FIFO method, spoilage, equivalent units. Refer to the information in Exercise 18-21. Suppose MacLean Manufacturing Company uses the FIFO method of

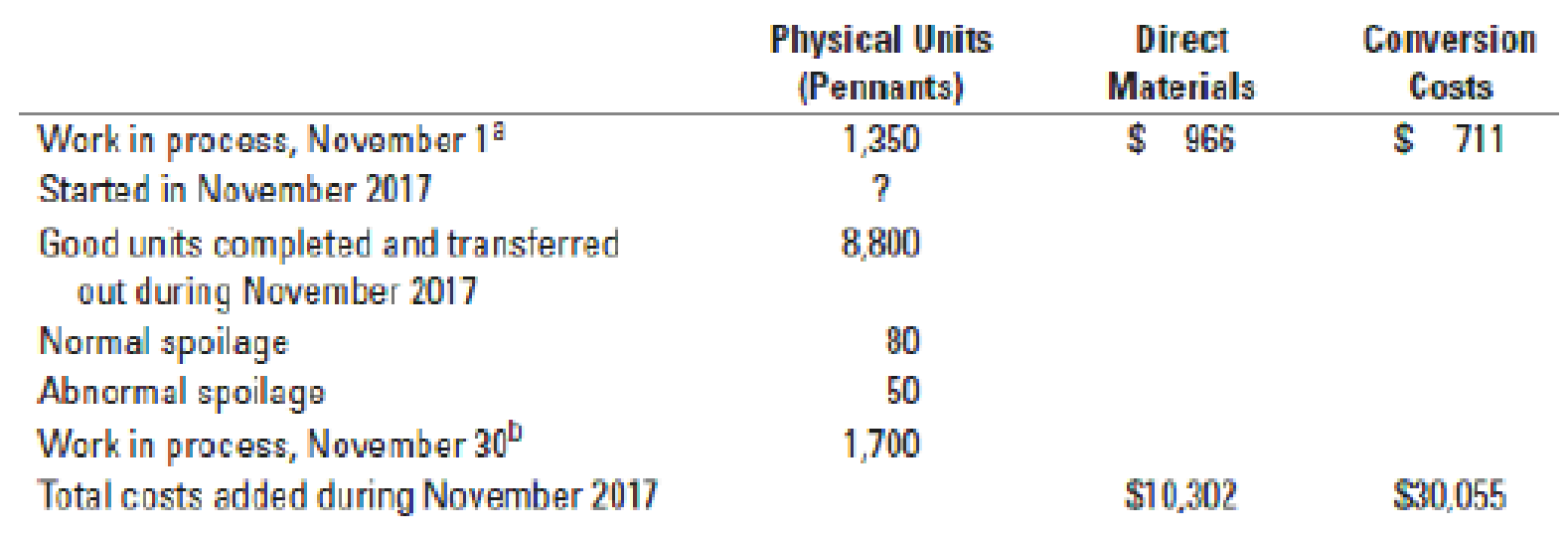

18-21 Weighted-average method, spoilage, equivalent units. (CMA, adapted) Consider the following data for November 2017 from MacLean Manufacturing Company, which makes silk pennants and uses a process-costing system. All direct materials are added at the beginning of the process, and conversion costs are added evenly during the process. Spoilage is detected upon inspection at the completion of the process. Spoiled units are disposed of at zero net disposal value. MacLean Manufacturing Company uses the weighted-average method of process costing.

a Degree of completion: direct materials, 100%; conversion costs, 45%.

b Degree of completion: direct materials, 100%; conversion costs, 35%.

Learn your wayIncludes step-by-step video

Chapter 18 Solutions

COST ACCOUNTING

Additional Business Textbook Solutions

Intermediate Accounting (2nd Edition)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Operations Management

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

Business Essentials (12th Edition) (What's New in Intro to Business)

Fundamentals of Management (10th Edition)

- Provide correct answer is accountingarrow_forwardMilani, Incorporated, acquired 10 percent of Seida Corporation on January 1, 2023, for $190,000 and appropriately accounted for the investment using the fair-value method. On January 1, 2024, Milani purchased an additional 30 percent of Seida for $600,000 which resulted in significant influence over Seida. On that date, the fair value of Seida's common stock was $2,000,000 in total. Seida's January 1, 2024, book value equaled $1,850,000, although land was undervalued by $120,000. Any additional excess fair value over Seida's book value was attributable to a trademark with an eight-year remaining life. During 2024, Seida reported income of $300,000 and declared and paid dividends of $110,000. Required: Prepare the 2024 journal entries for Milani related to its investment in Seida. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheetarrow_forwardThe leo company hadarrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning