College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Textbook Question

thumb_up100%

Chapter 17, Problem 12SPB

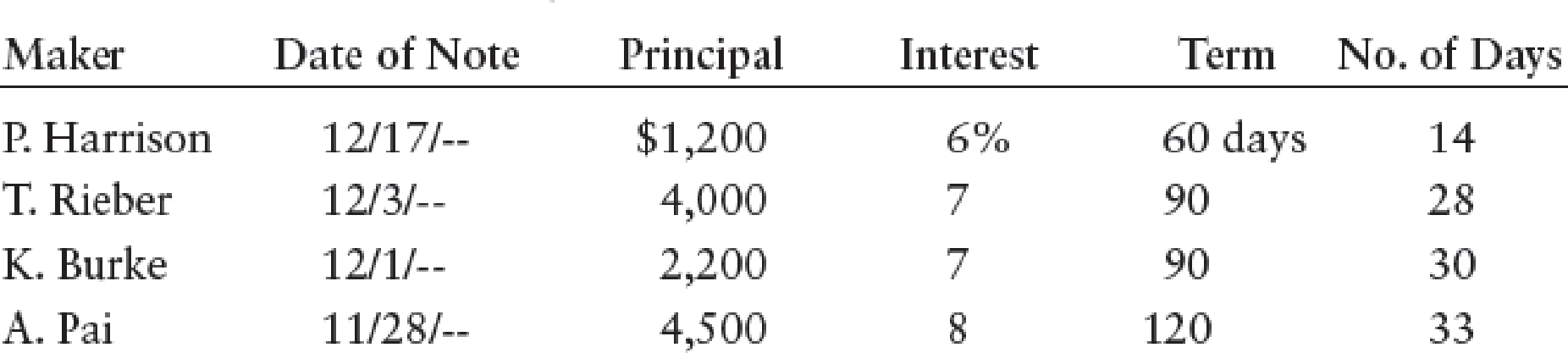

ACCRUED INTEREST RECEIVABLE The following is a list of outstanding notes receivable as of December 31, 20--:

REQUIRED

- 1. Compute the accrued interest at the end of the year.

- 2. Prepare the

adjusting entry in the general journal.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

A company's Accounts Receivable balance at Dec. 31 was $120,000, and there was a debit balance of $600 in the Allowance for Doubtful Accounts. The firm estimates that 4% of the A/R will prove to be uncollectible. After the appropriate adjusting entry is made for estimated credit losses, what is the net realizable value of the accounts receivables at year-end?

choose best answer me

Fill this blank space with correct options

Chapter 17 Solutions

College Accounting, Chapters 1-27

Ch. 17 - The maturity value of a note includes both...Ch. 17 - Prob. 2TFCh. 17 - The difference between the maturity value of a...Ch. 17 - Prob. 4TFCh. 17 - When a dishonored note is collected, interest is...Ch. 17 - Principal plus interest equals ______ of a note....Ch. 17 - Prob. 2MCCh. 17 - Prob. 3MCCh. 17 - Prob. 4MCCh. 17 - Accrued interest payable is reported as a ______...

Ch. 17 - Prob. 1CECh. 17 - Prob. 2CECh. 17 - Prob. 3CECh. 17 - Prob. 1RQCh. 17 - Prob. 2RQCh. 17 - Prob. 3RQCh. 17 - Prob. 4RQCh. 17 - Prob. 5RQCh. 17 - Prob. 6RQCh. 17 - Prob. 7RQCh. 17 - Prob. 8RQCh. 17 - Prob. 9RQCh. 17 - On which notes receivable and notes payable is it...Ch. 17 - Prob. 11RQCh. 17 - When a business borrows money from a bank on a...Ch. 17 - What kind of account is Discount on Notes Payable,...Ch. 17 - Prob. 14RQCh. 17 - Prob. 15RQCh. 17 - TERM OF A NOTE Calculate total time in days for...Ch. 17 - Prob. 2SEACh. 17 - DETERMINING DUE DATE Determine the due date for...Ch. 17 - JOURNAL ENTRIES (NOTE RECEIVED, RENEWED, AND...Ch. 17 - Prob. 5SEACh. 17 - JOURNAL ENTRIES (ACCRUED INTEREST RECEIVABLE) At...Ch. 17 - JOURNAL ENTRIES (NOTE ISSUED, RENEWED, AND PAID)...Ch. 17 - JOURNAL ENTRIES (NOTE ISSUED FOR BANK LOAN)...Ch. 17 - JOURNAL ENTRIES (ACCRUED INTEREST PAYABLE) At the...Ch. 17 - NOTES RECEIVABLE ENTRIES J. K. Pratt Co. had the...Ch. 17 - NOTES RECEIVABLE DISCOUNTING Marienau Suppliers...Ch. 17 - ACCRUED INTEREST RECEIVABLE The following is a...Ch. 17 - NOTES PAYABLE ENTRIES Milo Radio Shop had the...Ch. 17 - ACCRUED INTEREST PAYABLE The following is a list...Ch. 17 - TERM OF A NOTE Calculate total time in days for...Ch. 17 - CALCULATING INTEREST Using 360 days as the...Ch. 17 - DETERMINING DUE DATE Determine the due date for...Ch. 17 - JOURNAL ENTRIES (NOTE RECEIVED, RENEWED, AND...Ch. 17 - JOURNAL ENTRIES (NOTE RECEIVED, DISCOUNTED,...Ch. 17 - JOURNAL ENTRIES (ACCRUED INTEREST RECEIVABLE) At...Ch. 17 - JOURNAL ENTRIES (NOTE ISSUED, RENEWED, AND PAID)...Ch. 17 - JOURNAL ENTRIES (NOTE ISSUED FOR BANK LOAN)...Ch. 17 - JOURNAL ENTRIES (ACCRUED INTEREST PAYABLE) At the...Ch. 17 - NOTES RECEIVABLE ENTRIES M. L. DiMaurizio had the...Ch. 17 - NOTES RECEIVABLE DISCOUNTING Madison Graphics had...Ch. 17 - ACCRUED INTEREST RECEIVABLE The following is a...Ch. 17 - Prob. 13SPBCh. 17 - ACCRUED INTEREST PAYABLE The following is a list...Ch. 17 - Prob. 1MYWCh. 17 - Rochelle needed to borrow 3,000 for three months...Ch. 17 - Eddie Edwards and Phil Bell own and operate The...Ch. 17 - Prob. 1CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Financial Accounting Questionarrow_forwardOn July 31, Harrison Company had an Accounts Receivable balance of $25,400. During the month of August, total credits to Accounts Receivable were $68,000 from customer payments. The August 31 Accounts Receivable balance was $18,500. What was the amount of credit sales during August? A) $68,000 B) $39,100 C) $61,100 D) $75,900 E) $7,900 helparrow_forwardQuick answer of this accounting questionsarrow_forward

- Tell me correct solutionsarrow_forwardNonearrow_forwardOn July 31, Harrison Company had an Accounts Receivable balance of $25,400. During the month of August, total credits to Accounts Receivable were $68,000 from customer payments. The August 31 Accounts Receivable balance was $18,500. What was the amount of credit sales during August? A) $68,000 B) $39,100 C) $61,100 D) $75,900 E) $7,900arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

7.2 Ch 7: Notes Payable and Interest, Revenue recognition explained; Author: Accounting Prof - making it easy, The finance storyteller;https://www.youtube.com/watch?v=wMC3wCdPnRg;License: Standard YouTube License, CC-BY