EBK FINANCIAL & MANAGERIAL ACCOUNTING

13th Edition

ISBN: 9780100545052

Author: WARREN

Publisher: YUZU

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 17, Problem 17.1CP

Managerial analysis

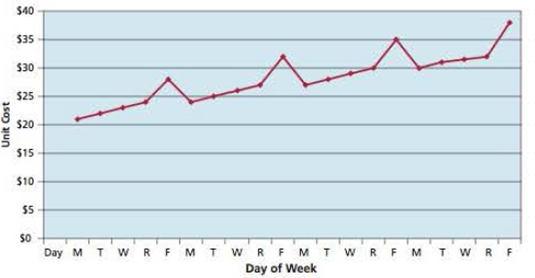

The controller of the plant of Minsky Company prepared a graph of the unit costs from the

How would you interpret this information? What further information would you request?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the current price of capital railways?

Accurate answer

How many barrel were completed in September

Chapter 17 Solutions

EBK FINANCIAL & MANAGERIAL ACCOUNTING

Ch. 17 - Prob. 1DQCh. 17 - What kind of firm would use a job order cost...Ch. 17 - Which account is used in the job order cost system...Ch. 17 - Prob. 4DQCh. 17 - What is a job cost sheet?Ch. 17 - Prob. 6DQCh. 17 - Discuss how the predetermined factory overhead...Ch. 17 - A. How is a predetermined factory overhead rate...Ch. 17 - Prob. 9DQCh. 17 - Describe how a job order cost .system can be used...

Ch. 17 - Issuance of materials On April 6, Almerinda...Ch. 17 - Prob. 17.1BPECh. 17 - Direct labor costs During April, Almerinda Company...Ch. 17 - Direct labor costs During August, Rothchild...Ch. 17 - Factory overhead costs During April, Almerinda...Ch. 17 - Prob. 17.3BPECh. 17 - Applying factory overhead Almerinda Company...Ch. 17 - Prob. 17.4BPECh. 17 - Job costs At the end of April, Almerinda Company...Ch. 17 - Job costs At the end of August, Rothchild Company...Ch. 17 - Prob. 17.6APECh. 17 - Prob. 17.6BPECh. 17 - Transactions in a job order cost system Five...Ch. 17 - Cost flow relationships The following information...Ch. 17 - Cost of materials issuances under the FIFO method...Ch. 17 - Entry for issuing materials Materials issued for...Ch. 17 - Entries for materials Eclectic Ergonomics Company...Ch. 17 - Prob. 17.6EXCh. 17 - Entry for factory labor costs The weekly time...Ch. 17 - Prob. 17.8EXCh. 17 - Factory overhead rates, entries, and account...Ch. 17 - Predetermined factory overhead rate Spring Street...Ch. 17 - Predetermined factory overhead rate Poehling...Ch. 17 - Entry for jobs completed; cost of unfinished jobs...Ch. 17 - Entries for factory costs and jobs completed Old...Ch. 17 - Financial statements of a manufacturing firm The...Ch. 17 - Decision making with job order costs Alvarez...Ch. 17 - Prob. 17.16EXCh. 17 - Job order cost accounting for a service company...Ch. 17 - Job order cost accounting for a service company...Ch. 17 - Entries for costs in a job order cost system...Ch. 17 - Prob. 17.2APRCh. 17 - Job order cost sheet Remnant Carpet Company sells...Ch. 17 - Analyzing manufacturing cost accounts Fire Rock...Ch. 17 - Flow of costs and income statement Ginocera Inc....Ch. 17 - Entries for costs in a job order cost system Royal...Ch. 17 - Entries and schedules for unfinished jobs and...Ch. 17 - Job order cost sheet Stretch and Trim Carpet...Ch. 17 - Analyzing manufacturing cost accounts Clapton...Ch. 17 - Prob. 17.5BPRCh. 17 - Managerial analysis The controller of the plant of...Ch. 17 - Job order decision making and rate deficiencies...Ch. 17 - Factory overhead rate Salvo Inc., a specialized...Ch. 17 - Recording manufacturing costs Todd Lay just began...Ch. 17 - Prob. 17.5CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- hello teacher please help mearrow_forwardWhat must have been the change in total assets and in which direction did this change occur on these financial accounting question?arrow_forwardThe income statement for September indicates a net income of $65,000. The corporation also paid $15,000 in dividends during the same period. If there was no beginning balance in stockholders' equity, what is the ending balance in stockholders' equity? Accurate answerarrow_forward

- What is the average cost per snowmobilearrow_forwardThe income statement for September indicates a net income of $65,000. The corporation also paid $15,000 in dividends during the same period. If there was no beginning balance in stockholders' equity, what is the ending balance in stockholders' equity?arrow_forwardfinal answer isarrow_forward

- nonearrow_forwardA company can sell all the units it can produce of either Product X or Product Y but not both. Product X has a unit contribution margin of $18 and takes four machine hours to make, while Product Y has a unit contribution margin of $25 and takes five machine hours to make. If there are 6,000 machine hours available to manufacture a product, income will be: A. $6,000 more if Product X is made B. $6,000 less if Product Y is made C. $6,000 less if Product X is made D. the same if either product is made.arrow_forwardAccurate answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cost Classifications - Managerial Accounting- Fixed Costs Variable Costs Direct & Indirect Costs; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=QQd1_gEF1yM;License: Standard Youtube License