Concept explainers

Flexible Budget

Oak Hill Township operates a motor pool with 20 vehicles. The motor pool furnishes gasoline, oil, and other supplies for the cars and hires one mechanic who does routine maintenance and minor repairs. Major repairs are done at a nearby commercial garage. A supervisor manages the operations.

Each year, the supervisor prepares a

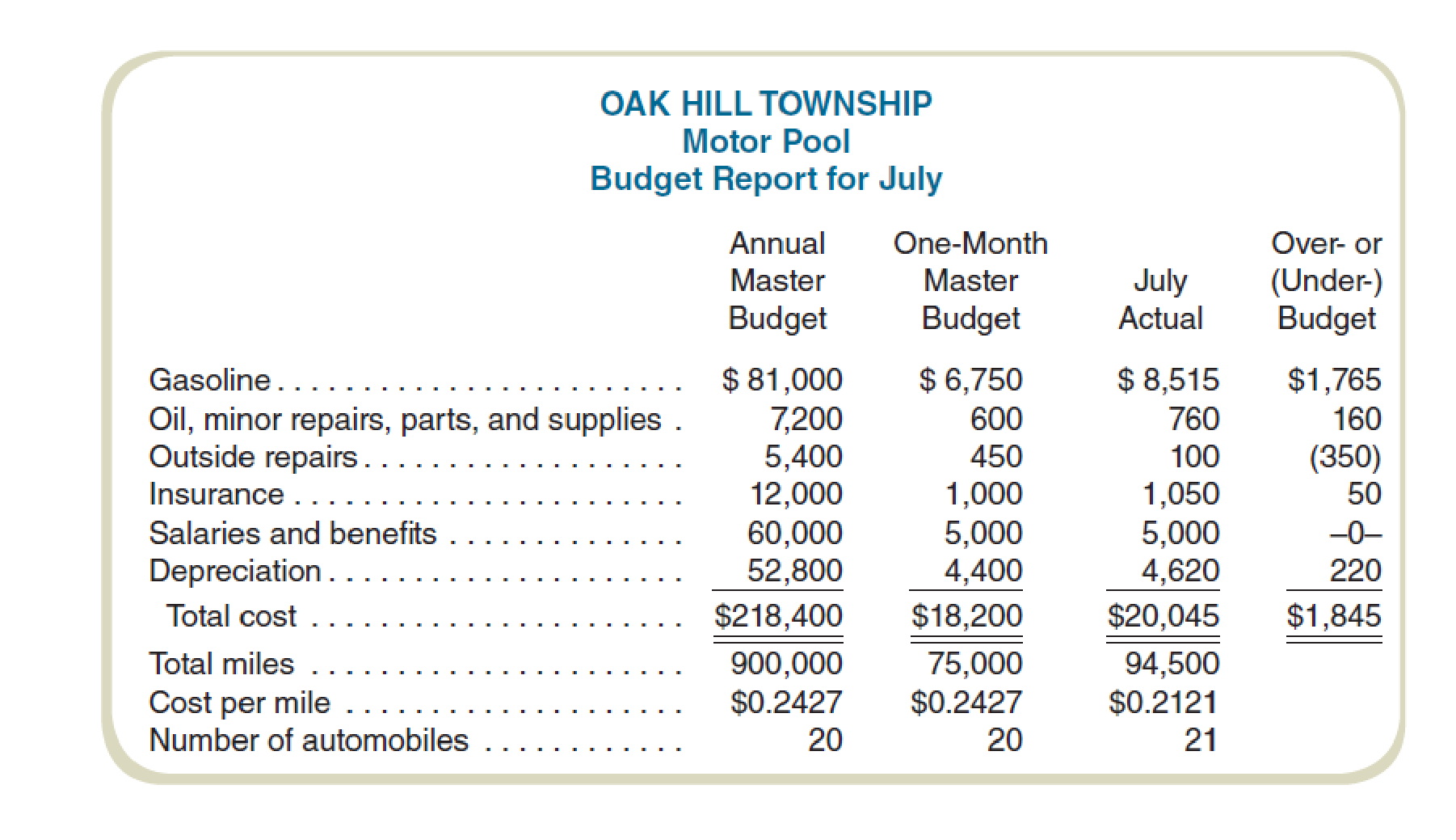

The following schedule presents the master budget for the year and for the month of July.

The annual budget was based on the following assumptions:

- 1. Automobiles in the pool: 20.

- 2. Miles per year per automobile: 45,000.

- 3. Miles per gallon per automobile: 20.

- 4. Gas per gallon: $1.80.

- 5. Oil, minor repairs, parts, and supplies per mile: $0,008.

- 6. Outside repairs per automobile per year: $270.

The supervisor is unhappy with the monthly report, claiming that it unfairly presents his performance for July. His previous employer used flexible budgeting to compare actual costs to budgeted amounts.

Required

- a. What is the gasoline monthly flexible budget and the resulting amount over-or under-budget? (Use miles as the activity base.)

- b. What is the monthly flexible budget for the oil, minor repairs, parts, and supplies and the amount over-or underbudget? (Use miles as the activity base.)

- c. What is the monthly flexible budget for salaries and benefits and the resulting amount over-or underbudget?

- d. What is the major reason for the cost per mile to decrease from S0.2427 budgeted to $0.2121 actual?

Want to see the full answer?

Check out a sample textbook solution

Chapter 17 Solutions

FUNDAMENTAL'S OF COST ACCOUNTING LL

- The following transactions of Weber Company occurred during the current year: The company acquired a tract of land in exchange for 1,000 shares of $10 par value common stock. The stock was traded on the New York Stock Exchange at $24 on the date of exchange. The land had a book value on the selling company’s records of $5,000, and it was believed to be worth “anything up to $30,000.” An engine on a truck was replaced. When the truck was purchased 3 years ago, it cost $10,000 and was being depreciated at $2,000 per year. The engine cost $1,000 to replace. The company acquired a tract of land that was believed to have mineral deposits by issuing 500 shares of preferred stock of $50 par value. The preferred stock was rarely traded. The last transaction was 2 months earlier, when 50 shares were sold at $75 per share. The owner of the land was willing to accept cash of $55,000, and an appraisal had shown a value of $60,000. The company purchased a machine with a list price of $8,500 by…arrow_forwardWhat should Davidson record as the cost of the new van on these general accounting question?arrow_forwardCompute the annual rate of return on these financial accounting questionarrow_forward

- FGH Floral Company has a delivery truck that is being sold after 5 years of use. The current book value of the delivery truck is $6,000. If FGH Floral Company sells the delivery truck for $9,000, what is the impact of this transaction? Answerarrow_forwardFinancial Accounting Question please solvearrow_forwardY Company purchased an asset for $73,000 on January 1, Year 1. The asset was expected to have a four-year life and an $8,000 salvage value. What would be the amount of depreciation expense for Year 1 using double-declining balance? Answerarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,