Concept explainers

FIFO method (continuation of 17-36).

- 1. Do Problem 17-36 using the FIFO method of

process costing . Explain any difference between the cost per equivalent unit in the assembly department under the weighted-average method and the FIFO method. - 2. Should Hoffman’s managers choose the weighted-average method or the FIFO method? Explain briefly.

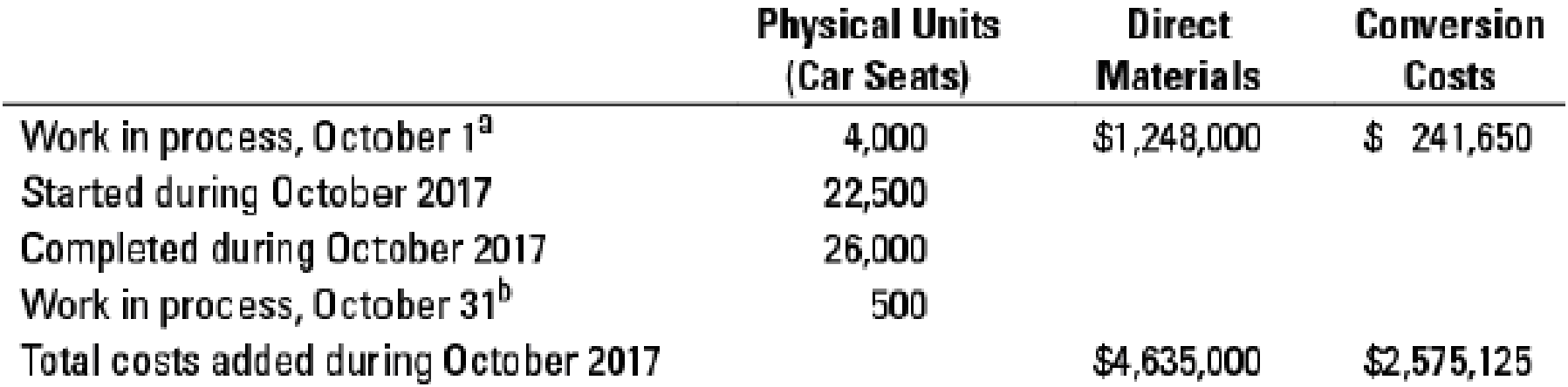

17-36 Weighted-average method. Hoffman Company manufactures car seats in its Boise plant. Each car seat passes through the assembly department and the testing department. This problem focuses on the assembly department. The process-costing system at Hoffman Company has a single direct-cost category (direct materials) and a single indirect-cost category (conversion costs). Direct materials are added at the beginning of the process. Conversion costs are added evenly during the process. When the assembly department finishes work on each car seat, it is immediately transferred to testing.

Hoffman Company uses the weighted-average method of process costing. Data for the assembly department for October 2017 are as follows:

a Degree of completion: direct materials, ?%; conversion costs, 45%.

b Degree of completion: direct materials, ?%; conversion costs, 65%.

- 1. For each cost category, compute equivalent units in the assembly department. Show physical units in the first column of your schedule.

Required

- 2. What issues should the manager focus on when reviewing the equivalent-unit calculations?

- 3. For each cost category, summarize total assembly department costs for October 2017 and calculate the cost per equivalent unit.

- 4. Assign costs to units completed and transferred out and to units in ending work in process.

Learn your wayIncludes step-by-step video

Chapter 17 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Additional Business Textbook Solutions

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Microeconomics

Engineering Economy (17th Edition)

Financial Accounting: Tools for Business Decision Making, 8th Edition

Macroeconomics

- What is the total number of units to be assigned?arrow_forwardGeneral Accountingarrow_forwardApsara Beverages Co. uses process costing to account for the production of bottled sports drinks. Direct materials are added at the beginning of the process, and conversion costs are incurred uniformly throughout the process. Equivalent units have been calculated to be 21,600 units for materials and 18,000 units for conversion costs. Beginning inventory consisted of $13,500 in materials and $7,200 in conversion costs. May costs were $62,400 for materials and $72,000 for conversion costs. The ending inventory still in process was 7,000 units (100% complete for materials, 50% for conversion). The cost per equivalent unit for materials using the weighted-average method would be____.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning