Concept explainers

FIFO method, spoilage. Refer to the information in Problem 18-35.

Required

Do Problem 18-35 using the FIFO method of

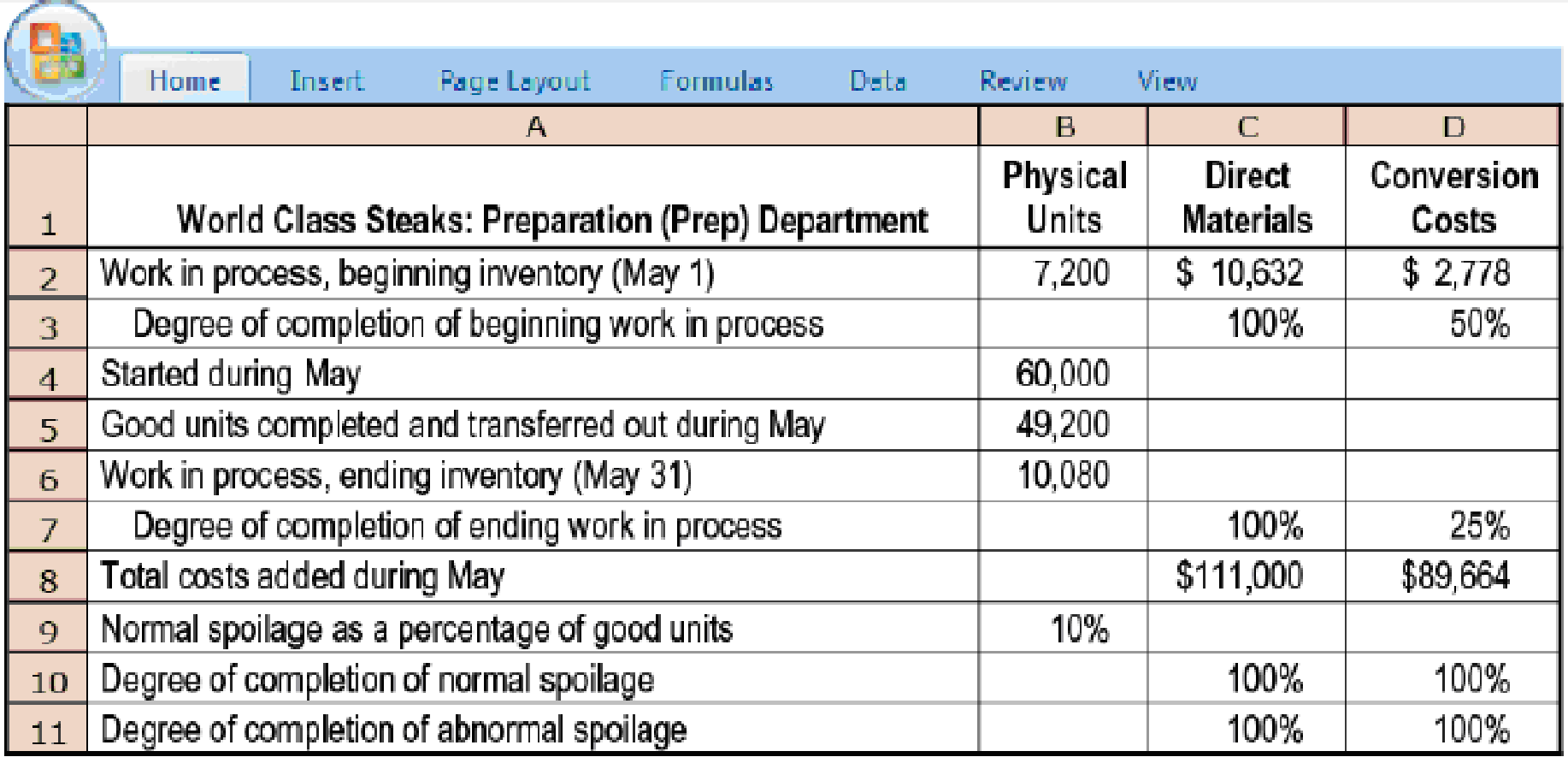

18-35 Weighted-average method, spoilage. World Class Steaks is a meat-processing firm based in Texas. It operates under the weighted-average method of process costing and has two departments: preparation (prep) and shipping. For the prep department, conversion costs are added evenly during the process, and direct materials are added at the beginning of the process. Spoiled units are detected upon inspection at the end of the prep process and are disposed of at zero net disposal value. All completed work is transferred to the shipping department. Summary data for May follow:

Required

For the prep department, summarize the total costs to account for and assign those costs to units completed and transferred out (including normal spoilage), to abnormal spoilage, and to units in ending work in process. (Problem 18-37 explores additional facets of this problem.)

Want to see the full answer?

Check out a sample textbook solution

Chapter 18 Solutions

COST ACCOUNTING

- Milani, Incorporated, acquired 10 percent of Seida Corporation on January 1, 2023, for $190,000 and appropriately accounted for the investment using the fair-value method. On January 1, 2024, Milani purchased an additional 30 percent of Seida for $600,000 which resulted in significant influence over Seida. On that date, the fair value of Seida's common stock was $2,000,000 in total. Seida's January 1, 2024, book value equaled $1,850,000, although land was undervalued by $120,000. Any additional excess fair value over Seida's book value was attributable to a trademark with an eight-year remaining life. During 2024, Seida reported income of $300,000 and declared and paid dividends of $110,000. Required: Prepare the 2024 journal entries for Milani related to its investment in Seida. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheetarrow_forwardThe leo company hadarrow_forwardMCQ 4arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning