Concept explainers

Materials Mix and Yield Variances

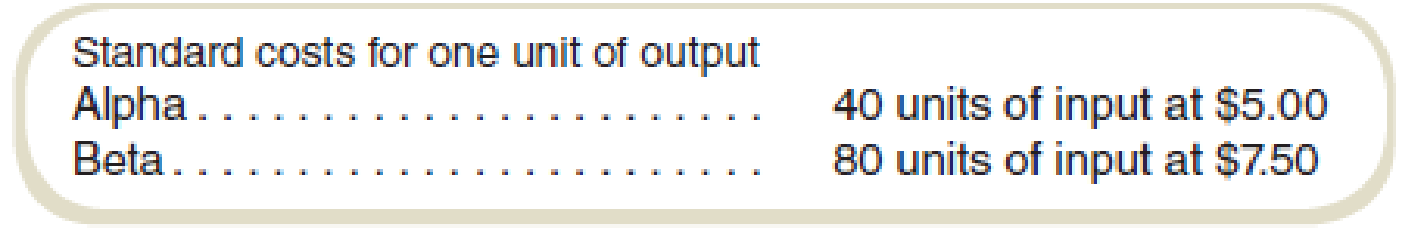

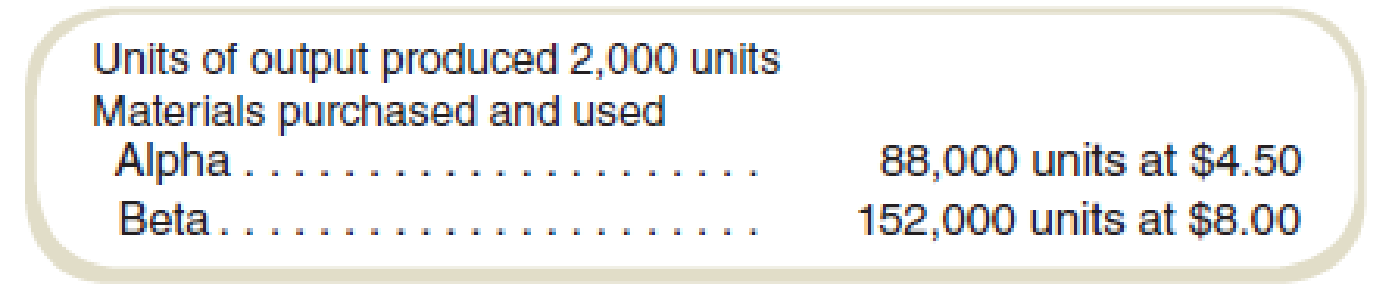

Stacy, Inc., produces a product using a process that allows for substitution between two materials, Alpha and Beta. The company has the following direct materials data for its product:

The company had the following results in June:

Required

- a. Compute materials price and efficiency variances.

- b. Compute materials mix and yield variances.

a.

Compute materials price and efficiency variances.

Answer to Problem 30E

The value of materials price variance is $44,000 F, and efficiency variance is $40,000 U for product Alpha, and for product Beta, the materials price variance is $76,000 U, and efficiency variance is $60,000 F.

Explanation of Solution

Materials price variance:

Materials price variance is resultant materials price that has been computed or derived at the end of the accounting period for which the computations are being done.

Efficiency variance:

Efficiency variance is the resultant efficiency that has been computed or derived at the end of the accounting period for which the computations are being done.

Compute the materials price variance:

| Particulars | Alpha | Beta |

| Materials variance: | ||

| Actual | $396,000 | $1,216,000 |

| Standard | $440,000 | $1,140,000 |

|

Materials variance | $44,000 F | $76,000 U |

Table: (1)

Compute the efficiency variance:

| Particulars | Alpha | Beta |

|

Mix variance: | ||

| Actual | $440,000 | $1,140,000 |

| Standard | $400,000 | $1,200,000 |

|

Mix variance | $40,000 U | $60,000 F |

| Materials yield variance: | ||

| Actual | $400,000 | $1,200,000 |

| Standard | $400,000 | $1,200,000 |

|

Materials yield variance | $0 | $0 |

|

Efficiency variance | $40,000 U | $60,000 F |

Table: (2)

| Measure | Alpha | Beta |

| AP | $4.50 | $8.00 |

| AQ | 88,000 | 152,000 |

| SP | $5.00 | $7.50 |

| ASQ | 80,000(1) | 160,000 (2) |

| SQ | 80,000 (3) | 160,000(4) |

Table: (3)

Working note 1:

Compute the ASQ for alpha:

Working note 2:

Compute the ASQ for alpha:

Working note 3:

Compute the SQ of Alpha:

Working note 4:

Compute the SQ of Beta:

b.

