Concept explainers

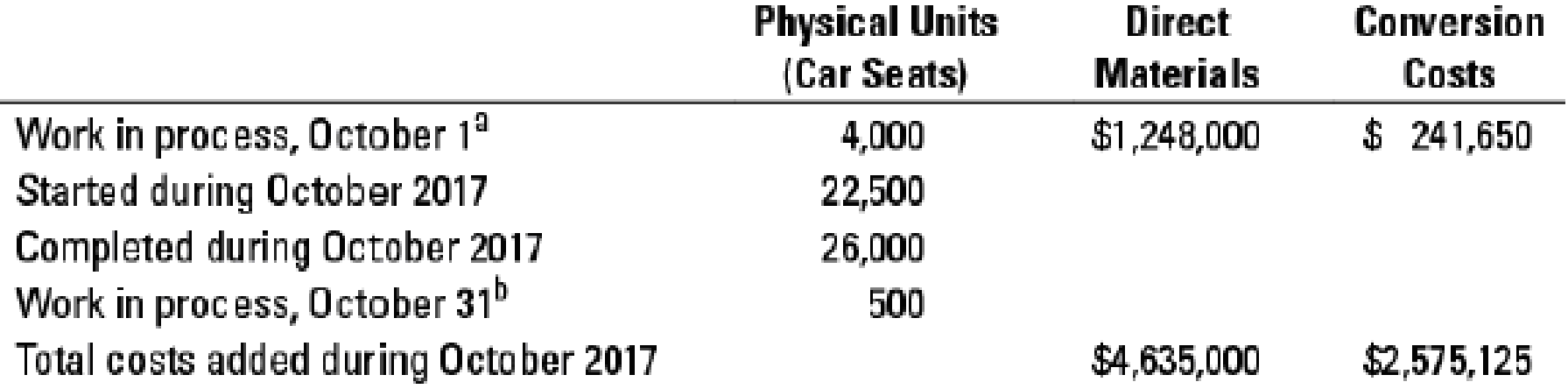

Weighted-average method. Hoffman Company manufactures car seats in its Boise plant. Each car seat passes through the assembly department and the testing department. This problem focuses on the assembly department. The process-costing system at Hoffman Company has a single direct-cost category (direct materials) and a single indirect-cost category (conversion costs). Direct materials are added at the beginning of the process. Conversion costs are added evenly during the process. When the assembly department finishes work on each car seat, it is immediately transferred to testing.

Hoffman Company uses the weighted-average method of

a Degree of completion: direct materials, ?%; conversion costs, 45%.

b Degree of completion: direct materials, ?%; conversion costs, 65%.

- 1. For each cost category, compute equivalent units in the assembly department. Show physical units in the first column of your schedule.

Required

- 2. What issues should the manager focus on when reviewing the equivalent-unit calculations?

- 3. For each cost category, summarize total assembly department costs for October 2017 and calculate the cost per equivalent unit.

- 4. Assign costs to units completed and transferred out and to units in ending work in process.

Learn your wayIncludes step-by-step video

Chapter 17 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Additional Business Textbook Solutions

Intermediate Accounting (2nd Edition)

Financial Accounting, Student Value Edition (5th Edition)

Principles of Economics (MindTap Course List)

Fundamentals of Management (10th Edition)

Operations Management

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

- Sterling Equipment Ltd. purchased machinery for $80,000 with a salvage value of $5,000 and a 6-year useful life. The company initially used the straight-line method, but after two years, switched to the double-declining balance method. What is the depreciation expense for Year 3?arrow_forwardhow much is hunt's owner equity?arrow_forwardHello teacher please given answer general accountingarrow_forward

- Suppose Chrysler Motors has 720 million shares outstanding with a share price of $68.25, and $30 billion in debt. If in three years, Chrysler has 750 million shares outstanding trading for $76 per share, how much debt will Chrysler have if it maintains a constant debt-equity ratio?arrow_forwardi want to correct answer is accountingarrow_forwardLet us suppose that the Apex Corporation's total annual sales are 4,800 units, the average inventory level is 400 units, and the annual working days are 320 days. The inventory days of supply (DOS) are____. a. Somewhere between 30 and 31 days. b. 26.67 days. c. 20.38 days. d. None of the above.answerarrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning