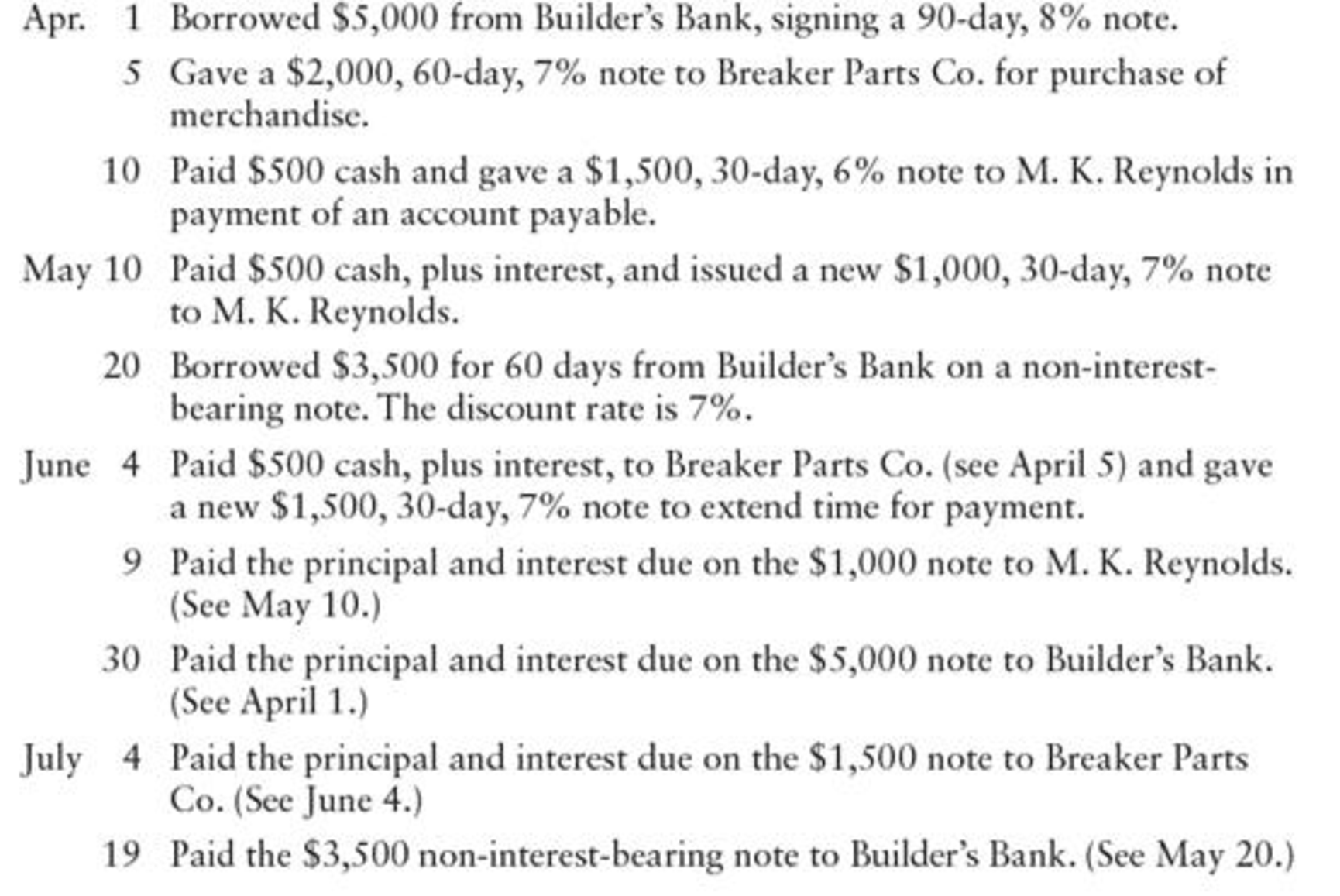

NOTES PAYABLE ENTRIES Milo Radio Shop had the following notes payable transactions:

REQUIRED

Record the transactions in a general journal.

Prepare journal entry to record the following transactions of MR Shop.

Explanation of Solution

Note Payable:

Note payable is an obligation of the business to pay to its creditors in future for the benefits received that carries some interest.

