Concept explainers

Various stock transactions; correction of

• LO18–4

IFRS

Part A

During its first year of operations, the McCollum Corporation entered into the following transactions relating to shareholders’ equity. The corporation was authorized to issue 100 million common shares, $1 par per share.

Required:

Prepare the appropriate journal entries to record each transaction.

| Jan. 9 | Issued 40 million common shares for $20 per share. |

| Mar. 11 | Issued 5,000 shares in exchange for custom-made equipment. McCollum’s shares have traded recently on the stock exchange at $20 per share. |

Part B

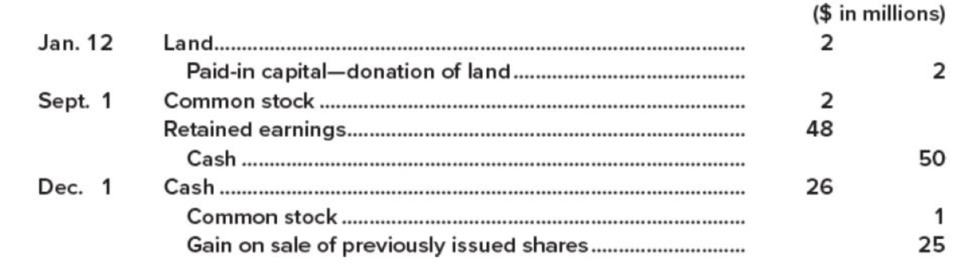

A new staff accountant for the McCollum Corporation recorded the following journal entries during the second year of operations. McCollum retires shares that it reacquires (restores their status to that of authorized but unissued shares).

Required:

Prepare the journal entries that should have been recorded for each of the transactions.

Want to see the full answer?

Check out a sample textbook solution

Chapter 18 Solutions

Intermediate Accounting

Additional Business Textbook Solutions

Accounting Information Systems (14th Edition)

Essentials of MIS (13th Edition)

Management (14th Edition)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Financial Accounting, Student Value Edition (5th Edition)

- 4. A purchase of equipment for cash will:A. Increase assetsB. Decrease total assetsC. Have no effect on assetsD. Increase liabilitiesarrow_forwardWhen a company collects cash from a customer in advance, it should:A. Recognize revenue immediatelyB. Record a liabilityC. Record it as equityD. Ignore it until revenue is earnedarrow_forwardThe journal entry to record the purchase of office supplies on account would include:A. Debit Supplies, Credit CashB. Debit Supplies, Credit Accounts PayableC. Debit Cash, Credit SuppliesD. Debit Accounts Payable, Credit Suppliesarrow_forward

- 7. Which of the following is an adjusting entry?A. Payment of salariesB. Depreciation expenseC. Purchase of suppliesD. Payment of rent in advancearrow_forward5. What is the normal balance of the Dividends account?A. DebitB. CreditC. Zero balanceD. Depends on the type of dividendarrow_forward6. Which of the following transactions decreases stockholders' equity?A. Issuing sharesB. Paying dividendsC. Earning net incomeD. Receiving customer paymentsarrow_forward

- Accounting?arrow_forward9. If a company fails to adjust for accrued interest expense, what is the effect on the financial statements?A. Assets overstatedB. Liabilities understatedC. Revenues understatedD. Equity overstated need helllparrow_forward9. If a company fails to adjust for accrued interest expense, what is the effect on the financial statements?A. Assets overstatedB. Liabilities understatedC. Revenues understatedD. Equity overstatedarrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,