18.16QCh. 18 - The costs of legal, promotional, and accounting...Ch. 18 - When a corporation acquires its own shares, those...Ch. 18 - Discuss the conceptual basis for accounting for a...Ch. 18 - The prescribed accounting treatment for stock...Ch. 18 - Brandon Components declares a 2-for-1 stock split....Ch. 18 - What is a reverse stock split? What would be the...Ch. 18 - Suppose you own 80 shares of Facebook common stock...Ch. 18 - Prob. 18.24QCh. 18 - Comprehensive income LO181 Schaeffer Corporation...Ch. 18 - Stock issued LO184 Penne Pharmaceuticals sold 8...Ch. 18 - Prob. 18.3BECh. 18 - Prob. 18.4BECh. 18 - Prob. 18.5BECh. 18 - Retirement of shares LO185 Agee Storage issued 35...Ch. 18 - Treasury stock LO185 The Jennings Group...Ch. 18 - Prob. 18.8BECh. 18 - Prob. 18.9BECh. 18 - Cash dividend LO188 Real World Financials...Ch. 18 - Effect of preferred stock on dividends LO187 The...Ch. 18 - Property dividend LO187 Adams Moving and Storage,...Ch. 18 - Stock dividend LO188 On June 13, the board of...Ch. 18 - Prob. 18.14BECh. 18 - Stock split LO188 Refer to the situation...Ch. 18 - Prob. 18.16BECh. 18 - Comprehensive income LO182 The following is from...Ch. 18 - Prob. 18.2ECh. 18 - Earnings or OCI? LO182 Indicate by letter whether...Ch. 18 - Stock issued for cash; Wright Medical Group LO184...Ch. 18 - Issuance of shares; noncash consideration LO184...Ch. 18 - Prob. 18.6ECh. 18 - Share issue costs; issuance LO184 ICOT Industries...Ch. 18 - Reporting preferred shares LO184, LO187 Ozark...Ch. 18 - Prob. 18.9ECh. 18 - Prob. 18.10ECh. 18 - Retirement of shares LO185 In 2018, Borland...Ch. 18 - Treasury stock LO185 In 2018, Western Transport...Ch. 18 - Treasury stock; weighted-average and FIFO cost ...Ch. 18 - Prob. 18.14ECh. 18 - Prob. 18.15ECh. 18 - Prob. 18.16ECh. 18 - Transact ions affecting retained earnings LO186,...Ch. 18 - Effect of cumulative, nonparticipating preferred...Ch. 18 - Stock dividend LO188 The shareholders equity of...Ch. 18 - Prob. 18.20ECh. 18 - Cash in lieu of fractional share rights LO188...Ch. 18 - Prob. 18.22ECh. 18 - Transact ions affecting retained earnings LO186...Ch. 18 - Profitability ratio LO181 Comparative balance...Ch. 18 - Prob. 18.25ECh. 18 - Various stock transactions; correction of journal...Ch. 18 - Share buybackcomparison of retirement and treasury...Ch. 18 - Reacquired sharescomparison of retired shares and...Ch. 18 - Prob. 18.4PCh. 18 - Shareholders equity transactions; statement of...Ch. 18 - Prob. 18.6PCh. 18 - Prob. 18.7PCh. 18 - Prob. 18.8PCh. 18 - Effect o f preferred stock characteristics on...Ch. 18 - Prob. 18.10PCh. 18 - Stock dividends received on investments;...Ch. 18 - Various shareholders equity topics; comprehensive ...Ch. 18 - Prob. 18.13PCh. 18 - Prob. 18.1BYPCh. 18 - Prob. 18.2BYPCh. 18 - Research Case 184 FASB codification; comprehensive...Ch. 18 - Judgment Case 185 Treasury stock; stock split;...Ch. 18 - Prob. 18.6BYPCh. 18 - Prob. 18.7BYPCh. 18 - Prob. 18.8BYPCh. 18 - Prob. 1CCTC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forward(1) prepare the december 31 entry for bramble corporation to record amortization of intangibles. the trademark has an estimated useful life of 4 years with a residual value of $3,520 [it is not $3,460]arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License