Prepare journal entry to record the following transactions of MR Shop are shown below:

| Date | Account titles and Explanation | Debit | Credit |

| April 1 | Cash | $5,000 | |

| Notes payable | $5,000 | ||

| (To record note issued for bank loan) | |||

| April 5 | Purchases | $2,000 | |

| Notes payable | $2,000 | ||

| (To record note issued for inventory purchase) | |||

| April 10 | Accounts payable - M.K.R | $2,000 | |

| Cash | $500 | ||

| Notes payable | $1,500 | ||

| (To record partial payment made and issued note to settle account) | |||

| May 10 | Notes payable (old note) | $1,500 | |

| Interest expense (1) | $7.50 | ||

| Cash | $507.50 | ||

| Notes payable (new note) | $1,000 | ||

| (To record paid interest and part of partial of principal on old note and issued new note) | |||

| May 20 | Cash (3) | $3,459.17 | |

| Discount on bonds payable (2) | $40.83 | ||

| Notes payable | $3,500 | ||

| (To record issued note for bank loan) | |||

| June 4 | Notes payable (old note) | $2,000 | |

| Interest expense (4) | $23.33 | ||

| Cash | $523.33 | ||

| Notes payable (new note) | $1,500 | ||

| (To record paid interest and part of partial of principal on old note and issued new note) | |||

| June 9 | Notes payable | $1,000 | |

| Interest expense (5) | $5.83 | ||

| Cash | $1,005.83 | ||

| (To record paid note with interest at maturity) | |||

| June 30 | Notes payable | $5,000 | |

| Interest expense (6) | $100 | ||

| Cash | $5,100 | ||

| (To record paid note with interest at maturity) | |||

| July 4 | Notes payable | $1,500 | |

| Interest expense (7) | $8.75 | ||

| Cash | $1,508.75 | ||

| (To record paid note with interest at maturity) | |||

| July 19 | Notes payable | $3,500 | |

| Interest expense (8) | $40.83 | ||

| Discount on notes payable | $40.83 | ||

| Cash | $3,500 | ||

| (To record paid note at maturity) |

Table (1)

Working notes:

(1)Calculate interest expenses.

(2)Calculate discount on notes payable.

(3)Calculate cash proceeds.

(4)Calculate interest expense.

(5)Calculate interest expense.

(6)Calculate interest expense.

(7)Calculate interest expense.

(8)Calculate interest expense.

Want to see more full solutions like this?

Chapter 17 Solutions

College Accounting, Chapters 1-27

- REQUIRED Study the information given below and answer the following questions. Where discount factors are required use only the four decimals present value tables that appear after the formula sheet or in the module guide. Ignore taxes. 5.1 Calculate the Accounting Rate of Return on average investment of the second alternative (expressed to two decimal places). 5.2 Determine which of the two investment opportunities the company should choose by calculating the Net Present Value of each alternative. Your answer must include the calculation of the present values and NPV. 5.3 Calculate the Internal Rate of Return of the first alterative (expressed to two decimal places). Your answer must include two net present value calculations (using consecutive rates/percentages) and interpolation. INFORMATION The management of Bentall Incorporated is considering two investment opportunities: (5 marks) (9 marks) (6 marks) The first alternative involves the purchase of a new machine for R900 000 which…arrow_forwardREQUIRED Use the information provided below to answer the following questions: 4.1 Calculate the weighted average cost of capital (expressed to two decimal places). Your answer must include the calculations of the cost of equity, preference shares and the loan. 4.2 Calculate the cost of equity using the Capital Asset Pricing Model (expressed to two decimal places). (16 marks) (4 marks) INFORMATION Cadmore Limited intends raising finance for a proposed new project. The financial manager has provided the following information to determine the present cost of capital to the company: The capital structure consists of the following: ■3 million ordinary shares issued at R1.50 each but currently trading at R2 each. 1 200 000 12%, R2 preference shares with a market value of R2.50 per share. R1 000 000 18% Bank loan, due in March 2027. Additional information The company's beta coefficient is 1.3. The risk-free rate is 8%. The return on the market is 18%. The Gordon Growth Model is used to…arrow_forwardA dog training business began on December 1. The following transactions occurred during its first month. Use the drop-downs to select the accounts properly included on the income statement for the post-closing balancesarrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage