Enterprise Fund Entries and Statements

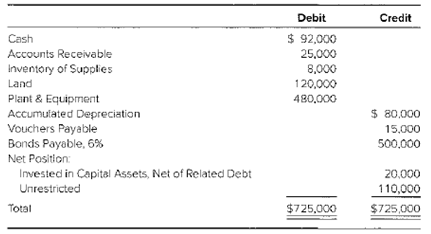

Augusta has a municipal water and gas utility district (MUD). The trail balance on January 1, 20X1, follows:

Additional Information for 20X1

- Charges to customers for water and gas were $420,000; collections were $432,000.

- A loan of $30,000 for two years was received from the general fund.

- The water and gas lines extended to a new development at a cost of $75,000. The contractor was paid.

- Supplies were acquired from central stores (internal service fund) for $12,400. Operating expenses were $328,000, and interest expense was $30,000. Payment was made for the interest and the payable to central stores, and $325,000 of the vouchers were paid.

Adjusting entries were as follows: estimated uncollectibleaccounts receivable , $6,300;depreciation expense, $32,000; and supplies expense, $15,200.

Required

- Prepare entries for the MUD enterprise fund for 20X1 and closing entries.

- Prepare a statement of net position for the fund for December 31, 20X1.

- Prepare a statement of revenues, expenses, and changes in fund net position for 20X1. Assume that the $500,000 of the 6 percent bonds is related to the net capital assets of land and of plant and equipment.

- Prepare a statement of

cash flows for 20X1.

a

Introduction: An enterprise fund is one of two proprietary funds. It is the amounts charged to the general public, to recover all or most of the cost of goods and services provided by the government to the general public. An enterprise fund is one of two proprietary funds.

The entries for the enterprise fund for 20X1 and closing entries.

Explanation of Solution

| Particulars | Debit $ | Credit $ |

| 1. Accounts receivable | 420,000 | |

| Revenue | 420,000 | |

| (Recognition of receivable from customers) | ||

| 2. Cash | 432,000 | |

| Accounts receivable | 432,000 | |

| (Received cash on account of accounts receivable) | ||

| Cash | 30,000 | |

| Due to general fund | 30,000 | |

| (Received loan from general fund) | ||

| 3. Plant and equipment | 75,000 | |

| Contracts payable | 75,000 | |

| (Extension of water and gas lines recognized) | ||

| Contract payable | 75,000 | |

| Cash | 75,000 | |

| (Record payment of extended lines) | ||

| 4. Inventory of supplies | 12,400 | |

| Operating expenses | 328,000 | |

| Interest expense | 30,000 | |

| Due to central stores fund | 12,400 | |

| Vouchers payable | 328,000 | |

| Interest payable | 30,000 | |

| (Expenses incurred are recognized) | ||

| Due to central stores fund | 12,400 | |

| Vouchers payable | 325,000 | |

| Interest payable | 30,000 | |

| Cash | 367,400 | |

| (Paid cash for dues to central fund vouchers and interest) | ||

| 5. Revenue | 6,300 | |

| Allowance for uncollectible | 6,300 | |

| (Reduction of revenue for uncollectible accounts) | ||

| Depreciation expense | 32,000 | |

| Accumulated depreciation | 32,000 | |

| (Adjustment for depreciation for the period) | ||

| Supplies expense | 15,200 | |

| Inventory of supplies | 15,200 | |

| (Adjustment for supplies on hand) | ||

| Closing entries: | ||

| Revenue | 413,700 | |

| Operating expenses | 328,000 | |

| Interest expense | 30,000 | |

| Depreciation expense | 32,000 | |

| Supplies expense | 15,200 | |

| Profit and loss summary | 8,500 | |

| (Closing of nominal accounts) | ||

| Profit and loss summary | 8,500 | |

| Net assets − unrestricted | 8,500 | |

| (Profit and loss summary account closed and amount transferred to net assets unrestricted) | ||

| Net Assets − unrestricted | 43,000 | |

| Net assets − invested in capital | 43,000 | |

| (Recognition of increase in net asset invested) |

Calculation of increase in net assets invested:

| Ending balance of net capital assets | $563,000 |

| Less: Related debt | (500,000) |

| Beginning balance in net assets − invested in capital assets | (20,000) |

| Increase in net assets invested | $43,000 |

b

Introduction: An enterprise fund is one of two proprietary funds. It is the amounts charged to the general public, to recover all or most of the cost of goods and services provided by the government to the general public. An enterprise fund is one of two proprietary funds.

The statement of net position for the fund for December 31, 20X1.

Answer to Problem 18.8E

Total assets as per statement of net assets $686,500

Explanation of Solution

A MUD Enterprise Fund

Statement of Net Assets

December 31, 20X1

| $ | $ | |

| Assets: | ||

| Cash | 111,600 | |

| Accounts receivable | 13,000 | |

| Less: Allowance for uncollectible | (6,300) | 6,700 |

| Inventory of supplies | 5,200 | |

| Land | 120,000 | |

| Plant and equipment | 555,000 | |

| Less: Accumulated depreciation | (112,000) | 443,000 |

| Total Assets | 686,500 | |

| Liabilities: | ||

| Vouchers payable | 18,000 | |

| Due to general fund | 30,000 | |

| Bonds payable | 500,000 | |

| Total Liabilities | 548,000 | |

| Net Assets: | ||

| Invested in capital assets, net of related debt | 63,000 | |

| Unrestricted | 75,500 | |

| Total Net Assets | 138,500 | |

| 686,500 |

c

Introduction: An enterprise fund is one of two proprietary funds. It is the amounts charged to the general public, to recover all or most of the cost of goods and services provided by the government to the general public. An enterprise fund is one of two proprietary funds.

The statement of revenues, expenses and changes in fund net position for 20X1. Assuming $500,000 of the 6 percent bonds is related to the net capital assets of land and of plant and equipment.

Answer to Problem 18.8E

Change in net assets $8,500

Explanation of Solution

A MUD Enterprise fund

Statement of Revenues, Expenses and

Changes in Fund Net Assets

For the year ended December 31, 20X1

| $ | $ | |

| Revenues: | ||

| Revenue from services | 413,700 | |

| Expenses: | ||

| Operating expense | 328,000 | |

| Depreciation | 32,000 | |

| Supplies | 15,200 | |

| Total expenses | 375,200 | |

| Operating income | 38,500 | |

| Non-operating expenses | ||

| Interest on capital − related debt | 30,000 | |

| Change in net assets | 8,500 | |

| Net assets, January 1 | 130,000 | |

| Net assets, December 31 | 138,500 |

d

Introduction: An enterprise fund is one of two proprietary funds. It is the amounts charged to the general public, to recover all or most of the cost of goods and services provided by the government to the general public. An enterprise fund is one of two proprietary funds.

The statement of cash flows 20X1.

Answer to Problem 18.8E

Net increase in cash $19,600

Explanation of Solution

A MUD Enterprise Fund

Statement of Cash Flows

December 31, 20X1

| $ | $ | |

| Cash flows from operating activities: | ||

| Cash received from customers | 432,000 | |

| Cash payments for goods and services | (325,000) | |

| Cash paid to internal service fund for supplies | (12,400) | |

| Net cash provided by operating activities | 94,600 | |

| Cash flows from non-capital financing activities: | ||

| Cash received from general fund for non-capital loan | 30,000 | |

| Net cash provided by non-capital financing activities | 30,000 | |

| Cash flow from capital and related financing activities | ||

| Interest on capital related debts | (30,000) | |

| Extension of service lines | (75,000) | |

| Net cash used for capital and related financing activities | (105,000) | |

| Cash flow from investing activities | 0 | |

| Net increase in cash | 19,600 | |

| Cash at the beginning of the year | 92,000 | |

| Cash at the end of the year | 111,600 |

Want to see more full solutions like this?

Chapter 18 Solutions

EBK ADVANCED FINANCIAL ACCOUNTING

Additional Business Textbook Solutions

Intermediate Accounting (2nd Edition)

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Macroeconomics

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Financial Accounting, Student Value Edition (5th Edition)

Fundamentals of Management (10th Edition)

- Can you solve this general accounting problem with appropriate steps and explanations?arrow_forwardPlease explain the solution to this general accounting problem with accurate explanations.arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forward

- Please provide the answer to this general accounting question with proper steps.arrow_forwardCan you help me solve this general accounting question using valid accounting techniques?arrow_forwardI am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education