Compute materials mix and materials yield variances.

Answer to Problem 30E

The value of materials mix and materials yield variances of product Alpha are $$40,000 U and $0 respectively, and the value of materials mix and materials yield variances of product Beta $60,000 and $0respectively.

Explanation of Solution

Materials mix variance:

Materials mix variance is the resultant market mix that has been computed or derived at the end of the accounting period for which the computations are being done for two or more than two products.

Materials yield variance:

Materials yield variance is the resultant difference between the cost of finished goods expected from a specific amount of raw material that has been computed or derived at the end of the accounting period for which the computations are being done.

Compute the materials mix variance and materials yield variance for product Alpha and Beta:

| Particulars | Alpha | Beta |

|

Mix variance: | ||

| Actual | $440,000 | $1,140,000 |

| Standard | $400,000 | $1,200,000 |

|

Mix variance | $40,000 U | $60,000 F |

| Materials yield variance: | ||

| Actual | $400,000 | $1,200,000 |

| Standard | $400,000 | $1,200,000 |

|

Materials yield variance | $0 | $0 |

Table: (4)

| Measure | Alpha | Beta |

| AP | $4.50 | $8.00 |

| AQ | 88,000 | 152,000 |

| SP | $5.00 | $7.50 |

| ASQ | 80,000(1) | 160,000 (2) |

| SQ | 80,000 (3) | 160,000(4) |

Table: (5)

Thus, the value of materials mix and materials yield variances of product Alpha are $$40,000 U and $0 respectively, and the value of materials mix and materials yield variances of product Beta $60,000 and $0respectively.

Want to see more full solutions like this?

Chapter 17 Solutions

FUNDAMENTAL'S OF COST ACCOUNTING LL

- Vimal Manufacturing bases its manufacturing overhead budget on budgeted direct labor-hours. The direct labor budget indicates that 7,500 direct labor-hours will be required in June. The variable overhead rate is $5.20 per direct labor-hour. The company's budgeted fixed manufacturing overhead is $130,000 per month, which includes depreciation of $11,200. All other fixed manufacturing overhead costs represent current cash flows. What should be the June cash disbursements for manufacturing overhead on the manufacturing overhead budget?arrow_forwardHow much overhead would be applied to production?arrow_forwardMala Corporation uses direct labor hours in its predetermined overhead rate. At the beginning of the year, the estimated direct labor hours were 16,120 hours and the total estimated manufacturing overhead was $425,680. At the end of the year, actual direct labor hours for the year were 17,355 hours and the actual manufacturing overhead for the year was $315,600. Overhead at the end of the year was _____.arrow_forward

- What should be tansen manufacturing predetermined overhead rate for September?arrow_forwardA company had $5 million in sales, $3 million in cost of goods sold, and $1 million in selling and administrative expenses during the last fiscal year. If the company's income tax rate was 25%, what was the company's gross profit margin percentage? a. 20% b. 50% c. 30% d. 40%arrow_forwardThe balance in the office supplies account on June 1 was $16,300, supplies purchased during June were $4,300, and the supplies on hand at June 30 were $3,100. The amount to be used for the appropriate adjusting entry is:arrow_forward

- need help this questionsarrow_forwardHow much overhead would be applied to production?arrow_forwardThe Tansen Manufacturing overhead budget is based on budgeted direct labor-hours. The direct labor budget indicates that 9,500 direct labor-hours will be required in September. The variable overhead rate is $6.00 per direct labor-hour. The company's budgeted fixed manufacturing overhead is $145,000 per month, which includes depreciation of $32,500. All other fixed manufacturing overhead costs represent current cash flows. The company recomputes its predetermined overhead rate every month. What should be Tansen Manufacturing’s predetermined overhead rate for September? A. $6.00 B. $18.90 C. $21.26 D. $16.00arrow_forward

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning