Internal Service Fund Entries and Statements

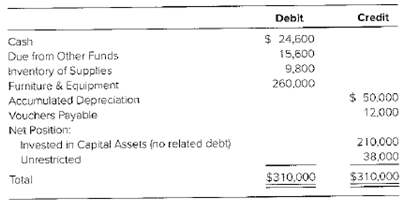

Bellevue City’s printing shop had the following

Additional Information for 20X2

- During 20X2, the printing shop acquired supplies for $96,000, furniture for $1,500, and a copier for $3,200.

- Printing jobs billed to other funds amounted to $292,000; cash received from other funds, $287,300; costs of printing jobs, $204,000, including $84,000 of supplies; operating expenses, $38,000, including $8,400 of supplies;

depreciation expense, $23,000; and vouchers paid, $243,000.

Required

- Prepare entries for the printing shop for 20X2, including closing entries.

- Prepare a statement of net position for the fund on December 31, 20X2. No debt is related to the year-end amount of the fund’s capital assets.

- Prepare a statement of revenues, expenses, and changes in fund net position for 20X2.

- Prepare a statement of

cash flows for 20X2.

a

Proprietary funds: These funds are established for governmental operations for income determination and capital maintenance. There are two major proprietary funds, the internal service fund, and the enterprise fund. As their funds are for revenue generation for government accrual method of accounting is used, these funds record their own long-term assets and record depreciation of these assets, and long-term debt as commercial operations. The entries for 20X2 including closing entries.

Explanation of Solution

Entries for 20X2

| Particulars | Debit $ | Credit $ |

| Inventory of supplies | 96,000 | |

| Furniture and equipment | 4,700 | |

| Vouchers payable | 100,700 | |

| (Acquisition of supplies furniture and office equipment recognized) | ||

| Due from other funds | 292,000 | |

| Billings to departments | 292,000 | |

| (Billings for completed jobs recognized) | ||

| Cash | 287,300 | |

| Due from other funds | 287,300 | |

| (Cash collection on billings recognized) | ||

| Costs of printing jobs | 204,000 | |

| Operating expenses | 38,000 | |

| Inventory of supplies | 92,400 | |

| Vouchers payable | 149,600 | |

| (Cost of printing jobs recognized) | ||

| Depreciation expense | 23,000 | |

| Accumulated depreciation | 23,000 | |

| (Depreciation for the period recorded) | ||

| Vouchers payable | 243,000 | |

| Cash | 243,000 | |

| (Paid approved vouchers) | ||

| Closing entries: | ||

| Billings to departments | 292,000 | |

| Costs of printing jobs | 204,000 | |

| Operating expenses | 38,000 | |

| Depreciation expense | 23,000 | |

| Profit and loss summary | 27,000 | |

| (All the nominal accounts closed and balance transferred to profit and loss summary) | ||

| Profit and loss summary | 27,000 | |

| Net Assets − Unrestricted | 27,000 | |

| (Profit and loss summary account closed) | ||

| Net Assets − Invested in capital assets, net related debt | 18,300 | |

| Net assets − unrestricted | 18,300 | |

| (Reclassification of net asset as of end of period) |

Reclassification of net assets as of end of period:

| Beginning balance in net assets | $210,000 |

| Less: Ending balance of net capital assets | $191,700 |

| $18,300 |

b

Proprietary funds: These funds are established for governmental operations for income determination and capital maintenance. There are two major proprietary funds, the internal service fund, and the enterprise fund. As their funds are for revenue generation for government accrual method of accounting is used, these funds record their own long-term assets and record depreciation of these assets, and long-term debt as commercial operations. The preparation of statement of net position for the fund on December 31, 20X2

Answer to Problem 18.10E

Net Assets as per statement of net position $275,000

Explanation of Solution

B Printing Shop Fund

Statement of Net Assets

December 31, 20X2

| $ | $ | |

| Assets: | ||

| Cash | 68,900 | |

| Due from other funds | 20,300 | |

| Inventory of supplies | 13,400 | |

| Furniture and equipment | $264,700 | |

| Less: Accumulated depreciation | (73,000) | 191,700 |

| Total assets | 294,300 | |

| Liabilities: | ||

| Vouchers payable | 19,300 | |

| Net assets: | ||

| Invested in capital assets net of related debt | 191,700 | |

| Unrestricted | 83,300 | |

| Total net assets | 275,000 |

c

Proprietary funds: These funds are established for governmental operations for income determination and capital maintenance. There are two major proprietary funds, the internal service fund, and the enterprise fund. As their funds are for revenue generation for government accrual method of accounting is used, these funds record their own long-term assets and record depreciation of these assets, and long-term debt as commercial operations. The preparation of Statement of revenues, expenses and changes in fund net position for 20X2

Answer to Problem 18.10E

Net Assets as per statement of net position $275,000

Explanation of Solution

B Printing shop fund

Statement of revenue, expenses and

Change in fund net assets

December 31, 20X2

| $ | $ | |

| Revenue: | ||

| Billing to departments | 292,000 | |

| Expenses: | ||

| Costs of printing jobs | 204,000 | |

| Operating | 38,000 | |

| Depreciation | 23,000 | (265,000) |

| Income | 27,000 | |

| Net assets January 1 | 248,000 | |

| Net assets December 31 | 275,000 |

d

Proprietary funds: These funds are established for governmental operations for income determination and capital maintenance. There are two major proprietary funds, the internal service fund, and the enterprise fund. As their funds are for revenue generation for government accrual method of accounting is used, these funds record their own long-term assets and record depreciation of these assets, and long-term debt as commercial operations. The preparation of statement of cash flow as of December 31, 20X2

Answer to Problem 18.10E

Net change in cash at the end $68,900

Explanation of Solution

B Printing shop fund

Internal service fund

Statement of cash flows

December 31, 20X2

| $ | $ | |

| Cash flows from operating activities: | ||

| Cash received from customers | 287,300 | |

| Cash payments for printing jobs | (283,300 | |

| Net cash provided by operating activities | 49,000 | |

| Cash flow from non-capital financing activity | 0 | |

| Cash flow from capital and related activity: | ||

| Acquisition of capital assets: | ||

| Furniture and copier | ($4,700) | |

| Cash flow from financing activity | (4,700) | |

| Cash flow from investing activities | 0 | |

| Net increase in cash | 44,300 | |

| Cash at beginning of year | 24,600 | |

| Cash at end of year | 68,900 |

Reconciliation of operating income to net cash

| $ | $ | |

| Operating income | 27,000 | |

| Adjustments to reconcile operating income to net cash used by operating activities: | ||

| Depreciation | 23,000 | |

| Change in assets and liabilities: | ||

| Increase in due from other funds from billings | (4,700) | |

| Increase in inventory of supplies | (3,600) | |

| Increase in vouchers payable | 7,300 | |

| Total adjustments | 22,000 | |

| Net cash provided by operating activities | 49,000 |

Want to see more full solutions like this?

Chapter 18 Solutions

EBK ADVANCED FINANCIAL ACCOUNTING

Additional Business Textbook Solutions

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Foundations Of Finance

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Marketing: An Introduction (13th Edition)

Intermediate Accounting (2nd Edition)

Horngren's Accounting (12th Edition)

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education